Feds Powell conducts press conference after January 2020 interest rate decision

- Fed wants to avoid misinterpretation with inflation wording

- Not comfortable with inflation persistently under 2%

- Want to signal not comfortable with prices below goal

- We expect Bill purchases to make reserves ample in 2nd quarter

- Fed will know when adjustments have run course when reserves are durably at a sustainable level

- At some point the Fed will raise minimum bid rate on repos

- reserve levels will have to be at a level high enough to remain ample. 1.5 trillion will be the bottom end of the range

- he expects reserve fluctuation particularly around tax season

- Fed will provide more details and will keep the process a smooth one

- Fed’s attention is just to raise the level of reserves. That is our sole intention

- Asked if Bill buying is QE , he says many things affect financial markets.

- Most forecasts underestimated labor participation gains

- Labor market continues to perform well

- Labor wages have moved from about 2% to 3% currently

- It is a bit surprising that wages haven’t risen more given such low unemployment

Market reaction:

- Gold has moved to new session highs at $1575.84

- US rates have moved lower with the 10 year falling to 1.5942%

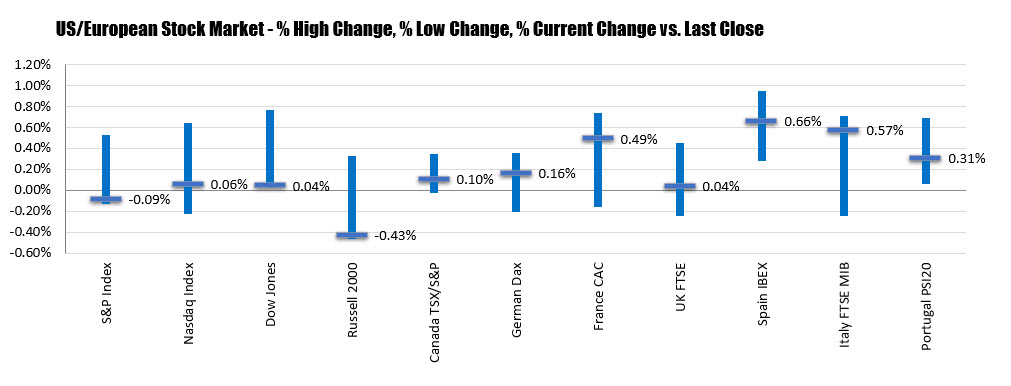

- NASDAQ index up 47 points at 9316.69. S&P index up 11.3 points (was up 13 points)

- EURUSUD moved to New York session highs at 1.1015. A trendline on the hourly chart is just ahead at 1.1017 and the falling 100 hour moving average is 1.10232

- USDCHF is moving toward session lows. Markets trading at 0.9728 from 0.9743. USDJPY moves lower as well (109.10 currently from 109.20).

- virus is a serious issue, significant human suffering

- coronavirus likely to disrupt activity in China, maybe world

- very uncertain about how far virus will spread

- Fed’s carefully monitoring situation around coronavirus

- sees grounds for cautious optimism on global economy

- supportive financial conditions, trade tensions easing and lower odds of hard Brexit all contributed to more positive outlook

- We will continue to adjust IOER as appropriate to help move the effective rate for the middle of the range

- there is no current urgency to make decision on standing repo facility

- over the long term it is possible there is a financial stability risk from climate change

- in the very early stages of the impact from climate change

- Phase 1 deal with China and USMCA is without question positive and should support the economy over time

- Trade policies uncertainty remains elevated

- Still have 2 or 3 active trade discussions going on at the moment

- There is a wait and see attitude for businesses on trade

- We need to be patient on trade deals economic impact

- Does not yet see a decisive recovery for manufacturing

- S&P index up 6.5 points

- NASDAQ index up 32 points

- The USD has ticked lower through the presser on a modest basis.

- We don’t think there is imminent risk on Chinese debt

- Fed sees asset value valuations somewhat elevated, but not extreme

- household that is in a good place

- business debt is rising but not threatening stability

- vulnerabilities to financial stability is moderate overall