Only old people prepare for a market crash. If you’re not leveraged at least 3:1 in this market you’re just not living.

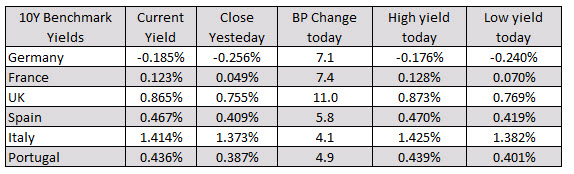

In other markets as European traders exit:

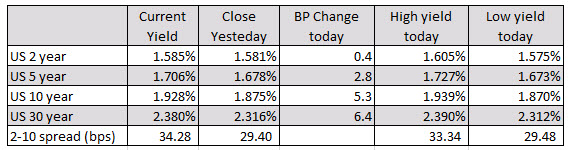

In other markets as European traders exit:US yields are also higher with the yield curve steepening. The 2 – 10 year spread has widened out to 34.28 basis points from 29.4 basis points on Friday.

Following on Thursday 2 January at 0145GMTwe’ll get the private survey Caixin/Markit Manufacturing PMI for December