Thought For A Day

WHO’s Tendros putting a more positive spin on the risks.

The tweet thread reads:

1. With markets in turmoil this morning, where are we on virus stimulus? I’ve spoken to two senior admin officials today who say the WH is working on various ideas. But it doesn’t seem to have gone much further than the brainstorming stage.

2. A senior administration official tells me this morning virus ideas were kicked around at the WH over the weekend. But he cautions that there’s nothing on paper and it is still a long way off. “Under pressure, will they want to say they have a plan? Yes. Do they? Not really.”

The statement via the NY Fed:

“The Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York has updated the current monthly schedule of repurchase agreement (repo) operations.

Beginning with today’s operation and through March 12, 2020, the Desk will increase the amount offered in daily overnight repo operations from at least $100 billion to at least $150 billion. In addition, the Desk will increase the amount offered in the two-week term repo operations on Tuesday, March 10, 2020 and Thursday, March 12, 2020 from at least $20 billion to at least $45 billion.”

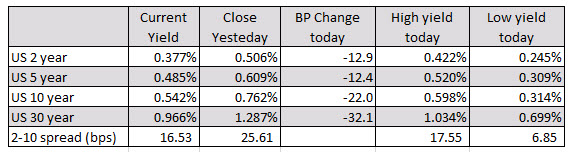

Projections for the Fed:

MS add that if recession: