Copper hits two year high this week

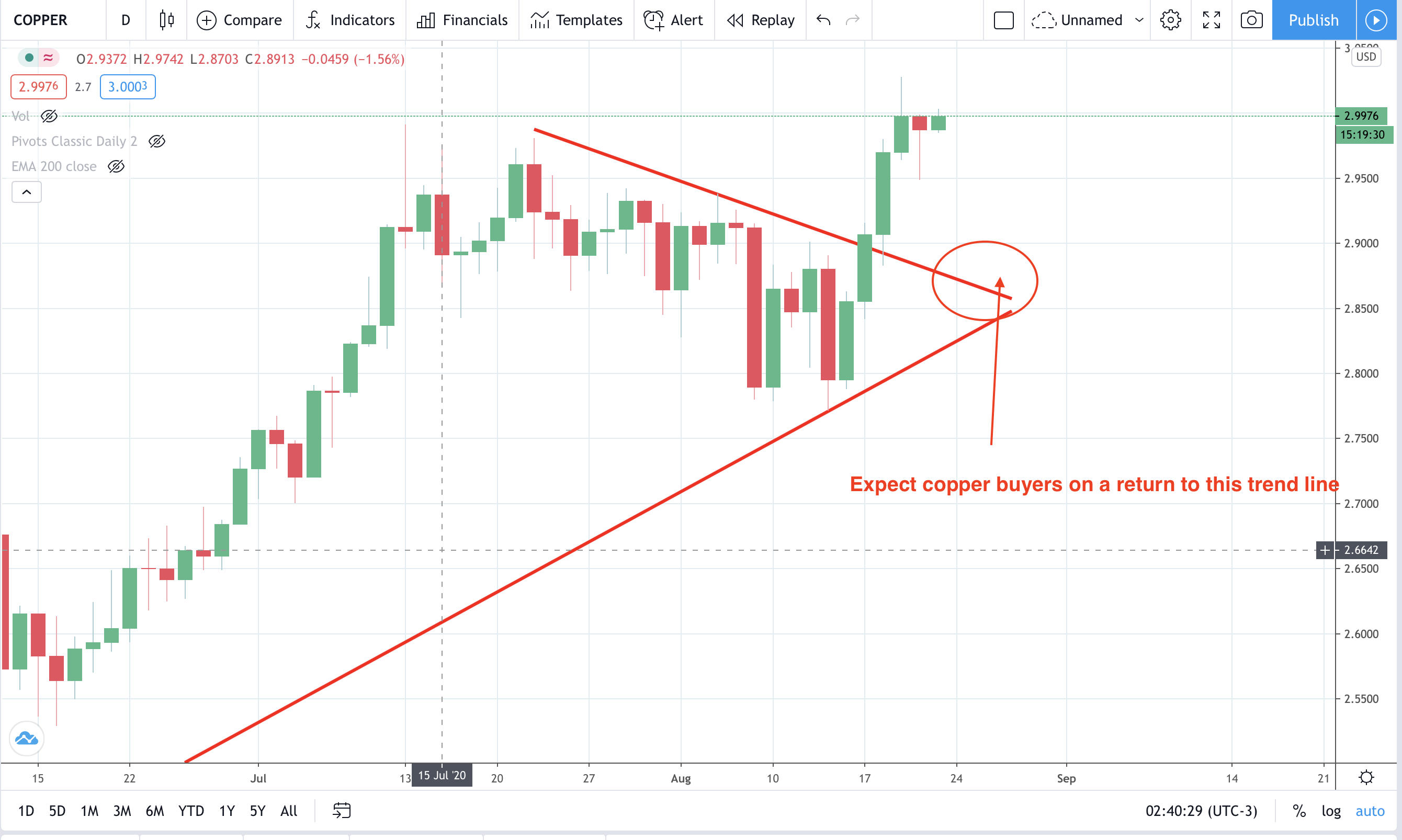

Copper prices have been rallying recently on the weaker dollar (it makes it cheaper for holders of other currencies to buy), supply issues and rising demand from China on Beijing’s stimulus package. Take a look at this chart from Reuters tracking China’s PMI’s with the LME index:

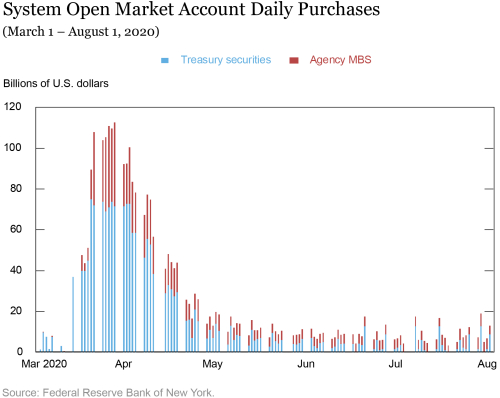

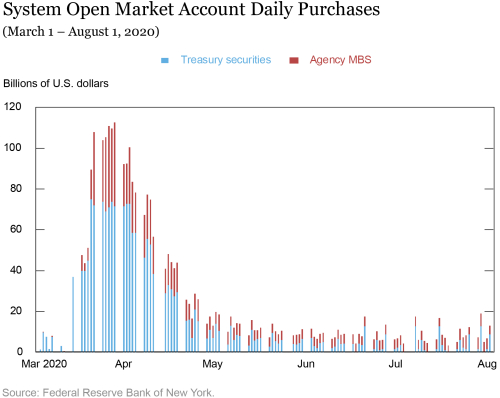

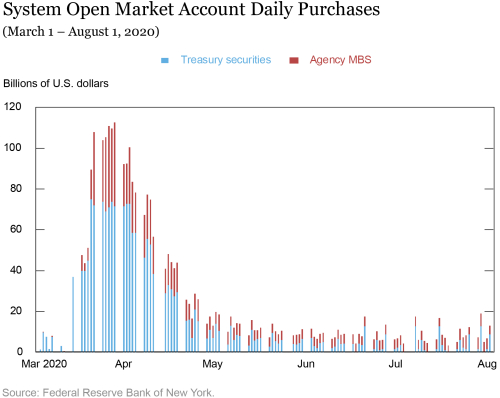

Copper futures look attractive from a return to the level marked as long as we don’t see USD strength over the next week or so. The Jackson Hole Symposium on Thursday will be key next week as the market looks for fresh guidance on US monetary policy