Major indices didn’t see a positive tick in the black today

The US major indices open lower and never traded in the black today. However, the good news is day closed near midrange after a near 3% decline in the S&P and Dow.

- All 11 sectors of the S&P closed lower.

- The NASDAQ @ its worst day since April 3, and

- The Dow closed 20% below its record high once again

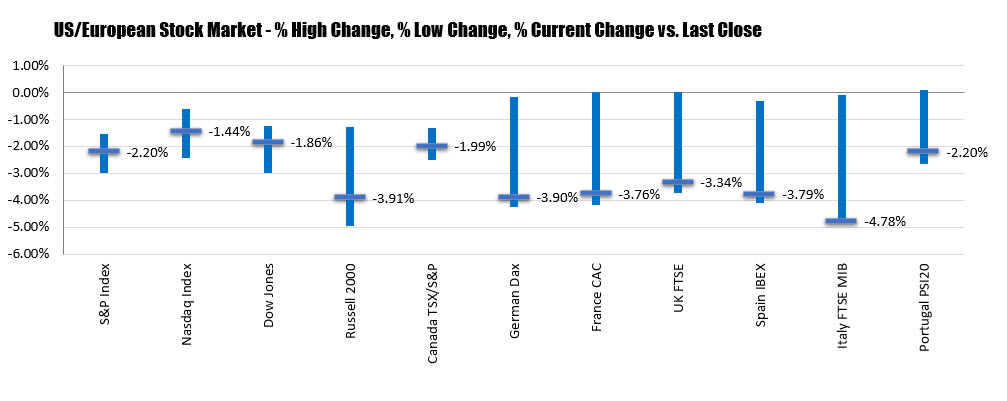

A look at the final numbers are showing:

- S&P index -62.70 points or -2.2% at 2783.36. The low price reached 2761.54. The high price extended to 2801.88

- NASDAQ index fell -122.564 points or -1.44% at 8393.17. The high price extended to 8464.65, while the low fell to 8308.79. The NASDAQ snapped a 4 day winning streak.

- Dow industrial average fell -445.44 points or -1.86% at 23504.35. The high price extended to 23649.72, while the low fell to 23233.32

European indices all fell sharply and closed near low levels for the day (see the ranges and changes below).