The US dollar is on course to record its worst July since 2010. This is according to Bloomberg data from the Commodity Futures Trading Commission which show that asset managers added to net long positions on the yen, euro and Canadian Dollar. These moves further added to the weakness in the Bloomberg Dollar Spot Index seeing it fall 3.4% this month. The net result is that the Index is on track for its worst July since 2010.

The reasons for dollar weakness

There are a number of reasons for dollar weakness:

- The further deterioration in the relationship between US and China

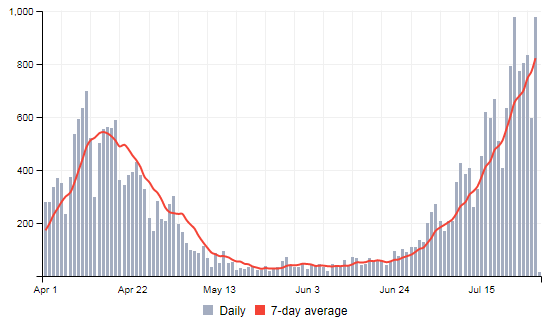

- The expanding COVID-19 case count in the US

- The uncertainties around a November presidential election

- Growing expectations that the Fed will need to cut policy rates further.

What to expect from the Fed tonight?

The Fed is expected to signal more accommodation tonight. So, if there is any talk of yield curve control or negative interest rates expect that to add further weakness to the USD. However, that seems unlikely as the Fed will most likely just stay in a wait and see mode. The Dollar Index has broken through a key monthly trend line and a clean break opens the way up for more sellers. The key monthly support sits below in the 90.00 region.

The US stocks are ending the day just off the lows for the day. The NASDAQ index by the way with a -1.27% decline.

The US stocks are ending the day just off the lows for the day. The NASDAQ index by the way with a -1.27% decline.