Forex futures positioning data for the week ending May 5, 2020.

- EUR long 76K vs 80K long last week. Shorts trimmed by 4K

- GBP short 12K vs 7K short last week. Shorts increased by 5K

- JPY long 27K vs 32K long last week. Longs trimmed by 5K

- CHF long 8K vs 6K long last week. Longs increased by 2K

- AUD short 33k vs 38K short last week. Shorts trimmed by 5K

- NZD short 15K vs 14K short last week. Shorts increased by 1K

- CAD short 32k vs 29K short last week. Shorts increased by 3K

Highlights:

- the largest position change was 5K in the GBP, JPY and AUD. The GBP positions were increased by 5K, while the JPY and AUD positions were trimmed by 5K

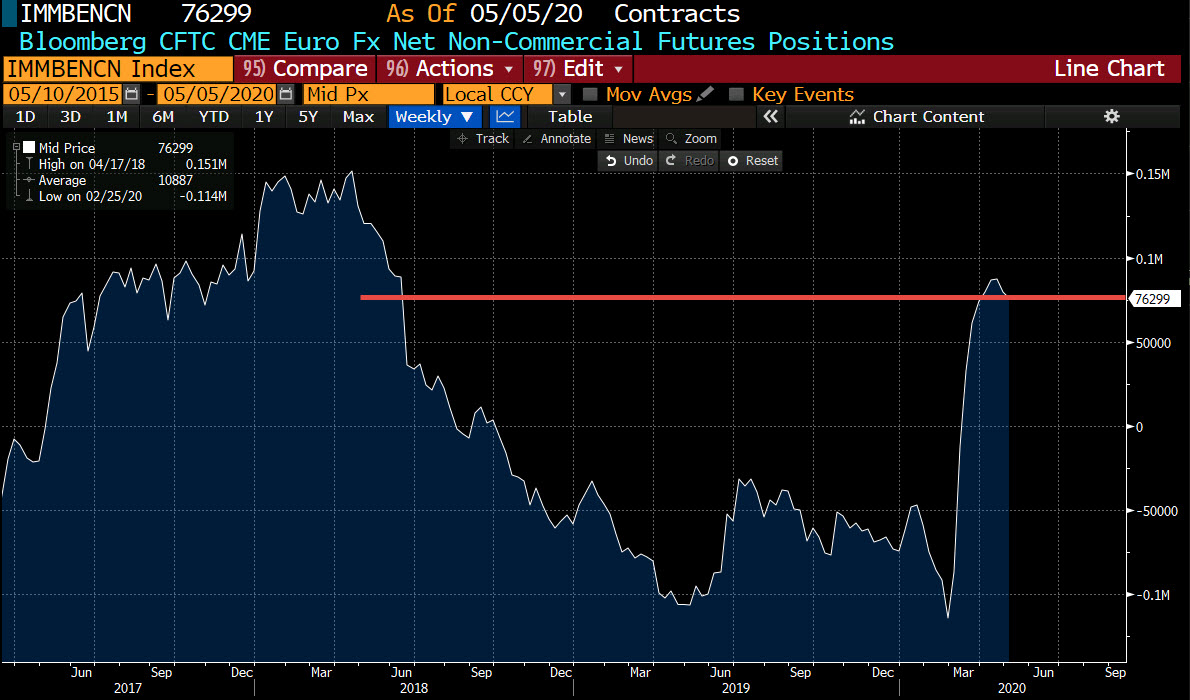

- The EUR long remains the largest position, but is lower for the 2nd week in a row. The net long over the last 2 weeks has seen the 87K to 76K this week

- The AUD and CAD are the next largest positions at 33K and 32K respectively. However, traders are short AUD,and long CAD.

Below is a chart of the deposition in the EUR. Although lower from the recent peak, it is still near high levels for the year, and high levels going back to June 2018.