Archives of “August 12, 2020” day

rssUS set to auction $38 billion in 10-year notes

Big auction due at the top of the hour

The US Treasury will raise $38 billion at the top of the hour by selling 10-year notes. In the prior sale the high-yield was 0.653%, which was a record low.

A few days ago that looked certain to be broken with 10s trading near 0.50% but there’s been a quick reversal in the past 5 trading days and the new notes are trading at 0.690% in the when-issued market.

In terms of FX, a yield higher than expected could push yields up and that would help USD/JPY extend its recent rally.

European shares rise. German Dax (major indices) up for the 4th consecutive day

Run to the upside continues

The European shares are closing higher for the day. The German DAX, France’s CAC, UK FTSE 100 has now moved higher for 4 consecutive days.

A look at the provisional closes shows:

- German DAX, +1%

- France’s CAC, +1%

- UK’s FTSE 100, +2.2%

- Spain’s Ibex, +0.4%

- Italy’s FTSE MIB, +1.0%

As London/European traders look to exit, the CHF remains the strongest. The JPY has taken over as the weakest of the majors. The USD has moved lower in the NY session (compared to opening levels). It is now mostly lower with declines vs. the CHF, EUR, CAD, AUD and NZD and gains only vs the JPY. It is back to unchanged vs the GBP after being higher vs the pound at the start of the day.

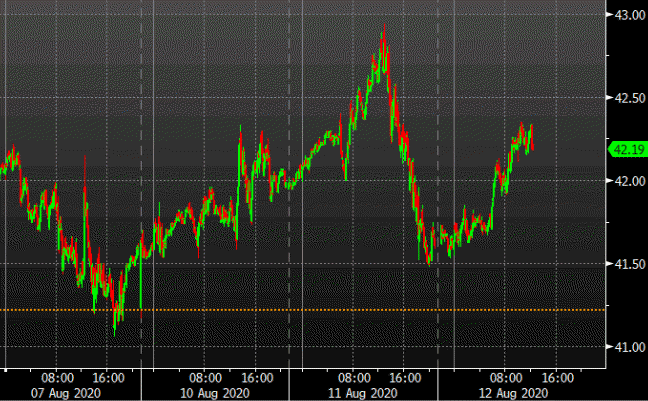

DOE crude oil inventories -4512K vs -2200K estimate

Crude oil inventories

- crude oil inventories draw of 4512K vs. draw of 2200K estimate. Last week draw 7373K

- gasoline inventories draw of -722K vs. draw of -400K estimate. Last week saw a build of 419K

- distillates a draw of 2322K vs. a build estimate of 1000K. Last week saw a build of 1591K

- Cushing build of 1336K vs a build of 532K last week

- Crude oil is currently trading at $42.53, up $0.93 or 2.17%

The private data last night showed:

- Crude -4400K

- Gasoline -1310K

Mnuchin says legislation needed for capital gains tax cut

That’s a change in stance and it’s weighing on the dollar

The Trump administration for years has been floating the idea of indexing capital gains to inflation. That picked up again this week and was briefly a tailwind for stock markets to start the week.

Mnuchin’s comment here evidently confirms that the White House has decided that unilaterally indexing capital gains isn’t possible and says it will take legislation. That’s not going to happen in the current congress and is very unlikely so long as Democrats control the House.

So the short story here is that it’s dead.

The US dollar is falling on this headline.

The percentage of S&P 500 companies that beat earnings per share expectations is increasing.

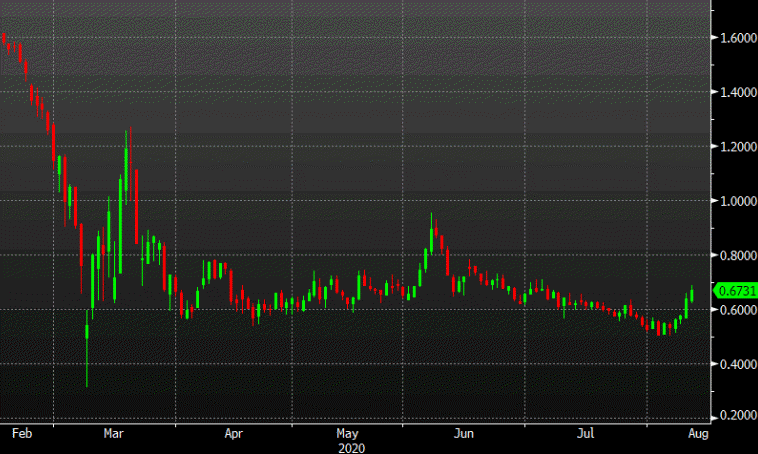

OPEC lowers global oil demand forecast

The latest forecasts in OPEC’s monthly report

OPEC now sees 2020 world oil demand down by 9.06 mbpd compared to a drop of 8.95 mbpd in the previous monthly report.

They say the second-half outlook points to the need for continued efforts to support a rebalancing in the market through OPEC+ adjustments.

With that, they cut their forecast for OPEC crude by 400K bpd this year and 500K bpd in 2021. Part of that is due to higher non-OPEC supply.

Crude is unmoved by the news and up 59-cents to $42.20/barrel on the day.

The main worry for oil is that OPEC starts to ramp up production again. Non-OPEC producers are filling in gaps from the huge cuts and that’s not going to fly forever.

Composition of Euro Area reserve assets and FX

Russia says first batch of coronavirus vaccine expected within two weeks

The vaccine clinical test results will also be published in that time frame

This according to Russian health minister, Mikhail Murashko. On the headline, I reckon he is referring to mass production. It’ll be interesting to see how this pans out over the coming months and how it will impact other countries to produce “breakthroughs”.

Meanwhile, the country itself just reported another 5,102 new virus cases and that sees the total confirmed cases exceeding 900,000 (~180,000 active cases). Another 129 deaths were also reported, bringing the tally on that front to 15,260 persons.

China reaffirms that US’ TikTok ban has nothing to do with national security

Comments by the Chinese foreign ministry

- Beijing has been ‘consistent’ on trade deal

- Declines to comment on further trade specifics

- Says position on US sanctions is clear and consistent

- Says US sanctions are irrational, groundless

- Reiterates opposition towards ties between US and Taiwan

There’s nothing really new here as this has been China’s stance all along but it does reaffirm expectations that both sides have a lot more than just the Phase One trade deal to discuss if they were to meet later this week.