Archives of “July 2020” month

rssLOL This chart of Bank of Canada’s assets..

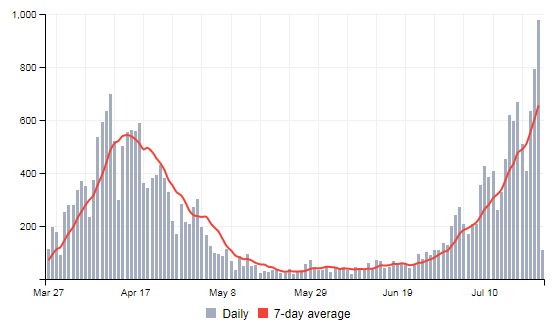

Japan PM Abe: Current situation does not call for state of emergency declaration

Comments by Japanese prime minister, Shinzo Abe

- Coronavirus cases are rising, government is watching closely

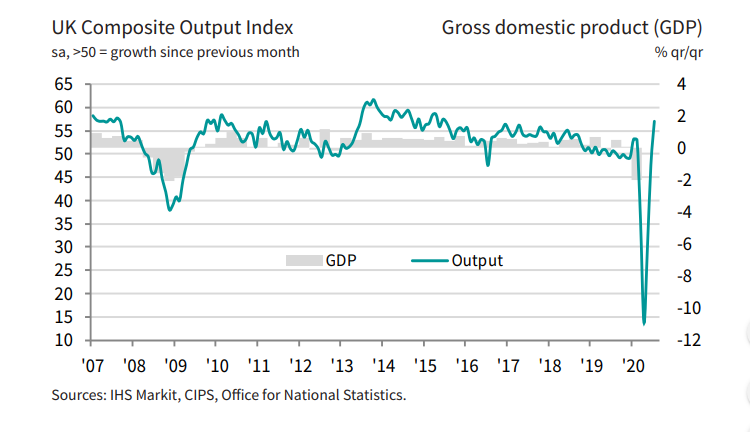

UK July flash services PMI 56.6 vs 51.5 expected

Latest data released by Markit/CIPS – 24 July 2020

- Prior 47.7

- Manufacturing PMI 53.6 vs 52.0 expected

- Prior 50.1

- Composite PMI 57.1 vs 51.7 expected

- Prior 47.7

The easing of lockdown measures has spurred a solid upturn in UK business activity, but once again this just reaffirms that conditions here are much better than they were compared to the May to June period. Still, it is a positive takeaway nonetheless.

“The UK economy started the third quarter on a strong footing as business continued to reopen doors after the COVID-19 lockdown. The surge in business activity in July will fuel expectations that the economy will return to growth in the third quarter after having suffered the sharpest contraction in modern history during the second quarter.

“However, while the recession looks to have been brief, the scars are likely to be deep. Even with the July rebound there’s a long way to go before the output lost to the pandemic is regained and, while businesses grew more optimistic about the year ahead, a V-shaped recovery is by no means assured.

“New orders showed only a relatively small rise in July, indicating that demand remains worryingly low at many firms. Hence July saw yet another sharp cut to employment levels as increasing numbers of companies scaled back their operating capacity. Many households are therefore likely to remain cautious with respect to spending with the job market deteriorating.

“Furthermore, not only do many consumer-facing businesses remain especially hard-hit by the pandemic and ongoing social distancing, we remain very concerned about the extent to which the recovery could be smothered by a lack of postBrexit trade deals.

“July’s PMI represents a step in the right direction, but there is a mountain still to climb before a sustainable recovery is in sight.”

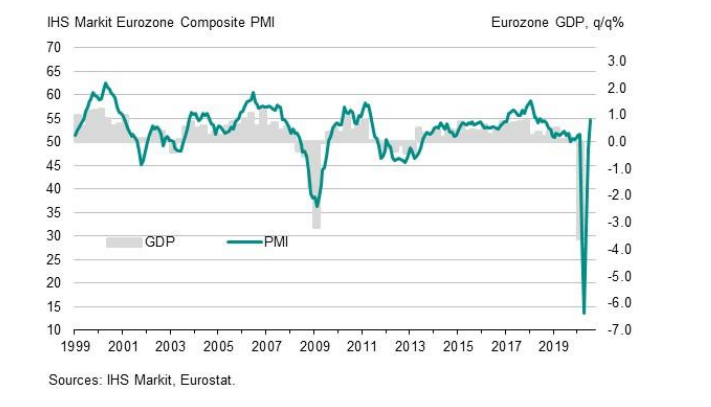

Eurozone July flash services PMI 55.1 vs 51.0 expected

Latest data released by Markit – 24 July 2020

- Prior 48.3

- Manufacturing PMI 51.1 vs 50.1 expected

- Prior 47.4

- Composite PMI 54.8 vs 51.1 expected

- Prior 48.5

Solid beats across the board as preempted by the French and German readings earlier. Both the services and composite prints are their highest in over 25 months. Even the manufacturing beat is the highest in 19 months.

“Companies across the euro area reported an encouraging start to the third quarter, with output growing at the fastest rate for just over two years in July as lockdowns continued to ease and economies reopened. Demand also showed signs of reviving, helping curb the pace of job losses.

“The data add to signs that the economy should see a strong rebound after the unprecedented collapse in the second quarter.

“However, while the survey’s output measures hint at an initial v-shaped recovery, other indicators such as backlogs of work and employment warn of downside risks to the outlook.

“The concern is that the recovery could falter after this initial revival. Firms continue to reduce headcounts to a worrying degree, with many worried that underlying demand is insufficient to sustain the recent improvement in output. Demand needs to continue to recover in coming months, but the fear is that increased unemployment and damaged balance sheets, plus the need for ongoing social distancing, are likely to hamper the recovery.”

China says that US’ Chengdu staff harmed China’s national security interest

Comments by the Chinese foreign ministry

- US’ Chengdu consulate diplomats must leave China in 30 days

- US must close Chengdu consulate within 72 hours

- US is totally responsible for current bilateral situation

Yen continues to firm as Treasury yields fall further on the session

US 5-year yields fall to a record low of 0.255%

Chinese equities close sharply lower to end the week

CSI 300 index fell by 4.4% in trading today

Meanwhile, the Shanghai Composite index also fell by 3.9% but despite the sharp drop in trading today, the weekly performance isn’t that bad for Chinese equities.

10yr US real yield down to -0.88%, through the absolute lows in late 2012

“What Buffett wouldn’t do”

Investing:

- Don’t be too fixated on daily moves in the stock market (from Berkshire letter published in 2014)

- Don’t get excited about your investment gains when the market is climbing (1996)

- Don’t be distracted by macroeconomic forecasts (2004)

- Don’t limit yourself to just one industry (2008)

- Don’t get taken by formulas (2009)

- Don’t be short on cash when you need it most (2010)

- Don’t wager against the U.S. and its economic potential (2015)

Management:

- Don’t beat yourself up over wrong decisions; take responsibility for them (2001)

- Don’t have mandatory retirement ages (1992)

- “Don’t ask the barber whether you need a haircut” because the answer will be what’s best for the man with the scissors (1983)

- Don’t dawdle (2006)

- Don’t interfere with great managers (1994)

- Don’t succumb to the attitudes that undermine businesses (2015)

- Don’t be greedy about compensation, if you’re my successor (2015)

Last, Buffett advises “Don’t worry about my health” — because Berkshire’s future success is is tied to reinsurance lieutenant Ajit Jain. “Worry about his.” (2001)

Investing:

Investing: