Some details still murky

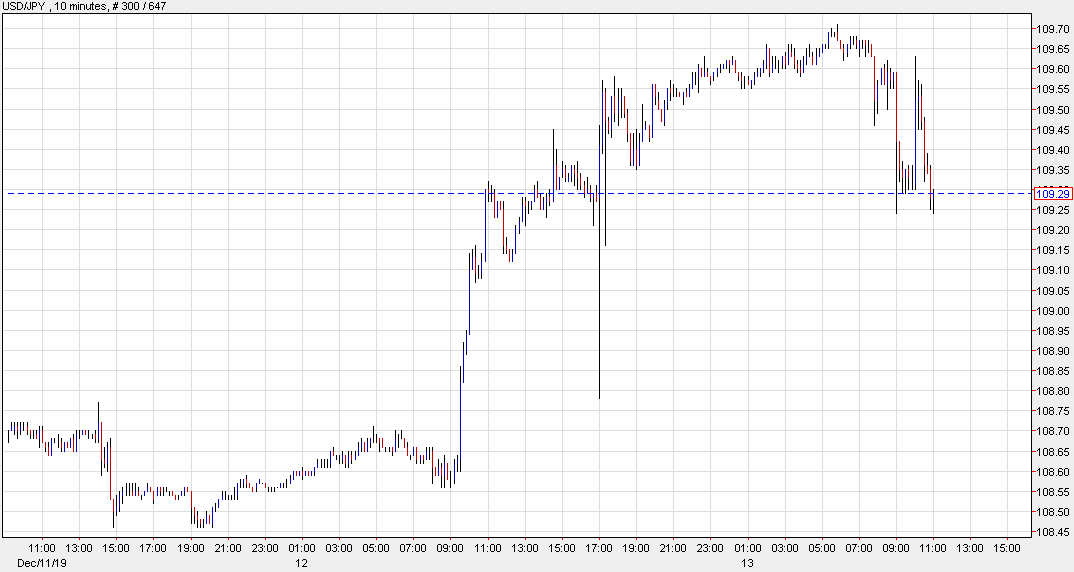

USD/JPY is at the lows of North American trade and back to flat on the day.

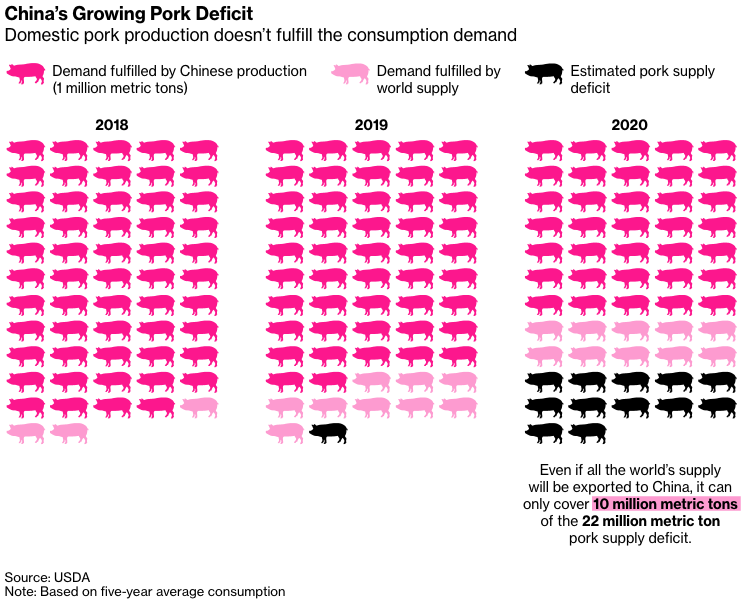

It appears as though China has balked at putting a specific number on US agricultural and manufacturing purchases, something the US had previously demanded. The problem for China is that putting a specific number on buying US agricultural goods would violate WTO rules. It also risks forcing them to buy US agriculture even if US prices are higher than elsewhere.

That might have caused some last-minute changes to the deal and a smaller tariff reduction. Yesterday’s reports said a 50% reduction on $360B of tariffed goods. Now it’s a 50% reduction on just $112B in goods.

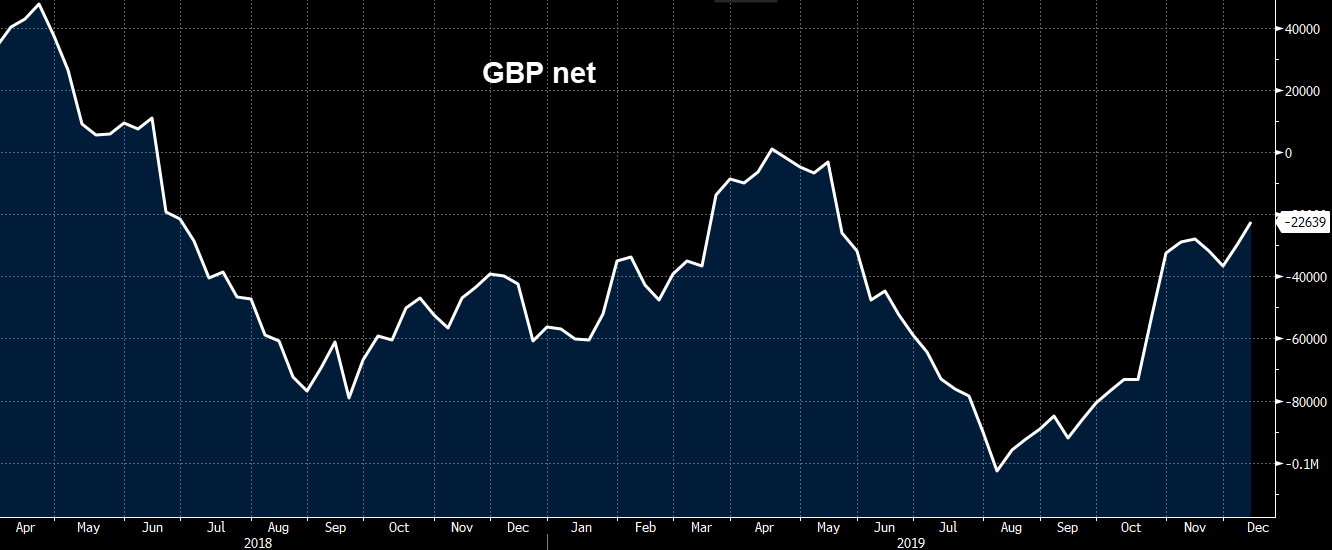

I think risk assets still probably creep higher from here because it’s the time of year when stocks tend to benefit from a Santa Claus rally with tax-loss selling done. The UK election also removes a big uncertainty.