- A speculator should make it a rule each time he closes a successful deal to take 50% of his profits and lock this sum up in a safe deposit box. The only money that is ever taken out of Wall Street by speculators is the money they draw out of their accounts after closing a successful deal.

- There is no better time than after a large “win” on a stock. Cash is your secret bullet in the chamber, keep a cash reserve.

- The single largest regret I have ever had in my financial life was not paying enough attention to this rule.

Archives of “June 4, 2020” day

rssKeep a Cash Reserve

- The successful speculator must always have cash in reserve.

- There is a never ending stream of opportunities in the stock market, and if you miss a good opportunity, wait a little while, be patient, and another one will come along.

- This desire to “always be in the game,” is one of the speculator’s greatest enemies in managing his money.

- Often money that is just sitting can later be moved into the right situation at the right time and make a vast fortune – patience – patience – patience is the key to success not speed – time is a cunning speculator’s best friend if he uses it right.

The simple case for buying everything right now

Suspend your disbelief and embrace the free-money future

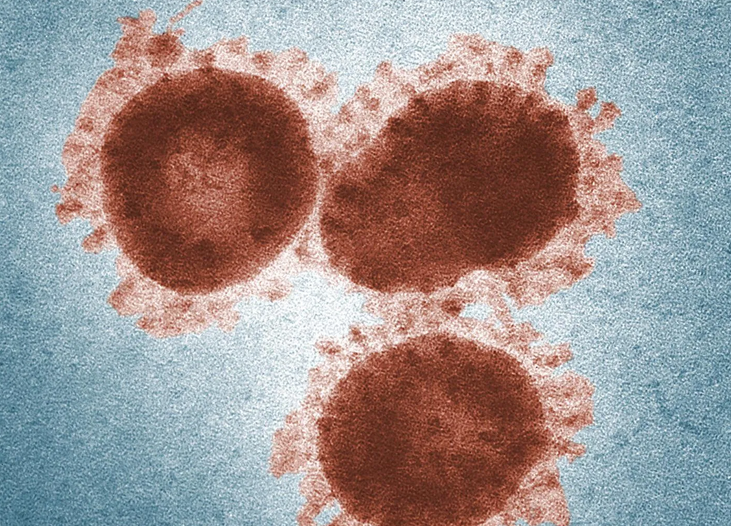

The enthusiasm in markets at the moment is bordering on euphoria. Retail money is pouring into the flavour-of-the-day and now FOMO is taking over more broadly.

You have to decide if you’re in or out. We all know the risks around the virus and the current economic data and it takes a huge leap of faith to pile in here but betting on humanity has been the best bet in world history.

1) We’re in the post pandemic world

Biggest stock market bubble in history

It doesn’t even matter anymore

China says that it has complained to the US about ban on Chinese airlines flights

Comments by the Chinese commerce ministry

- CAAC is in close contact with the US’ department of transportation

- Says China made progress on resolving the issue with the US

In case you missed it, the US said that it will no longer allow Chinese airlines to route passenger flights to the US starting from 16 June. So, this relates to that and is part of the broader spat between the two countries amid trade and the coronavirus crisis as well.

BOJ has no plans to buy municipal bonds for now

Takeshi Kato, head of the BOJ’s monetary affairs department, remarks

Kato remarks to parliament that the BOJ does not see the need now to add municipal bonds to a list of assets it purchases to inject liquidity into the financial system:

“We’re able to provide ample funds to the market with our purchases of JGB.”

This is a similar remark to that of BOJ governor Kuroda last month, so the current stance looks to be continuing – for now at least. But the hoarding continues though..

ECB the main highlight of the calendar day today

Little else in terms of data releases to distract from the ECB policy decision

The dollar is mildly firmer after some mixed tones in trading yesterday, despite yet another rally in equities where the Dow gained by over 2%.

The risk mood is more tepid though as we start the new day with Asian equities keeping closer to flat levels while US futures are also a touch lower but nothing too notable.

All eyes will turn towards the ECB in the session ahead, where the central bank is expected to take a more proactive approach and expand the size of its PEPP stimulus.

0630 GMT – Switzerland May CPI figures

Prior release can be found here. Inflation pressures are expected to stay more subdued amid the fallout from the virus outbreak and that should be reflected here. If anything, it should keep the SNB on their toes to prevent the franc from appreciating by too much.

0730 GMT – Germany May construction PMI

Construction activity should pick up a little from April to May but is likely to still reflect overall subdued conditions in the German economy, much like the other PMI readings have shown.

0830 GMT – UK May construction PMI

Prior release can be found here. After an epic fall in April, activity should see some improvement in May but remain highly subdued amid the fallout from the virus outbreak. The worry is that a prolonged situation such as this may lead to longer-term disruptions.

0900 GMT – Eurozone April retail sales data

Prior release can be found here. As we all know by now, April represents the worst month in terms of data releases so retail sales for the period is expected to plunge drastically.

1130 GMT – US May Challenger job cuts, layoffs

Job cuts hit a single-month record in April amid the virus outbreak and the overall labour market situation is expected to remain in a tenuous state amid the continued economic fallout, despite the reopening of states across the country.

1145 GMT – ECB announces its 4 June monetary policy decision

Prior meeting decision can be found here. All eyes will be whether or not the ECB will expand the size (and maybe length) of its PEPP stimulus, so that is the key spot to watch going into the decision. Besides that, the central bank is expected to leave other policy measures unchanged and reaffirm a similar forward guidance as back in April.

1230 GMT – ECB president Christine Lagarde holds press conference

The language/communication from Lagarde will be interesting, and she is likely to be pressed on the PEPP stimulus regardless of whether or not they expand it today. Also, the ECB will release their latest macroeconomic projections and with Lagarde having ruled out their previous ‘mild’ scenario, their latest view will be one to watch out for today.

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

US to impose restrictions on additional Chinese media outlets

The US has earmarked another four state-run Chinese media outlets as foreign embassies says Reuters.

- Doing so results in increased restrictions on their operations on US soil

- five Chinese outlets were placed under the restrictions in February

The State Department action could come on Thursday says the report. To include:

- China Central Television (CCTV)

- China News Service

Reuters citing three people familiar with the matter said on Wednesday.

—

Adding to US-China strains further.

Apple is disabling iPhones looted from its stores

Apple (AAPL) stores in New York, Los Angeles, Philadelphia, Portland and Washington, D.C. have been amongst those broken into and robbed.

- MarketWatch report that looted iPhones have been disabled and that the company has begun tracking them

- MW asked Apple for comments but the firm said it does not A comment on matters of security

How to unlock a stolen iPhone – is there an app for that?