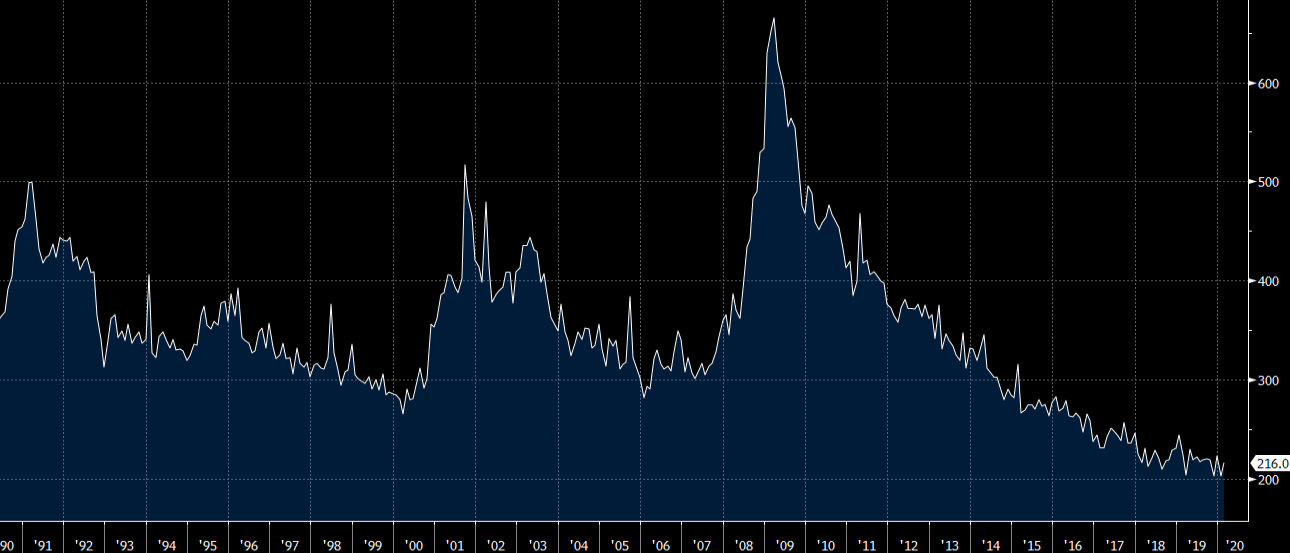

The world’s largest oil trader, Vitol, shares their view on the oil market

- Global oil demand could fall by more than 10% as lockdowns spread across Europe

- Drop would be much higher if lockdowns start to take hold in the US

- But that is currently not in their base case scenario

- But if it does happen, “you can get as bearish as you like” on oil prices

- Might run out of available commercial storage in a couple of months

- Important now how much China buys into strategic stocks

A fair take on the current situation and on the commercial storage part, Vitol is assuming current OPEC production remains i.e. Saudi and Russia continue to do battle. Just some food for thought as we continue to look at how the virus situation develops across the world.