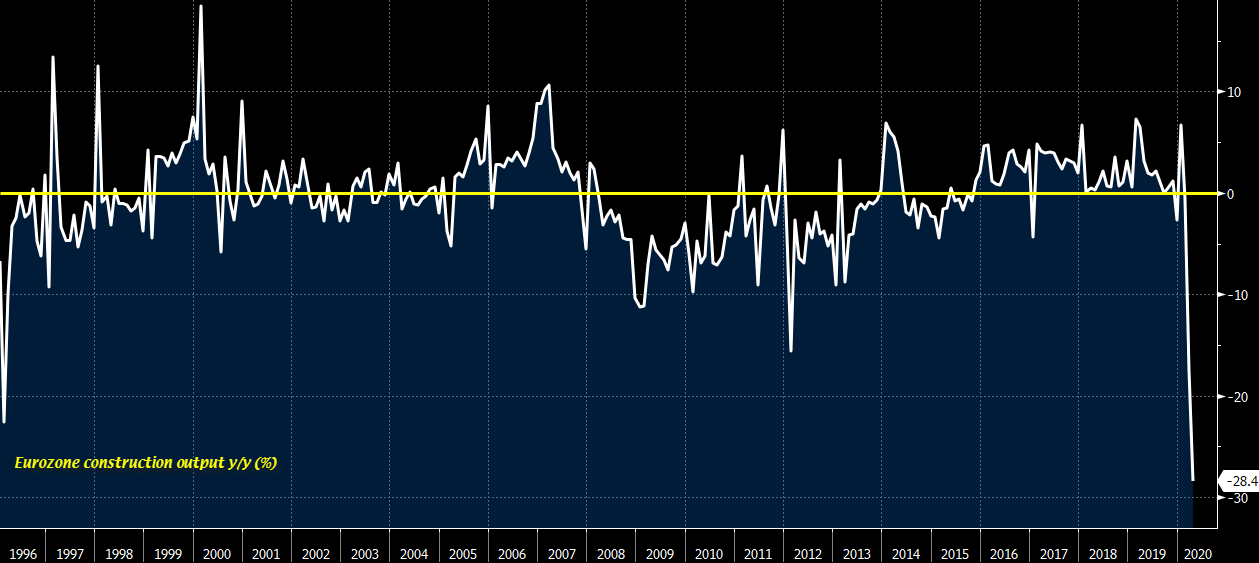

Latest data released by Eurostat – 17 June 2020

- Prior -14.1%; revised to -15.7%

- Construction output -28.4% y/y

- Prior -15.4%; revised to -17.5%

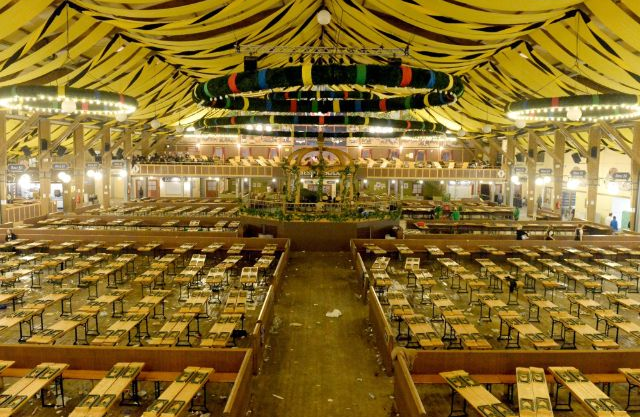

Despite the easing of border restrictions and the restart of international travel in Germany, large public events and gatherings are not going to return any time soon.

Huawei is said to have told suppliers to delay production for its newest flagship smartphone as the company weighs potential supply chain disruptions from an escalating US crackdown, according to sources familiar with the situation.

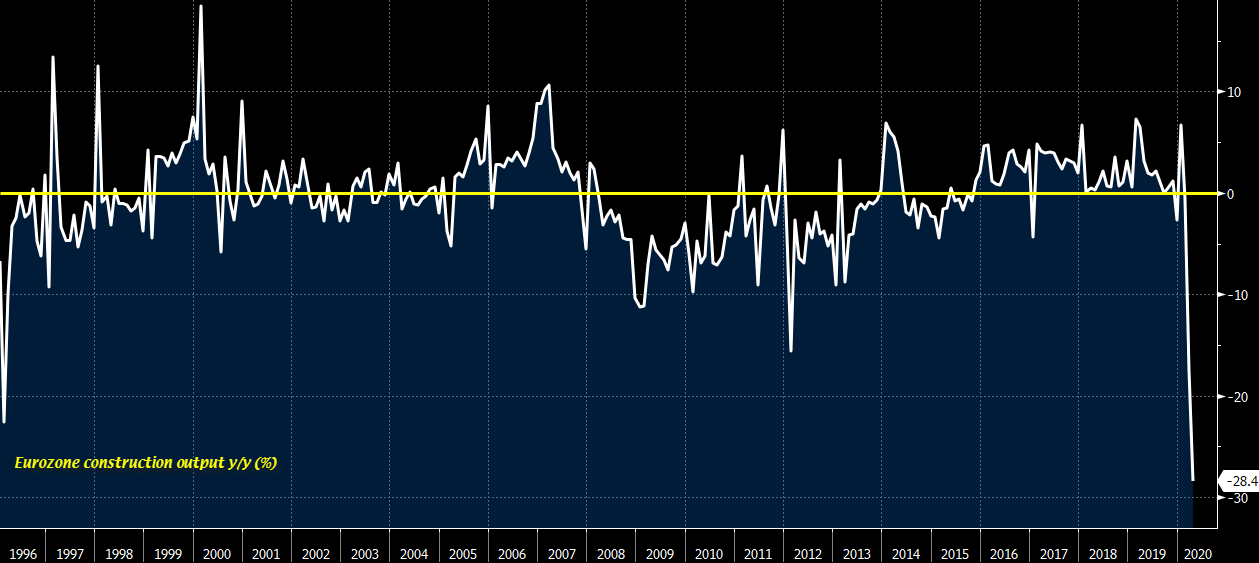

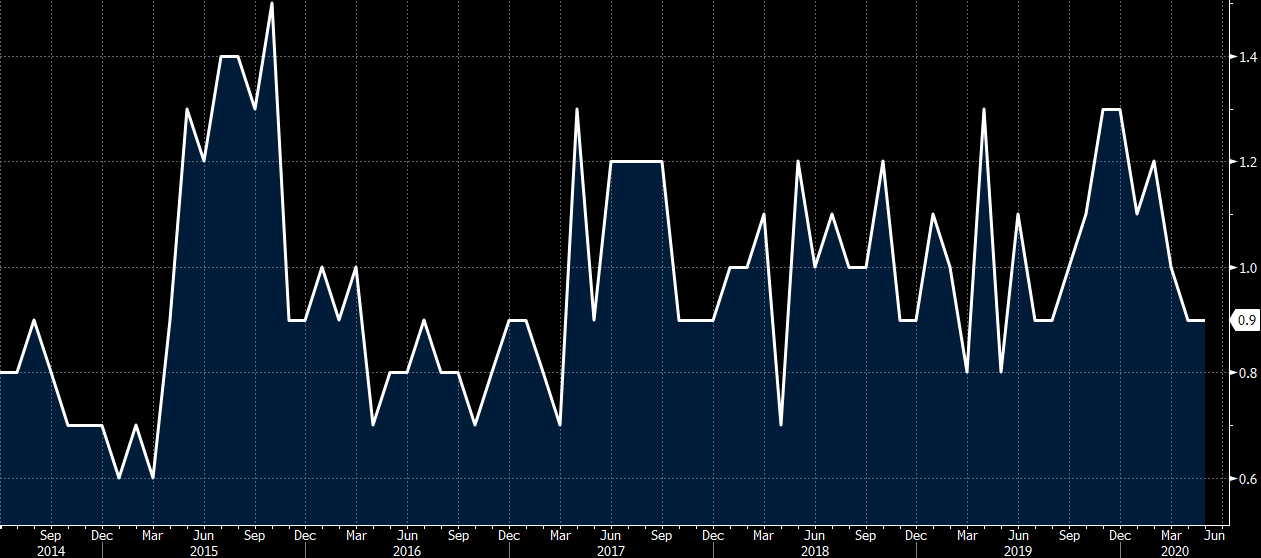

Trade balance adjusted -601bn yen

Exports -28.3% y/y for a miss

Imports -26.2% y/y for a miss

Outlook

U.S. stocks closed higher Tuesday, but off the session’s best levels, after Federal Reserve Chairman Jerome Powell suggested more fiscal stimulus may be needed as the American economy may only make a slow recovery from the COVID-19 pandemic.

Rising coronavirus cases in several U.S. states are also are concern for investors, even though retail sales and industrial production data show the economy is slowly recovering, and progress on the development of potential therapeutic drugs has been reported.

The Dow Jones Industrial Average DJIA, +2.04% rose 526.82 points, or 2%, to end at 26,289.98. The S&P 500 index SPX, +1.89% added 58.15 points to close at 3,124.74, a gain of 1.9%. The Nasdaq Composite Index COMP, +1.74% advanced 169.84 points, or 1.8%, to end at 9,895.84.

All three benchmarks extended their win streak to three straight sessions, but finished below their best levels of the day.