Would China sell their treasuries?

Interested in finding out about more market moving action that might be ahead?

Interested in finding out about more market moving action that might be ahead?

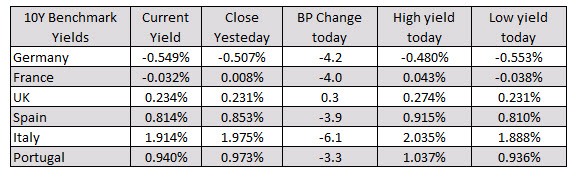

in the European debt market, yields are mostly lower. The exception is the UK 10 year with a modest 0.3 basis point gain:

This book is comprised of a series of edited interviews with George Soros, and is broken up into 3 parts. The first part is about his investing. He talks about his family history, investment philosophies and theories, his early times as an analyst on Wall Street, and the Quantum Fund. He talk about how his theories were related to some of his real trades, specifically the Japanese stock market, the Mexican market, and the British Pound.

This book is comprised of a series of edited interviews with George Soros, and is broken up into 3 parts. The first part is about his investing. He talks about his family history, investment philosophies and theories, his early times as an analyst on Wall Street, and the Quantum Fund. He talk about how his theories were related to some of his real trades, specifically the Japanese stock market, the Mexican market, and the British Pound.

The second section deals with his views on (and participation in) politics. He talks about philanthropy, the geopolitics of Europe, diplomacy, and open societies. The third section of the book deals with philosophy and talks about some of his personal writings.

This book was fun for me to read since it was about hedge funds back when hedge funds were pure – before they were contaminated by Wall Street. Since this book is about Soros the person, and not Soros the investor, a significant portion of the book is devoted to politics and philosophy, and not investing. Although these topics are not out of place, most people will be less interested in this stuff since they are more interested in his investments.

Since Soros talks about his theories (specifically his theory of reflexivity), this book could be considered a more philosophical version of Alchemy of Finance. Hence, this book will appeal to traders/investors looking to ponder their personal investing philosophies. Although Soros tries too hard at times to make every statement sound profound, the timeless philosophical topics he brings up lends the book substantial (as well as lasting) value. This is due to the fact that a majority of traders will always lose money. When novice traders are unable to achieve success, it is best for them to step back and ask fundamental questions, like “why do I trade?”. But most don’t do this, and this book can help with that.

Consequently, the most important lesson that can be extracted from Soros’s market philosophies is that it is important to HAVE market philosophies. When I wrote my “How to Become a Trader” checklist, I said that one of the first things you should do is to write down your philosophies about the markets. This catches some prospective traders off guard since it is something that they’ve never thought about.

The verbal tirade between the two countries is continuing, with China responding to Pompeo’s remarks overnight here. The foreign ministry is saying that Pompeo is contradicting himself and is using “one lie to cover up another” on the matter above.