OECD GDP Growth Projections

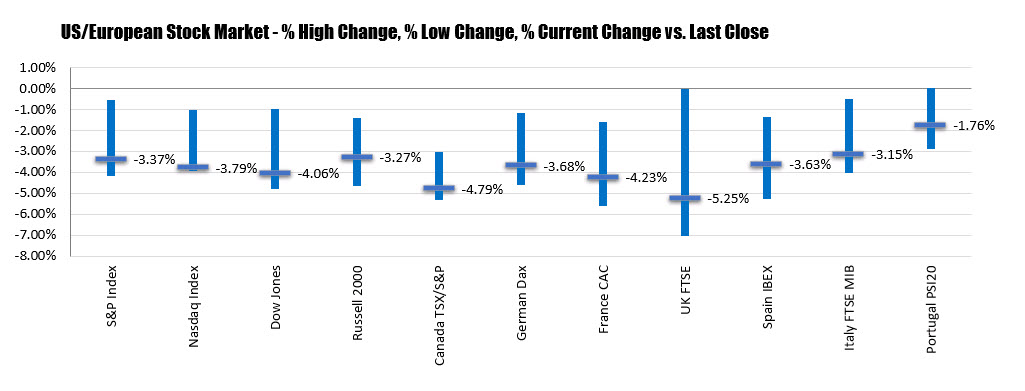

The closing levels are lower at:

Although lower for the day for all major indices closed with gains.

Although lower for the day for all major indices closed with gains.

The Bank of Canada today lowered its target for the overnight rate by 50 basis points to ¼ percent. The Bank Rate is correspondingly ½ percent and the deposit rate is ¼ percent. This unscheduled rate decision brings the policy rate to its effective lower bound and is intended to provide support to the Canadian financial system and the economy during the COVID-19 pandemic.

The spread of COVID-19 is having serious consequences for Canadians and for the economy, as is the abrupt decline in world oil prices. The pandemic-driven contraction has prompted decisive fiscal policy action in Canada to support individuals and businesses and to minimize any permanent damage to the structure of the economy.

The Bank is playing an important complementary role in this effort. Its interest rate setting cushions the impact of the shocks by easing the cost of borrowing. Its efforts to maintain the functioning of the financial system are helping keep credit available to people and companies. The intent of our decision today is to support the financial system in its central role of providing credit in the economy, and to lay the foundation for the economy’s return to normalcy.

The Bank’s efforts have been primarily focused on ensuring the availability of credit by providing liquidity to help markets continue to function. To promote credit availability, the Bank has expanded its various term repo facilities. To preserve market function, the Bank is conducting Government of Canada bond buybacks and switches, purchases of Canada Mortgage Bonds and banker’s acceptances, and purchases of provincial money market instruments. All these additional measures have been detailed on the Bank’s website and will be extended or augmented as needed.

Today, the Bank is launching two new programs.

First, the Commercial Paper Purchase Program (CPPP) will help to alleviate strains in short-term funding markets and thereby preserve a key source of funding for businesses. Details of the program will be available on the Bank’s web site.

Second, to address strains in the Government of Canada debt market and to enhance the effectiveness of all other actions taken so far, the Bank will begin acquiring Government of Canada securities in the secondary market. Purchases will begin with a minimum of $5 billion per week, across the yield curve. The program will be adjusted as conditions warrant, but will continue until the economic recovery is well underway. The Bank’s balance sheet will expand as a result of these purchases.

The Bank is closely monitoring economic and financial conditions, in coordination with other G7 central banks and fiscal authorities, and will update its outlook in mid-April. As the situation evolves, Governing Council stands ready to take further action as required to support the Canadian economy and financial system and to keep inflation on target.