Little change in the Nikkei after the 4-day weekend

That said, Japanese stocks did recover from an early setback today so that is a positive takeaway for risk buyers when looking at the overall mood.

That said, Japanese stocks did recover from an early setback today so that is a positive takeaway for risk buyers when looking at the overall mood.

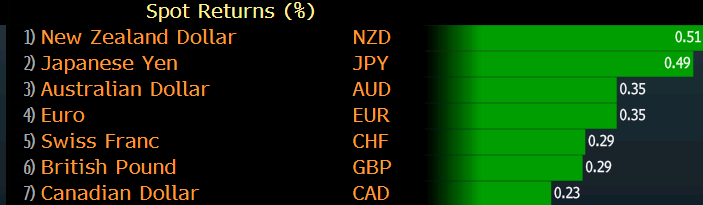

It is one-way traffic in trading to start the week with the dollar being battered across the board, while gold and silver are continuing their hot streak into the new week.

Some updates to the virus situation across Europe recently warning by Saxony state premier UK imposing a 14-days quarantine for travelers from Spain The country recorded a rise of 340 new cases today, a more modest figure but could be skewed due to the ‘weekend effect’. This compares to the slight jump of 816 and 784 new virus cases seen on 24 and 25 July respectively.The rise comes amid localised outbreaks, with a farm in Bavaria seeing more than 500 people quarantined after 174 workers were tested positive for the virus.RKI estimates the 4-day virus reproduction rate to be at 1.22 and the 7-day average to be 1.16 as of yesterday; keeping above the threshold of 1.00.There have been concerns about the rising cases across the country, with the virus reproduction rate keeping above 1.00 threshold (it was 1.3 on Saturday) while daily new infections rose by 1,130 on last Friday.On the latter, that has seen the 7-day average in terms of cases rise above 1,000 for the first time since early June.Local authorities are warning about complacency but besides , they are maintaining their course to keep the economy running.

The situation in Italy appears relatively ‘under control’ with 275 new cases reported in the past day. Regional governments are continuing to stay prudent by reinforcing the need to wear masks in public spaces so that is encouraging.The slight rise in cases in Spain is seeing countries take notice with the UK imposing a 14-day quarantine for travelers from the country, following Norway’s decision to reimpose a 10-day quarantine as well for people arriving from Spain.This comes amid a surge in cases in Catalonia but the Spanish government’s virus expert has warned that the infection is already spreading among the general community in Barcelona and Zaragoza – saying that the rate of contagion has tripled.French prime minister, Jean Castex, has also “strongly recommended” its citizens to avoid going to Catalonia (the border remains open) though the region itself announced closure of bars and nightclubs for 15 days on Friday last week.Catalonia (counted separately from Spain’s total) itself reported nearly 1,500 new cases on Saturday, as the number of new cases in the region is starting to pick up again.Despite warnings of complacency and what not, local authorities are continuing to reaffirm that these outbreaks are “localised” and have not spread out of control. The right now remains on the – or at least continuing down that path.In due time, we’ll see how this all plays out but no doubt further reopening of international borders are going to be extremely tricky.The positive takeaway is that the death rate in most places isn’t as high as when the initial outbreak began but as infection numbers rise, there could be a delayed effect on that as medical capacity also starts to be burdened even more.

Munchy is at it too …

Evans-Pritchard citing according to Il Sole (an Italian national daily business newspaper )

Link here for more (may be gated)

Roberto Gualtieri

Roberto Gualtieri

2350 GMT Japan Capex for Q1, final

0000GMT Reserve Bank of Australia – speech by Christopher Kent, Assistant Governor (Financial Markets), at the Kanga News webinar

0110 GMT BOJ JGB purchase operation

0130 GMT China Industrial Profits for June % y/y

0430 GMT Japan All Industry Activity Index for May

RBA’s Kent speaking today

RBA’s Kent speaking today