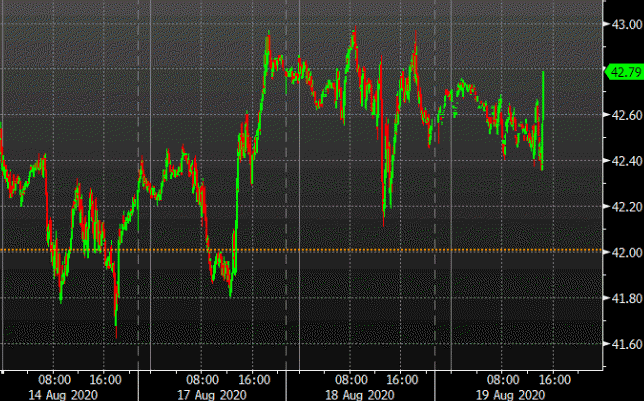

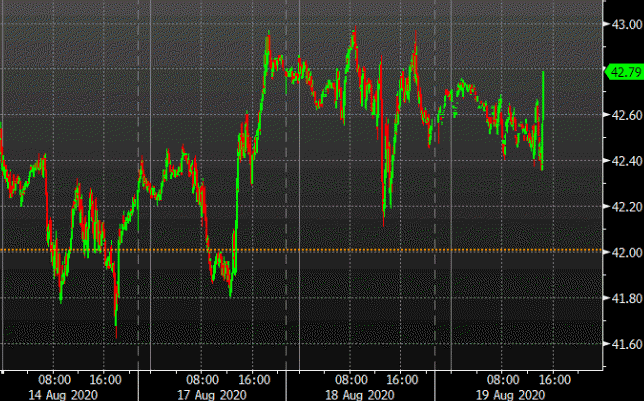

Weekly US petroleum inventory data

- Prior was -4512K

- Gasoline -3322K vs -1000K expected

- Distillates +152K vs -1200K expected

- Refinery utilization -0.1% vs +0.3% expected

- Production unchanged at 10.7 mbpd

- Crude -4264K

- Gasoline +4991K

- Distillates -964K

The market will be keenly eyeing the release of the July FOMC meeting minutes later today but it is unlikely to tell us much that we don’t already know at the moment.

But just take note that with all things OPEC+ related, there’s a likelihood it could be delayed for a few minutes or hours and what not. So, it will happen when it happens.

Japanese stocks are taking more positive cues from Wall Street yesterday, with the slight drop in the yen earlier on also helping exporter stocks a little.

The reported R values has been around 1 or slightly above since mid-July 2020. According to current observation, this seems to be associated to a great extent with an increasing number of cases among travel returnees. Further it is also associated with a larger number of smaller outbreaks and case numbers in Germany overall, which have increased steadily in recent weeks since the relaxation of the measures.

Prior lows were also times that gold outperformed equities. What’s different this time? Stocks have never been at record highs with fundamentals severely depressed. Never. Time to buy gold & sell stocks.