Archives of “August 19, 2020” day

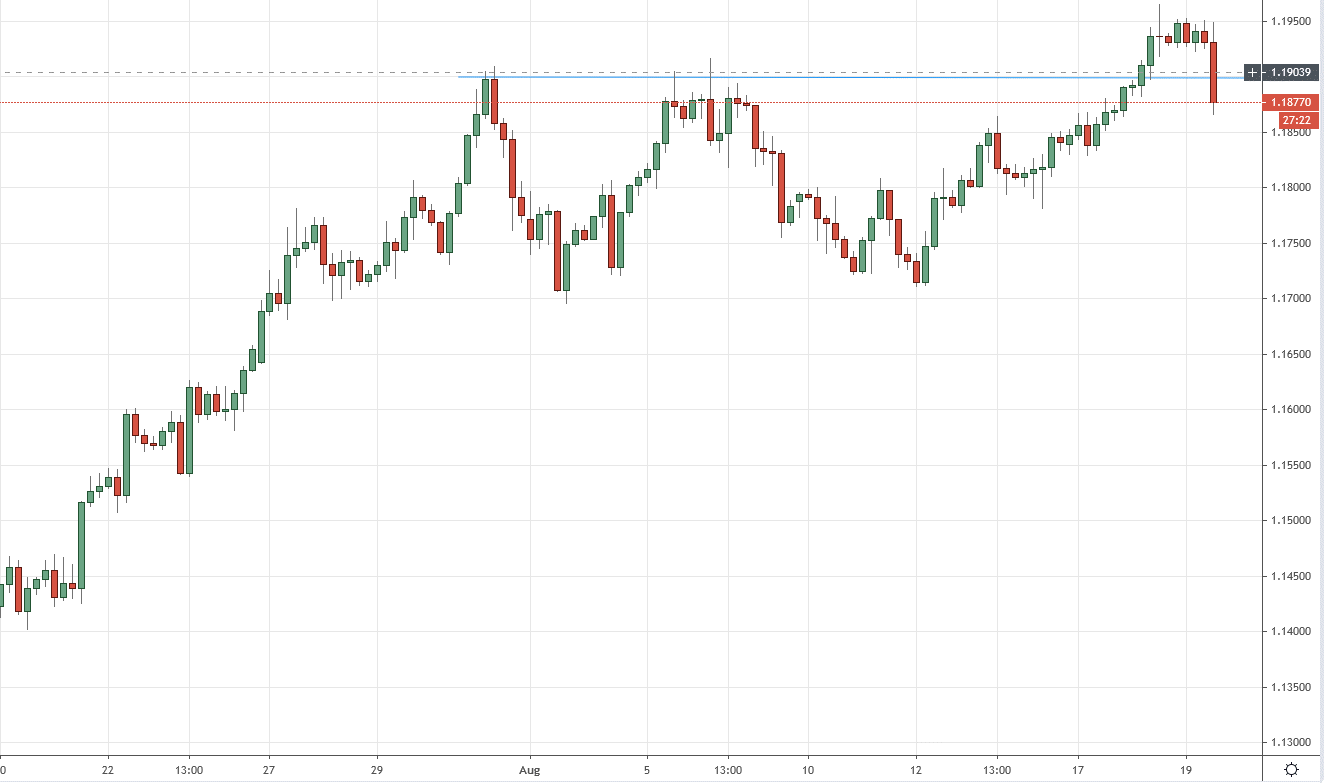

rssWhy the US dollar continues to rebound and what’s next

The pressure is on

The US dollar has extended its gains as market participants get caught wrong-footed in a rebound after multi-month lows.

The dollar looked to be breaking down yesterday and today but stabled itself and is making a move to the upside. There are two near term factors to watch:

1) The 20-year auction

The US is selling $25B in 20-year bonds at the top of the hour. Last week there was a strong 10-year sale and a very weak 30-year sale so the bond market is off balance. A higher-than-anticipted yield could boost the dollar further.

2) The FOMC minutes

The Fed is a below-the-radar risk at the moment. The strong belief in markets is that they’re creeping towards doing more for the economy but an improvement in US virus cases, decent economic data, higher inflation and the stock market at record highs might make them slow their roll. If so, the dollar could climb further

Overall, this looks like a position-squaring squeeze in a quiet mid-August market to me but you can’t take anything for granted. If it spills over into a broad risk-off move, then the dollar could have a lot of room to run.

The EUR/USD chart to me looks like a retest of the range break before a further breakout but a close over 1.19 today would add confidence.

Chart: Industrial metals index –

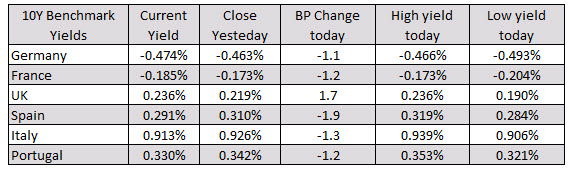

European shares rebound after yesterdays move lower

Major indices close near highs for the day

The European shares have rebounded after yesterdays move lower. They also are closing near their highs for the day. The provisional closes are showing:

- German DAX, +0.8%

- France’s CAC, +0.7%

- UK’s FTSE 100, +0.6%

- Spain’s Ibex, +0.64%

- Italy’s FTSE MIB, +0.8%

In the European debt market, the yields are mostly lower with the exception of the UK 10 year which rose by 1.7 basis points:

Apple shares hit the $2 trillion market cap

1st company to reach that milestone..

Apple has become the 1st company to crack the $2 trillion market cap level.

The company was the first to reach $1 trillion market cap back on Aug. 2, 2018. Amazing.

Apple announced a 4 to 1 stock split effective at the end of the month.

On July 31, Apple surpassed Saudi Aramco to become the world’s most valuable publicly traded company.

There is nevertheless some resistance against the area (around $467.77).

PS Amazon and Microsoft have market caps at $1.6T BTW.

US dollar springs to life

No headlines behind the move

USD/JPY is at the highs of the day, up 26 pips to 105.67 after falling as low as 105.10 in Asia.

The gain in the pair is part of a broad US dollar move higher. The euro, pounds and Swiss franc are all at session lows. Precious metals are also getting hit.

There is no correlation with the move and equities (very low volume this week) and bonds. There haven’t been any headlines driving the move but we’re coming up to the London fix.

It’s early but watch for this move to spread but I see it as a technical move so far with the euro breaking the daily range.

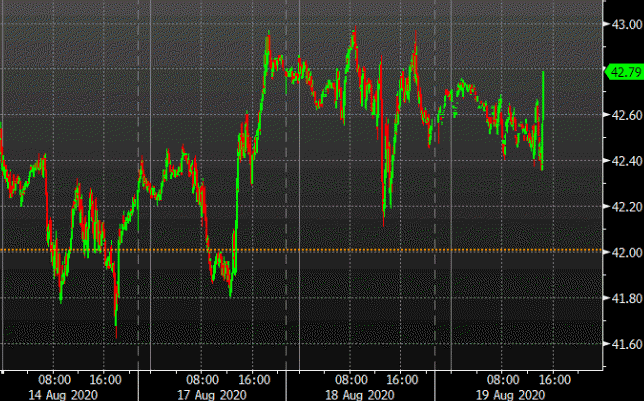

US weekly oil inventories -1632K vs -2850K expected

Weekly US petroleum inventory data

- Prior was -4512K

- Gasoline -3322K vs -1000K expected

- Distillates +152K vs -1200K expected

- Refinery utilization -0.1% vs +0.3% expected

- Production unchanged at 10.7 mbpd

API data late yesterday:

- Crude -4264K

- Gasoline +4991K

- Distillates -964K

Crude rose about 20 cents on the headlines to $42.79 per barrel. The headline isn’t as bullish as anticipated but the gasoline drawdown was larger.

The OPEC JMMC meeting is also taking place right now with Russia’s Novak stressing the need for full compliance.

FOMC meeting minutes, what to expect later?

Likely more noise more than anything else

The market will be keenly eyeing the release of the July FOMC meeting minutes later today but it is unlikely to tell us much that we don’t already know at the moment.

The Fed has acknowledged that the economic situation is starting to worsen a little and cast a bit of a dark cloud over the outlook in 2H 2020, considering the fact that the virus situation was escalating rather rapidly across the US last month.

If anything, I would say the minutes should just reaffirm that sentiment and also highlight that the Fed will still do whatever it takes to bolster the economy.

Other than that, there may be room to look out for potential policy changes/tweaks – possibly on future communication – but that is unlikely to offer much as the longer-term plan remains in tact (still just be mindful of this space in any case).

While the market may be looking to the minutes for further suggestions, it is not likely to change the themes that we have been seeing so far to start the week.

The softer outlook may be a signal for equities to pause after hitting all-time highs but for the dollar, election uncertainty and the stalemate on stimulus talks have been factors that are weighing on the currency; and those won’t be going away.

The dollar gave up on some key technical levels in trading yesterday but amid a tricky August so far, let’s see if sellers have the conviction to follow through ahead of the weekend.

What’s priced in for the US election

It’s 76 days until the election

The deadlock in US economic stimulus negotiations highlights the political risk for the US coming out of the election. The sides simply can’t compromise.

At this point, you have to assume that most Americas have made up their minds about Trump, Biden and how they will vote.

In normal times, a Biden win would be the consensus. National polls in the past week show him from +4 to +11. Of course, these aren’t normal times and no one has forgotten the surprise on election night in 2016. Even with that, it’s worth remembering that Clinton won the popular vote by about what was expected, it was that a handful of states surprised. Her polling average was also only about +3% and she never reached this kind of spread.

Here’s how BMO sees it:

WTO says indicators point to only partial uptick in world trade and output in Q3 2020

Adds that the strength of any such recovery remains highly uncertain

- World merchandise trade likely registered a historic fall in Q2 2020

- Additional indicators point to partial uptick in world trade, output in Q3 2020

- But L-shaped trajectory – rather than V-shaped – cannot be ruled out

The WTO comments according to the latest reading of its goods trade barometer. That pretty much adds to some uncertainty surrounding the pace of sustainability of the recovery we have seen from May to July up until now.

There is undeniable evidence that the global situation has improved considerably since bottoming out in April but there are concerns that the recovery process may be running out of steam as “new normal” conditions prevail.

We’ll get a better idea on how this all plays out in the latter stages of Q3 and in Q4 but with global travel still not resuming, it is safe to assume that global economic conditions may run into some added headwinds sooner rather than later.