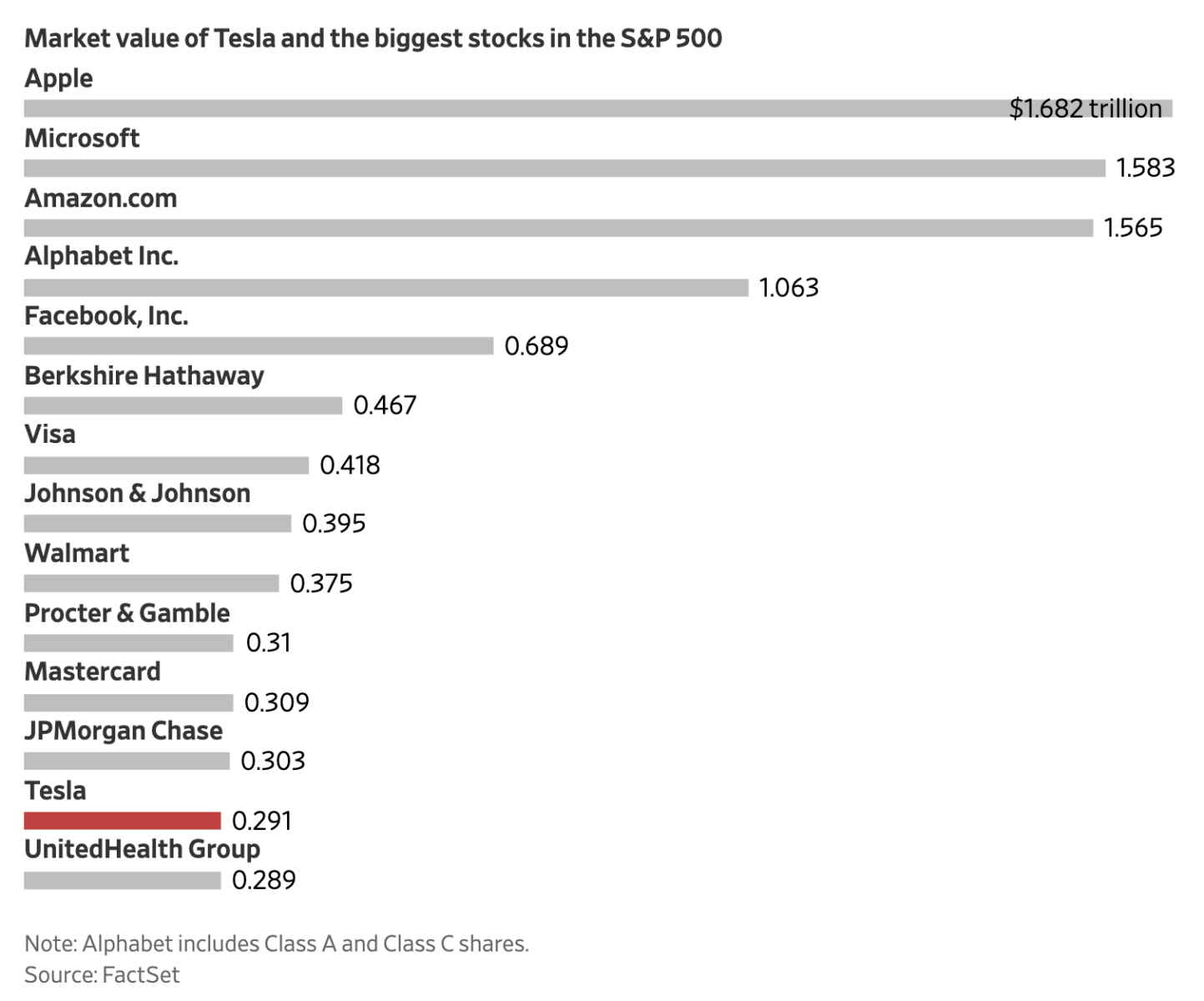

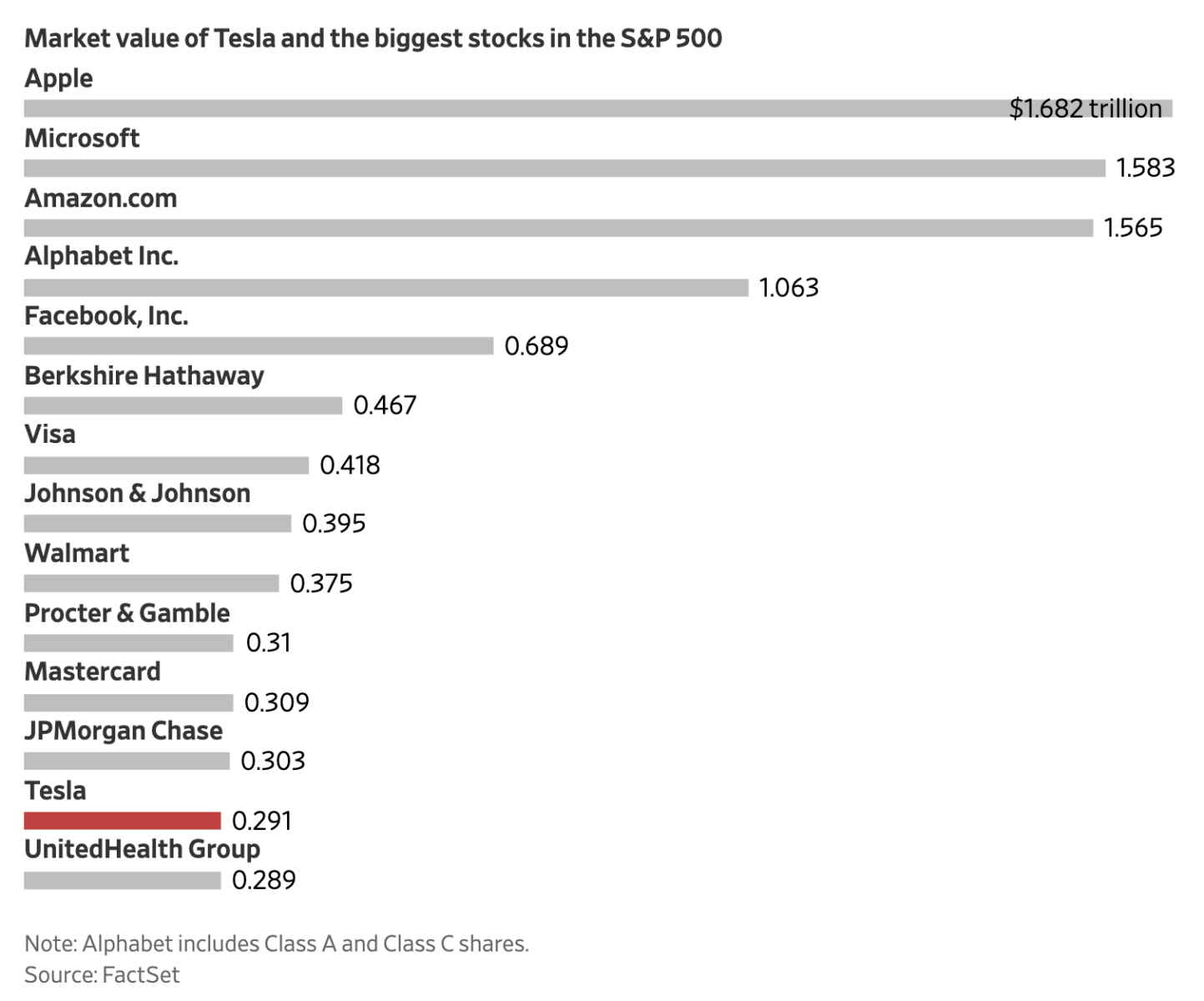

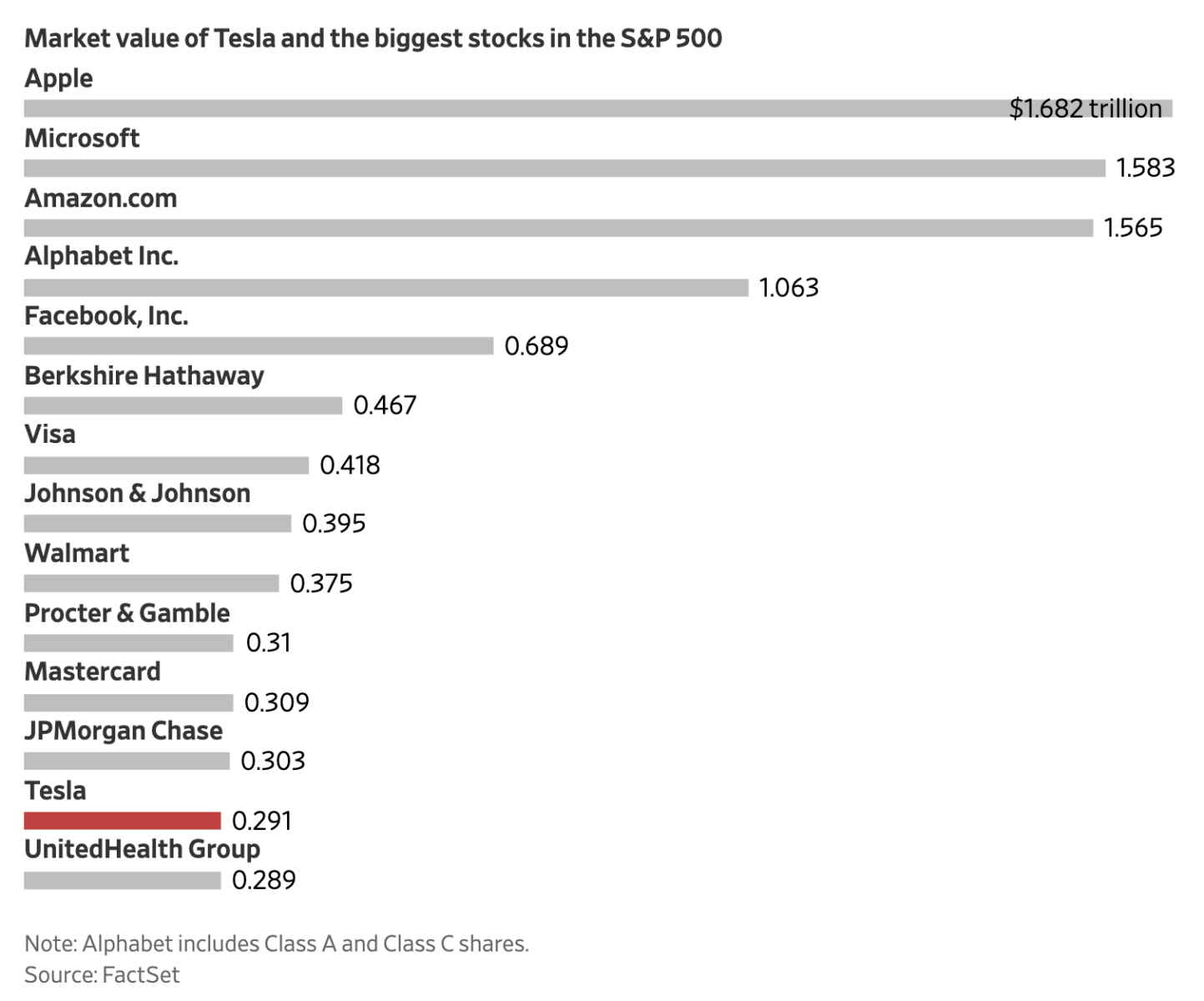

Tesla Knocks on S&P 500’s Door

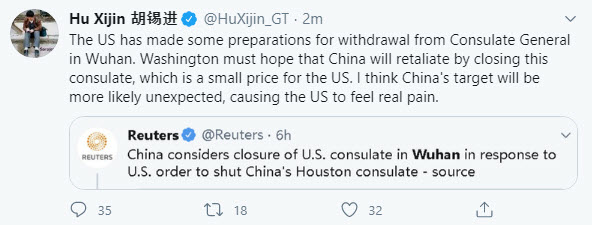

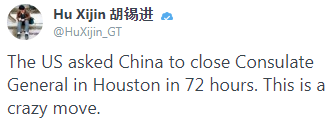

The warm and fuzzy feelings between US and China are not all that warm and fuzzy needless to say. It is hard to see things getting better.

The major European indices are ending the day lower. The provisional closes are showing:

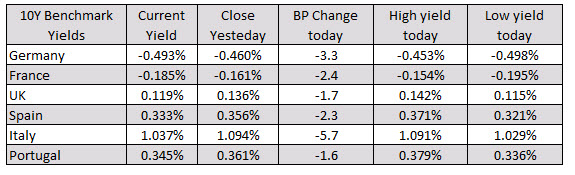

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:The price of the September contract just prior to the release was trading at $41.38. The price is currently trading at $41.47

This builds from the news from Global Times editor, Hu Xijin, earlier:

Major currency movement has been a little more subdued to start the day but the action should pick up soon enough and more so as we look towards North American trading later, following the moves that we saw in overnight trading.