Archives of “August 2020” month

rss31 Best Quotes on Investing

– Warren Buffett

- “Price is what you pay. Value is what you get.”

- “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”

- “Risk comes from not knowing what you are doing.”

- “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

- “In the business world, the rearview mirror is always clearer than the windshield.”

- “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

- “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

- “The difference between successful people and really successful people is that really successful people say no to almost everything.”

- “The stock market is a device for transferring money from the impatient to the patient.”

- “Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

- “I will tell you how to become rich. Close the doors, be fearful when others are greedy. Be greedy when others are fearful.”

– Philip Fisher

- “Conservative investor sleep well.”

- “The stock market is filled with individuals who know the price of everything, but the value of nothing.”

– Benjamin Graham

- “Buy not on optimism, but on arithmetic.”

- “The individual investor should act consistently as an investor and not as a speculator.”

- “If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.”

- The underlying principles of sound investment should not alter from decade to decade, but the application of these principles must be adapted to significant changes in the financial mechanisms and climate.”

– Charlie Munger

- “Spend each day trying to be a little wiser than you were when you woke up.” – Charlie Munger

- “Our job is to find a few intelligent things to do, not to keep up with every damn thing in the world.”

- “No wise pilot, no matter how great his talent and experience, fails to use his checklist.” – Charlie Munger Peter

– Peter Lynch

- “Behind every stock is a company. Find out what it’s doing.”

- “Although it’s easy to forget sometimes, a share is not a lottery ticket… it’s part ownership of a business.”

- “If you’re prepared to invest in a company, then you ought to be able to explain why in simple language that a fifth grader could understand, and quickly enough so the fifth grader won’t get bored.”

- “Go for a business that any idiot can run – because sooner or later, any idiot probably is going to run it.”

- “If you don’t study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.”

– A few Other Best Quotes on Investing

- “Minimizing downside risk while maximizing the upside is a powerful concept.” – Mohnish Pabrai

- “The secret to investing is to figure out the value of something – and then pay a lot less.” Joel Greenblatt

- “Every once in a while, the market does something so stupid it takes your breath away.” – Jim Cramer

- “While it might seem that anyone can be a value investor, the essential characteristics of this type of investor-patience, discipline, and risk aversion-may well be genetically determined.” -Seth Klarman

- “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

- “The four most dangerous words in investing are: ‘this time it’s different.’” – Sir John Templeton

US tech sector worth more than the entire European stock market

Can Stock splits drive S&P above 4000? Forbes

184.7% market cap to GDP. The Fed sees no asset bubbles.

Like a general fighting the last war

Central banks doing now what they should have been doing a decade ago

The last half of the 2010s was characterized by central banks trying to get back to ‘normal’ or to ‘home’ on interest rates. They were obsessed with getting away from the zero bound, just so they could cut again in the future.

They were slaves to the Phillips Curve and few of them emphasized (or realized) that technology, globalization and deunionization were putting downward pressure on prices.

Now we arrive in the 2020s and they’ve seen the light. They’re pledging to keep rates low and goose inflation above target. Kaplan today highlighted technology-enabled disruption as justification.

The problem is that the game is likely to change again. It’s all like a general investing in trench-digging equipment after the first world war. China is now exporting inflation.

I believe that the layering on of leverage should be one of the big takeaways from the market blowup in March. Central banks should be tackling that but instead, they’re building an even-larger tower of leverage in the belief that if anything goes wrong, they can always pump in enough money to make it better. That’s a mistake.

The real danger though is inflation. Yields moved up yesterday and in Asia today before correcting back lower. If they start to move up, bond investors are going to be sitting on massive paper losses.

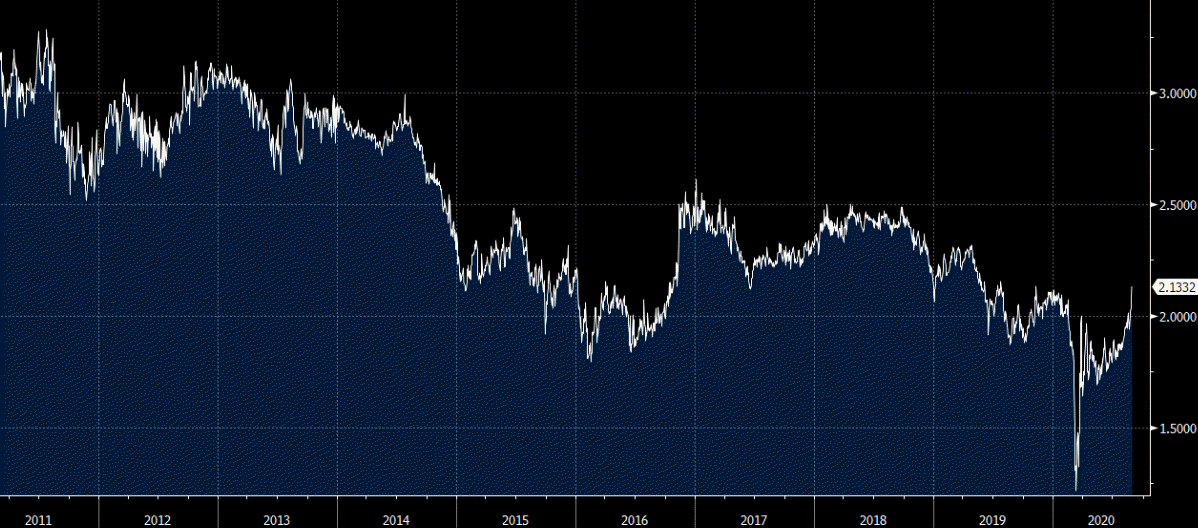

Already, parts of the market are signaling that inflation is coming.Note that 5y5y forward inflation rates today are at 2.13%; a level that would crush today’s 10-year note bond buyers at 0.73%.

That’s a long way from even the post-crisis era but you can see which direction it’s moving.

I’m the furthest thing from an evangelical on inflation but you can see the way that house prices, commodity prices and government spending are going.

US stocks finish strongly to cap another great week in global equities

Closing changes for the main bourses

- S&P 500 up 23 points, or 0.7%, to record 3507

- DJIA up 0.6%

- Nasdaq +0.6%

On the week:

- S&P 500 +3.3%

- DJIA +2.6%

- Nasdaq 3.4%

Europe weekly:

- Stoxx 50 +1.7%

- DAX +2.1%

- CAC +2.2%

- MIB +0.7%

- FTSE 100 -0.6%

You are unlikely to lose money investing in the S&P 500 in 10-year periods.

Germany’s Merkel: Things won’t return to normal until we have a coronavirus vaccine

Further comments by Merkel

- Hearing that there are hopeful approaches for developing a vaccine

- Says Germany is to spend most of EU funds on existing programs

- Says Germany is to get around €22 billion from recovery fund

Merkel laying down some expectations over how life will be over the next few months at the very least for Germany and/or Europe for the most part.

As smoothly as the economic recovery has been progressing, the fact remains that global travel is something that is unlikely to resume any time before the end of the year.

USD/JPY slips on Abe’s resignation but buyers keep defense of key near-term level

USD/JPY falls as the yen gains on Abe’s resignation as prime minister

Since Powell’s speech yesterday, the pair has pretty much followed the trajectory in bond yields and after a brief nudge lower post-Powell, the pair rose from 105.60 to a high earlier today of 106.95 – just short of testing its 100-day moving average @ 107.00.

But Abe’s resignation has thrown a bit of a curveball into yen trading ahead of the weekend, as the currency strengthened amid a risk-off wave in Japanese markets as the Nikkei tumbled on the news as well.

For USD/JPY, the pair dropped from around 106.70 to a low of 106.11 but buyers are keeping a defense of the 100-hour MA (red line) @ 106.20 for the time being.

That means the near-term bias is still more bullish as buyers are holding on to support at the key level above with further support then seen closer towards the 105.95-00 region, near the 200-hour MA (blue line).

For now, there may be pressure on yen pairs on the back of some uncertainty surrounding the political future of the country and if Abe’s successor will bring about major changes to economic policies i.e. ‘Abenomics’ and the BOJ monetary policy outlook.

The consensus argument is that the relative uncertainty is likely to be short-lived as the Japanese economy is in a rather fragile state following the coronavirus pandemic and no lawmaker – and even the BOJ – will be willing to risk things at the moment.

As such, there is a strong case that the relative strength in the yen may not last and as long as bond yields are elevated as per what we have seen post-Powell, that should underpin yen pairs in the bigger picture.

Back to USD/JPY, I’d be more convinced of a further drop if we do see the 200-hour MA @ 105.95 breached over the next few sessions. Otherwise, the relative softness in the dollar so far is also suggestive that the downside in the pair may not extend too much.