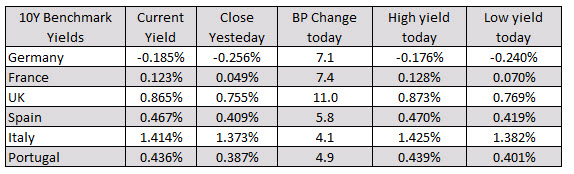

German DAX, -0.66%. UK’s FTSE, -0.68%

- German DAX, -0.66%

- France’s CAC, -0.79%

- UK’s FTSE, -0.68%

- Spain’s Ibex, -0.74%

- Italy’s FTSE MIB, -1.06%

- Portugal’s PSI 20, -0.62%

In other markets as European traders exit:

In other markets as European traders exit:- Spot gold is higher by $5.60 or 0.37% at $1516.18. It is trading at the highs for the day with the low down at $1510.86

- WTI crude oil futures are down $0.17 at $61.54, after failing to hold above the $62 level. The high price for the day reach $62.34

- S&P index -14 points or -0.44% at 3226

- NASDAQ -51.18 points or -0.57% at 8955.82

- Dow -129 points or -0.45% at 28514

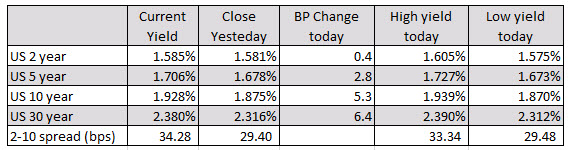

US yields are also higher with the yield curve steepening. The 2 – 10 year spread has widened out to 34.28 basis points from 29.4 basis points on Friday.