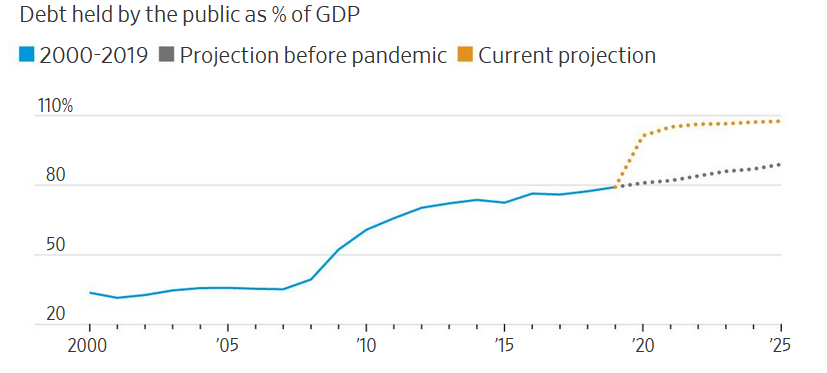

Trillions upon trillions in debt is the economic legacy of the virus

I’m going to write about this all day today because it appears to be relatively quiet.

Here is the basic playbook right now.

- The government issues debt

- The central bank buys it to keep yields low

It’s an incredible shell game and it will work to a point. Effectively, I think governments are going all-in on this strategy. Politely, it’s not nice to talk about it and to pretend that at some point the debt will be paid down. The reality is that Japan is 20 years ahead of the rest of the world with the west rapidly catching up.

Greg Ip in the WSJ today writes about the growing US deficit. He notes that the Committee for a Responsible Federal Budget pegs the deficit at $3.8 trillion this year. I expect more stimulus, weaker growth and at least $5 trillion.

The added debt could “threaten the future of the country,” Senate Majority Leader Mitch McConnell said Wednesday.

The problem is that fiscal conservatives have been sounding the alarm for 25 years and it was a boy-who-cried-wolf situation, nevermind the hypocrisy of a $1 trillion corporate tax cut.

The old-fashioned fear is that interest rates will rise but the Fed can repress that. What the real fear should be is that it falls on the dollar as global central banks shift reserves.

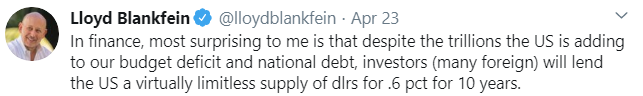

Here’s a tweet from the former Goldman Sachs CEO that was mocked but it touches on something real:

More on this later

More on this later

More on this later