S&P500 EV/EBITDA is almost as high as at the dotcom bubble peak of 1999/2000.

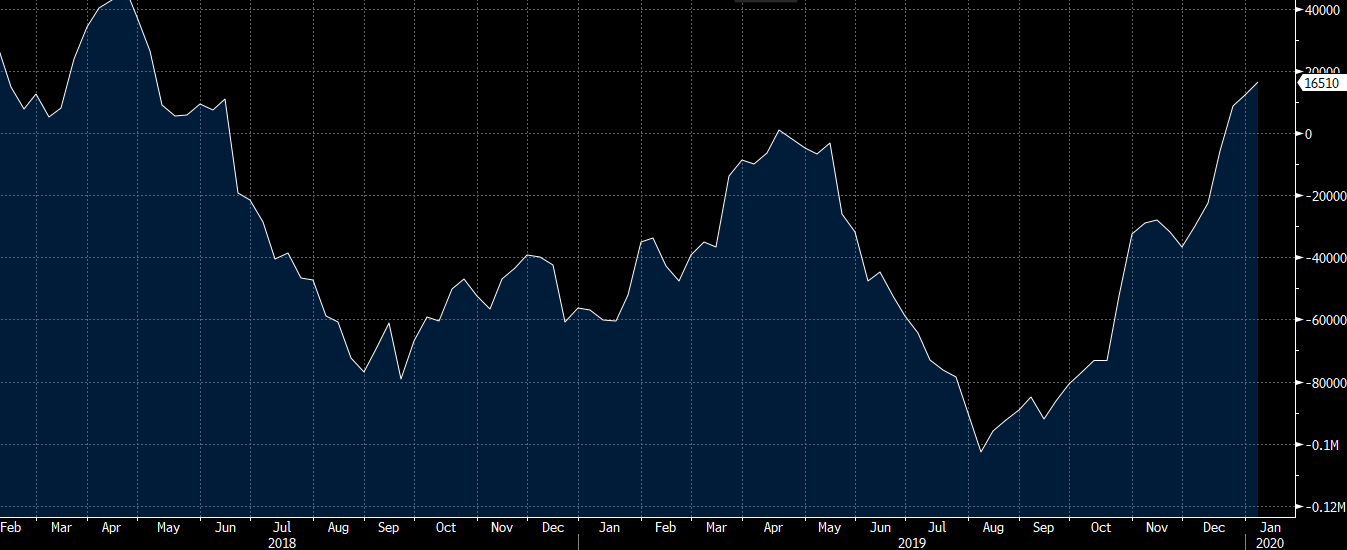

The theme across the board was less enthusiasm for the dollar. All the dollar longs were trimmed and there are growing longs in CAD and GBP. Is this really the big turn in the dollar? There is certainly some room to run on the speculative side before we get even close.

On the week:

The turnaround today is a bit of warning signal. Note that January is a weak seasonal month but there is a long-term trend of strength early in the month. I also tend to think the signing of the ‘phase one’ deal is sell-the-fact risk.