Archives of “July 23, 2020” day

rssThis is what happens when you let a govt run a copper/silver miner…

Apple reportedly delays launch event for new 5G iPhone

This according to a New York Post article

the New York Post is out with an article saying that “Apple is reportedly delaying a fall launch event for its next batch of iPhones to the later half of October”.

Apple is now on track to releases 5G iPhone just-in-time for the holiday season. This according to Japanese Apple blog Mac Otakara.

Apple shares are down about $10.55 or 2.71% on the day to $378.50. It’s high price reached $399.81 few days ago – just short of the magical $400 a share. Apple is expected to announce earnings on Thursday, July 30 after the close. That will be the same day that Amazon releases their earnings.

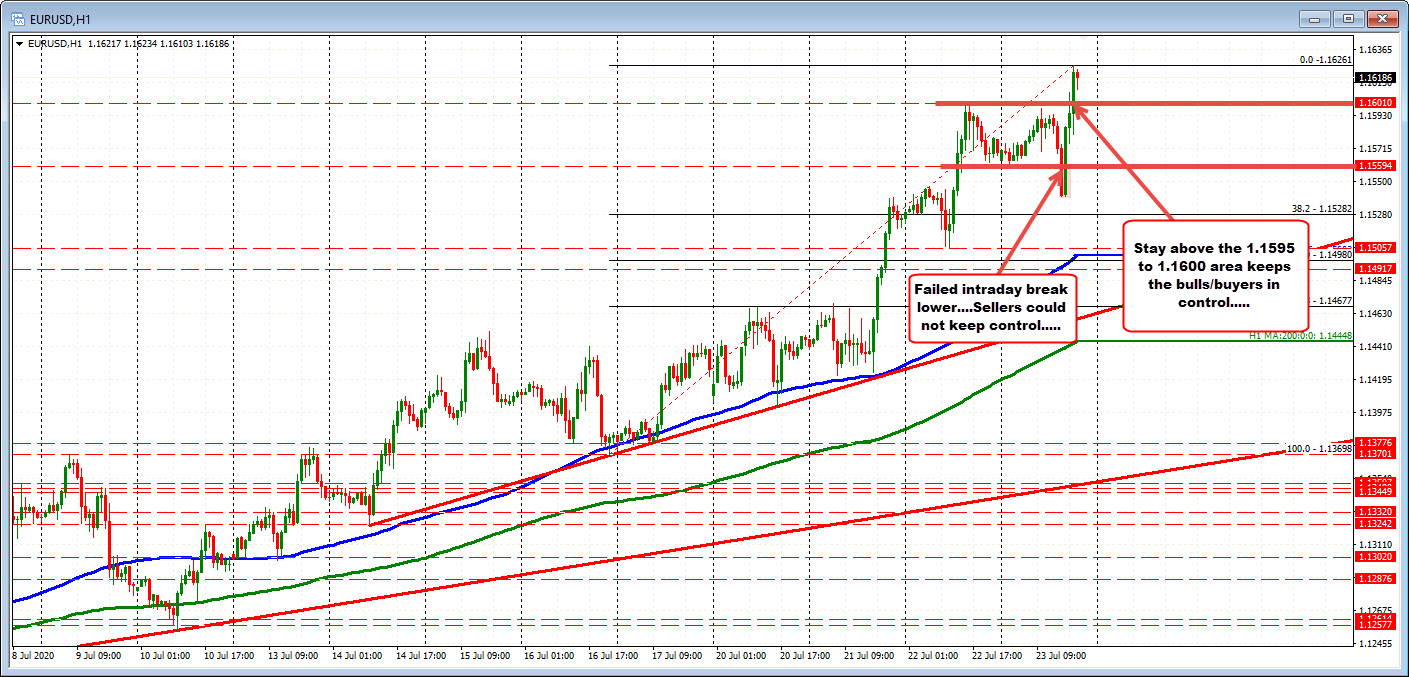

EURUSD extends above the $1.160

EURUSD also above the 50% retracement at 1.15958

The price of the EURUSD has broken above the 50% retracement of the move down from the 2018 high at 1.15958. The pair has also moved above the 1.1600 level in the process. That was the high price from yesterday’s trade. The high price has extended to 1.1626 after the break.

Drilling to the hourly chart, at the start of the session, the EURUSD moved below the swing lows in the 1.15594 area (see chart below). Staying below that level would have kept the sellers in control and would have would have opened the door for a further probe down toward the 38.2% retracement and rising 100 hour moving average (blue line on in the chart below).

That did not play out. The price moved back above the 1.15594 and started it’s move back to the upside.

Admittedly there was some up and down around the 1.1600 level with the 1st break failing. However the 2nd run higher was accompanied with more upside momentum.

Risk now is the 1.1595-1.1600. Traders would not want to see a reversal back down below that area after breaking.

Major European indices end the session mixed

Provisional closes for the European major indices

the European stock markets are closing for the day with mixed results. Germany, France, UK, and Spain are all trading within 0.11% of the Friday close. Italy had the biggest move with decline of -0.60% or more. The major indices are closing well off the session highs as well.

The provisional closes are showing:

- German DAX, +0.07%. At the high the index was up 0.87%

- France’s CAC, -0.06%. At the high the index was up 0.93%

- UK’s FTSE MIB, +0.11%. At the high the index was up 1.07%

- Spain’s Ibex, -0.06%. At the high the index was up 0.70%

- Italy’s FTSE MIB, -0.68%. At the high the index was up 0.44%

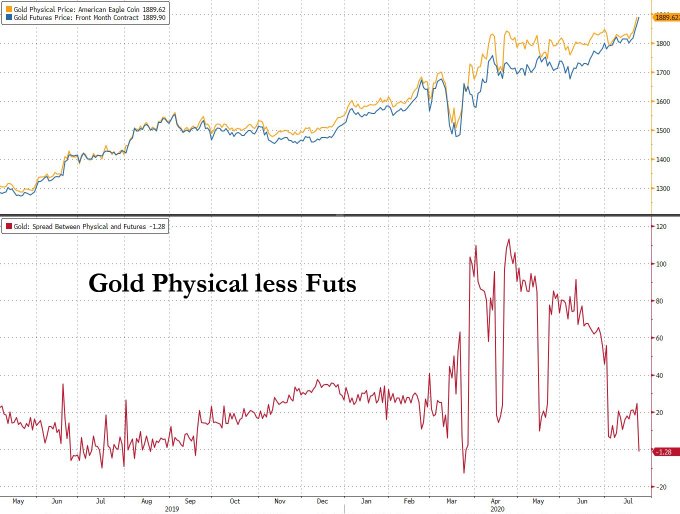

The world’s wealth is looking increasingly unnatural

The real yield on the 10-year US bond is at record lows.

ECB Lagarde: Recovery is about transforming the economy

ECB president Christine Lagarde speaking

ECB Christine Lagarde is speaking. She says:

- Recovery is about transforming the economy

- Reallocation of jobs, industry will take time

- Europe has shown can act quickly, adapt institutions

OK…..

WH press secretary: Trump will have another coronavirus briefing at 5 PM

White House press secretary McEnaney

- Pres. Trump will have another coronavirus briefing Thursday at 5 PM ET

- White House cafeteria worker tested positive for coronavirus: there was no significant contact

- Trump will speak at briefing on national strategy to reopen schools

Meanwhile, on the coronavirus, Houston area virus ICU cents is false 16% to lowest level since July 3. Good news from Houston.

Speaking of Houston, the US close the China consulate on accusations of espionage, theft. There is speculation that Beijing will retaliate by shutting Chengdu consulate, a strategically important post given American interest in Tibet.

China says US is breaking down the friendship bridge between the two countries

Comments by the Chinese foreign ministry

- US allegations are malicious slandering

- Repeats vow to make necessary response to US actions

- Says unaware of state television reportedly pulling EPL broadcasts off the air

As much as the headline sounds “bad”, actions speak louder than words. The comments don’t really signify much of an escalation to be honest. If shutting down consulates is the new tariffs, markets aren’t likely to react much more than they already have.