Touchdown, finally

Risk is pushing higher on the back of the headlines here with S&P 500 futures paring earlier losses while the Nikkei surges higher to over 7% gains. Meanwhile, AUD/USD is back up to above 0.6000 as the market cheers on the news.

Risk is pushing higher on the back of the headlines here with S&P 500 futures paring earlier losses while the Nikkei surges higher to over 7% gains. Meanwhile, AUD/USD is back up to above 0.6000 as the market cheers on the news.

The report says that the PBOC may announce a deposit rate cut in the coming days, in a bid to help banks squeeze out higher profits since they are enlisted to help spur the economic recovery following the virus outbreak in the country.

Consistent with the direction from G7 Leaders, we are taking action and enhancing coordination on our dynamic domestic and international policy efforts to respond to the global health, economic, and financial impacts associated with the spread of the coronavirus disease 2019 (COVID-19). Collectively, G7 nations have already enacted a wide-ranging set of health, economic, and financial stability measures. We will do whatever is necessary to restore confidence and economic growth and to protect jobs, businesses, and the resilience of the financial system. We also pledge to promote global trade and investment to underpin prosperity.

Our nations are working together to fight the COVID-19 outbreak and mitigate its impact, treat those affected, and prevent further transmission. G7 finance ministries are helping advance this effort by providing the funding needed to respond to the situation. In particular, we recognize the urgent need to increase support for the rapid development, manufacture, and distribution of diagnostics, therapeutics, and a vaccine for COVID-19. We are providing bilateral and multilateral assistance to strengthen foreign governments’ prevention efforts and their health and emergency response systems.

The G7 is committed to deliver the fiscal effort necessary to help our economies rapidly recover and resume the path towards stronger and more sustainable economic growth. Alongside our nations’ efforts to expand health services, G7 finance ministries are undertaking, and recommend all countries undertake, liquidity support and fiscal expansion to mitigate the negative economic impacts associated with the spread of COVID-19.

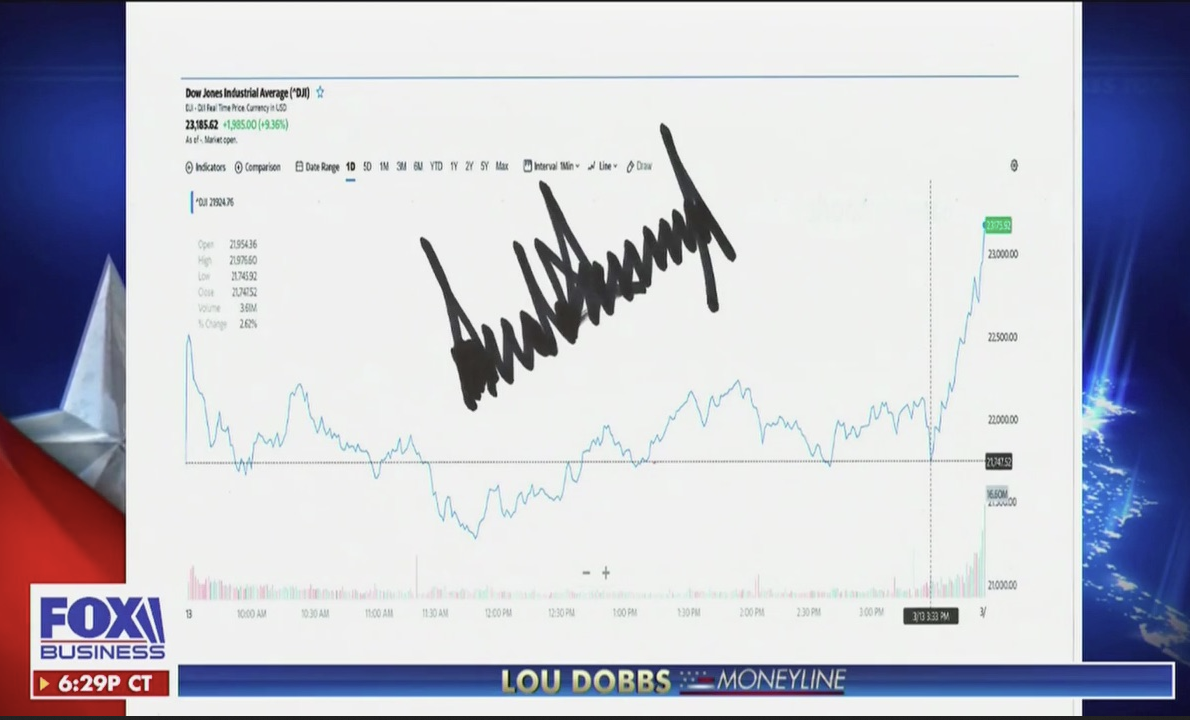

The promise of the Fed backstopping the US economy and Washington said to be closer to a stimulus package agreement is boosting investor hopes in Asian trading today.