This is when the world realizes what’s really happening

I’ve been warning for weeks that oil is a negative-yielding asset. If you have it and don’t want it, it’s a big problem to get rid of it.

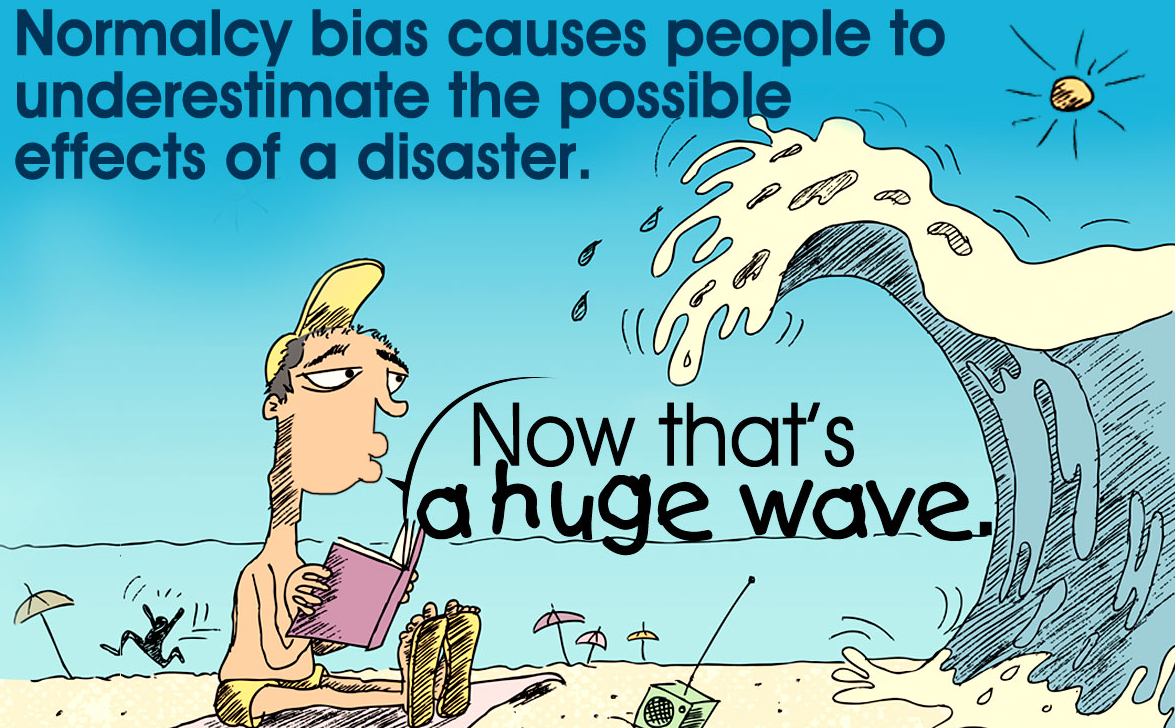

People just couldn’t comprehend how a commodity could go negative. But natural gas went negative last year at some delivery points. Before bond yields went negative people also couldn’t comprehend it. They said it was impossible. Now it’s normal.

Here’s the bottom line: When there is more oil than people can store, you have to pay someone to get rid of it.

Obviously, negative $33.30 per barrel is when someone get stuck and implodes.

There are some massive margin calls ongoing right now. Some funds have imploded and who knows what they might take down with them.

Crude is down 330% today