June FOMC meeting minutes

LINK to the Meeting Minutes from hte FOMC.

- Officials agreed on need for more analysis of yield curve control

- Fed was committed to using its full range of tools to support the US economy

- In their discussion of forward guidance and large-scale asset purchases, participants agreed that the Committee has had extensive experience with these tools, that they were effective in the wake of the previous recession, that they have become key parts of the monetary policy toolkit, and that, as a result, they have important roles to play in supporting the attainment of the Committee’s maximum-employment and price-stability goals.

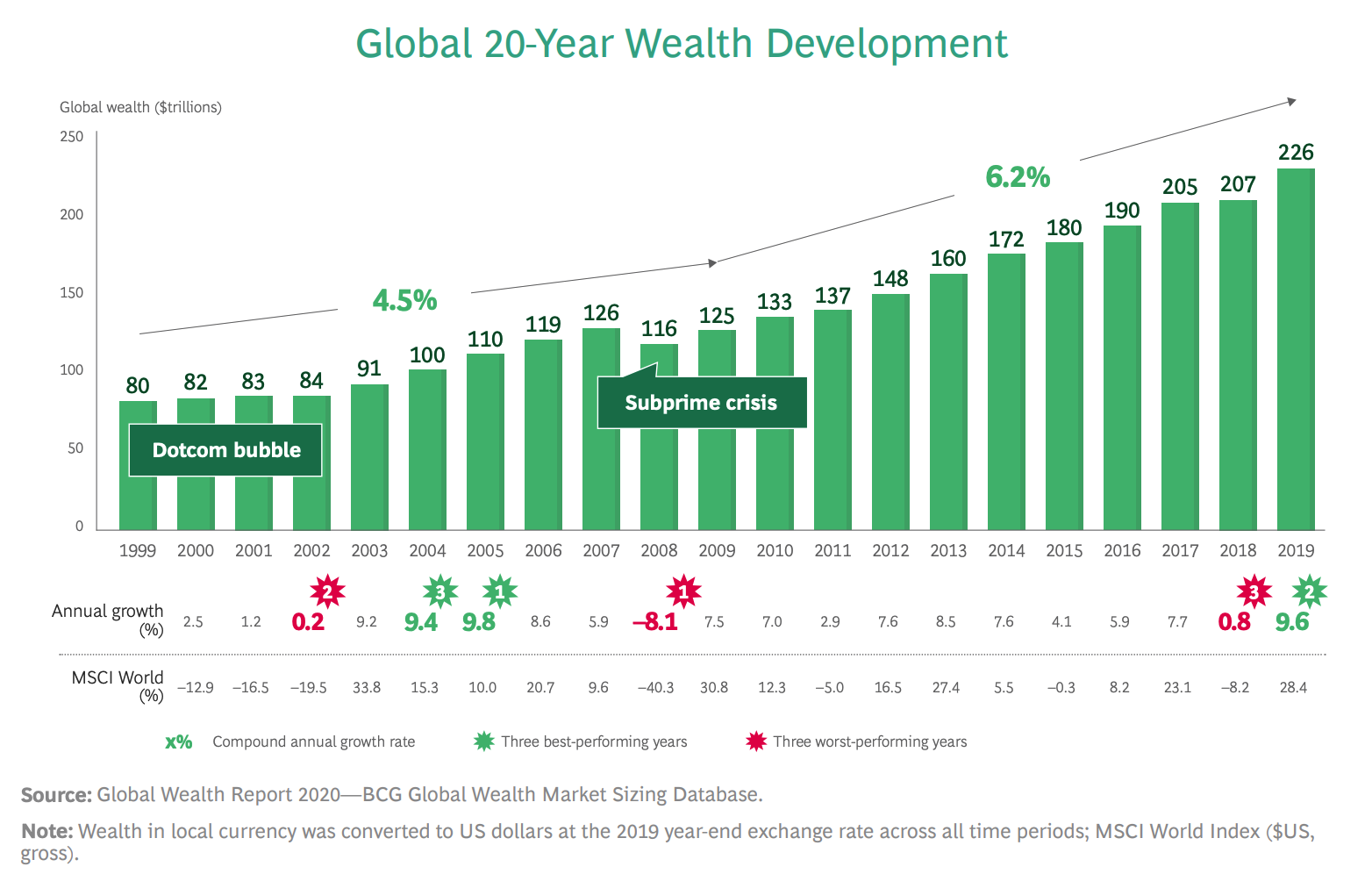

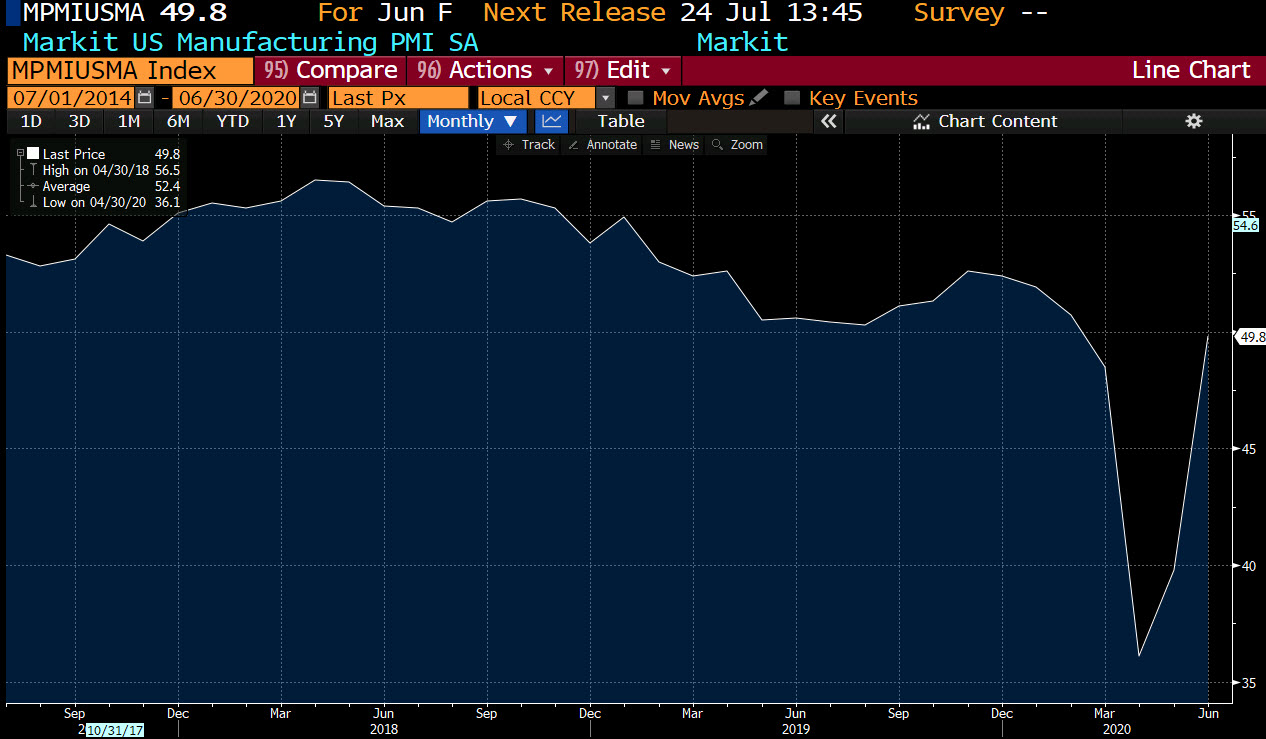

- Participants agreed that the data for the 2nd quarter would likely show the largest decline in economic activity in post-World War II history

- discussed whether yield curve caps or targets could support forward guidance and complement asset purchases

- most officials urged more explicit forward guidance

- most market participants did not anticipate policy changes at the June meeting. The target range for the federal funds rate was expected to remain at the ELB for at least the next couple of years, although many survey respondents attached some probability to the target range increasing in 2022.

- Most of Fed officials urged more explicit forward guidance

- officials expected strong second-half gain in consumption

- a number of participants a judge of forward guidance on rates and bond buying should aim to support rapid economic recovery, foster durable return to 2% inflation

- participants expected social distance in, saving in lower levels of employment and income to restrain the pace of expansion over the medium-term

- participants agreed that for guidance and asset purchases have important role in meeting employment and inflation goals

- consumer recovery not seen as rapid beyond 2020

- most Fed officials urged more clarity on asset purchases

- number of participants spoke in favor of tying forward guidance to inflation goals allowing a modest temporary overshoot of 2% target

- participants stressed that health care, fiscal policy measures, and actions by households and businesses would shape recovery prospects

- a couple favor guidance based on unemployment rate since it had been kept low in the past and could signal an extended period of support for the economy

- full recovery in employment would take some time

- a few participants favored forward guidance based on calendar promises, given the uncertainty about how fast the economy might recover

- a 2nd wave of coronavirus outbreak was no less plausible than their baseline forecast scenario and if it occurred, economic disruption will be more severe and protracted

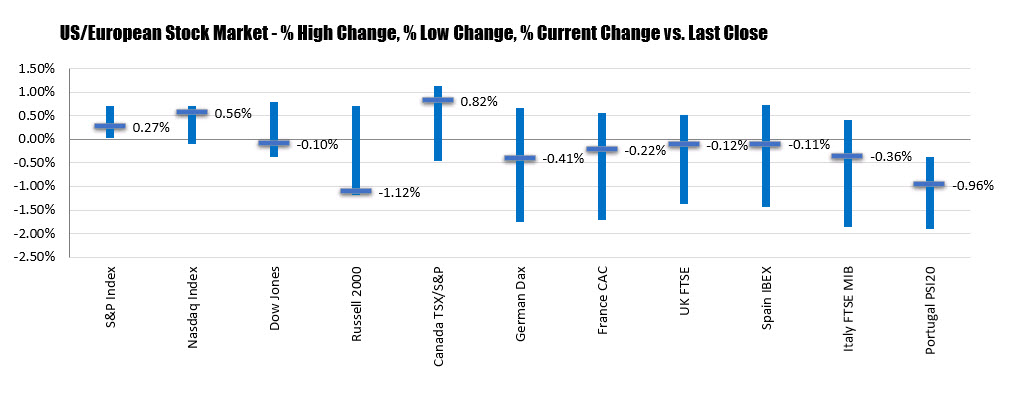

In other markets:

In other markets: