Will the economic recovery eventually live up to the hype?

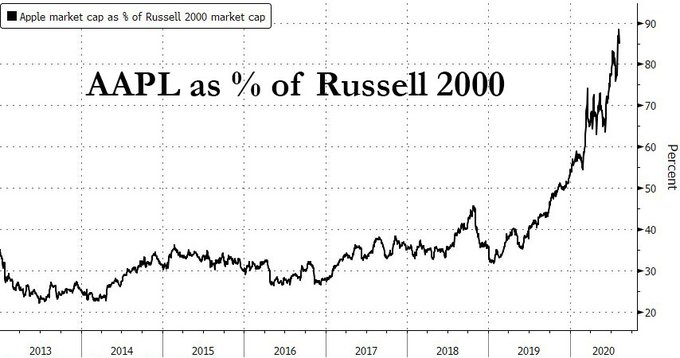

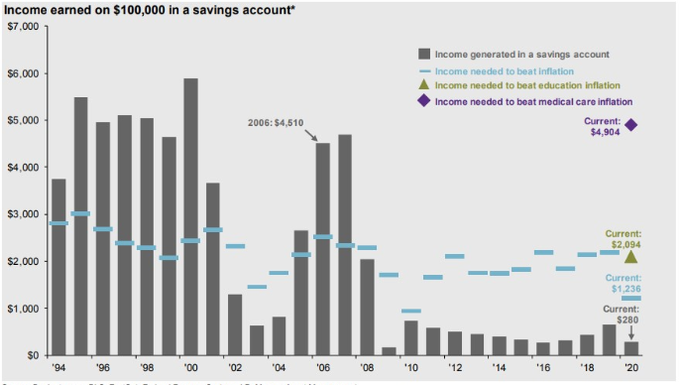

One of the above charts is not a “V”. And therein lies a potential longer-term problem that market participants will have to consider down the road.

As we move on from Q2 to Q3, the expectation is that ‘the worst is behind us’ when it comes to the pandemic and the economic fallout from the virus crisis.

While that will certainly be true, what it doesn’t say is that the economic recovery and the path towards “normalisation” may perhaps take much longer than anticipated.