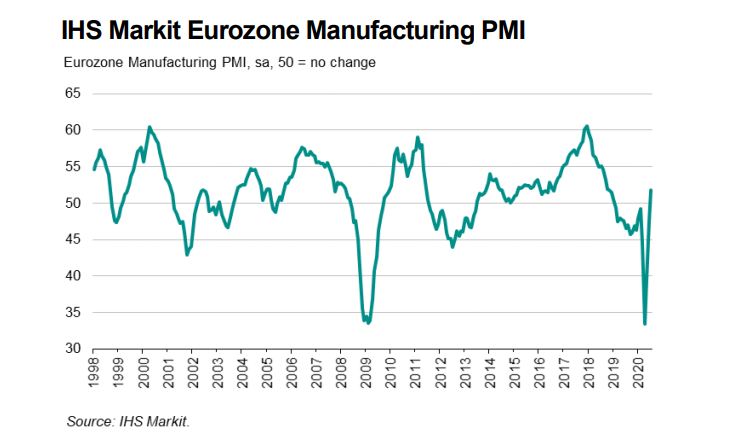

Latest data released by Markit – 3 August 2020

The preliminary report can be found here. This confirms the rebound in Eurozone factory activity back into growth levels amid gains in both output and new orders in July.

However, employment conditions are the key risk factor to watch out for in the months ahead as job cuts are picking up and that may scupper the recovery phase in the region.

Markit notes that:

“Eurozone factories reported a very positive start to the third quarter, with production growing at the fastest rate for over two years, fuelled by an encouraging surge in demand. Growth of new orders in fact outpaced production, hinting strongly that August should see further output gains. The order book improvement has also helped restore business confidence about the outlook in July to January’s pre-pandemic peak.

“The job numbers remain a major concern, however, especially as the labour market is likely to be key to determining the economy’s recovery path. Although the rate of job losses eased to the lowest since March, it remained greater than at any time since 2009, reflecting widespread cost-cutting in many firms where profits have been hit hard by the virus outbreak. Increased unemployment, job insecurity, second waves of virus infections and ongoing social distancing measures will inevitably restrain the recovery.

“The next few months numbers will therefore be allimportant in assessing whether the recent uplift in demand can be sustained, helping firms recover lost production and alleviating some of the need for further cost cutting going forward.”