Archives of “July 13, 2020” day

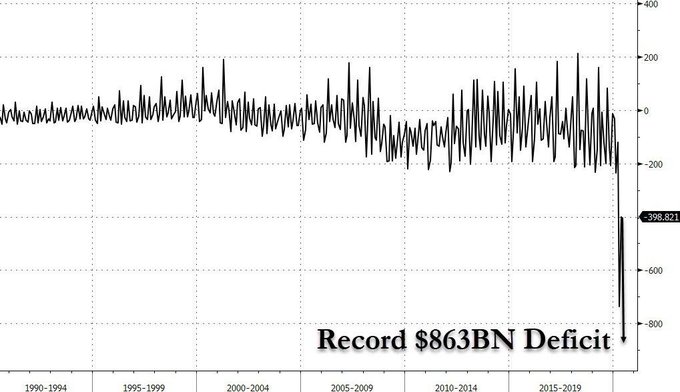

rssIt’s amazing that gold is only trading at $1800 given the below

An Update :US Dollar ,Sterling ,Euro ,Yen ,CAD ,AUD ,Chinese Yuan ,GOLD ,Crude -Anirudh Sethi

The bearish technical case for the dollar appears to be growing. It is a little disconcerting that it seems to have become the consensus view, and the gross and net long speculative euro positioning in the futures market is near two-year highs. However, the speculative positioning in the other currency futures is not nearly as extreme. Indeed, speculators are still net short sterling, Australian dollar, and Canadian dollar.

Turns in the market often appear to have a cascading effect. The turn does not happen all at once. Given that the euro is the single most important currency in the world after the dollar, that is the real interest. The Swiss Franc can sometimes be seen as its lead indicators. The Golden Cross (50 and 200-day moving averages) crossed down for last July. The euro’s averages crossed late last month, and at the start of last week, the 50-day moving average moved below the 200-day moving for the Dollar Index. The moving average for the Swedish krona crossed in the middle of June, while the Aussie’s averages crossed on the last session in June.

To read more enter password and Unlock more engaging content

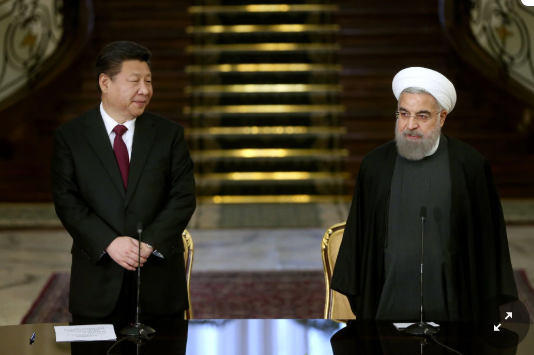

Iran and China are working towards partnerships – would benefit by offsetting US pressures on each

A weekend report from the Wall Street Journal on mooted wide ranging partnership discussion by the two countries:

- China would benefit from Iranian oil

- Iran would get Chinese investment

Iran and China partnering up would deflect US pressures and influence on both.

WSJ goes on:

- An initial draft of the Iran-China deal still requires Iranian parliamentary approval

- under a 25-year partnership, China would import “sustainable” levels of Iranian oil, but offered no further details

Here is the link for more (may be gated).

OPEC and its partners will consider increasing oil output at a meeting this week

Saudi Arabia and most others in the OPEC+ alliance support increasing output by around 2 million barrels a day say reports ahead of this week’s meeting.

- Key members of the Organization of the Petroleum Exporting Countries and its Russia-led allies will hold a virtual meeting on Wednesday 15 July

There is no further detail on this, link here

The increased optimism comes as hopes are up that demand is beginning to recover and will continue to do so. Its not going to be smooth sailing though.

Thought For A Day