Bloomberg dollar index at 7-week high

The DXY is the standard dollar index but it’s weightings are flawed, which is why I prefer the Bloomberg Dollar Index and its trade-weighted nature.

It highlights how the US dollar has climbed from a three-month low at the start of the month to a seven-week high in a steady rally.

It’s up once again today despite the US holiday as the antipodeans and pound slide.

I don’t like to do technical analysis on an index but there isn’t much standing in the way of a further rally.

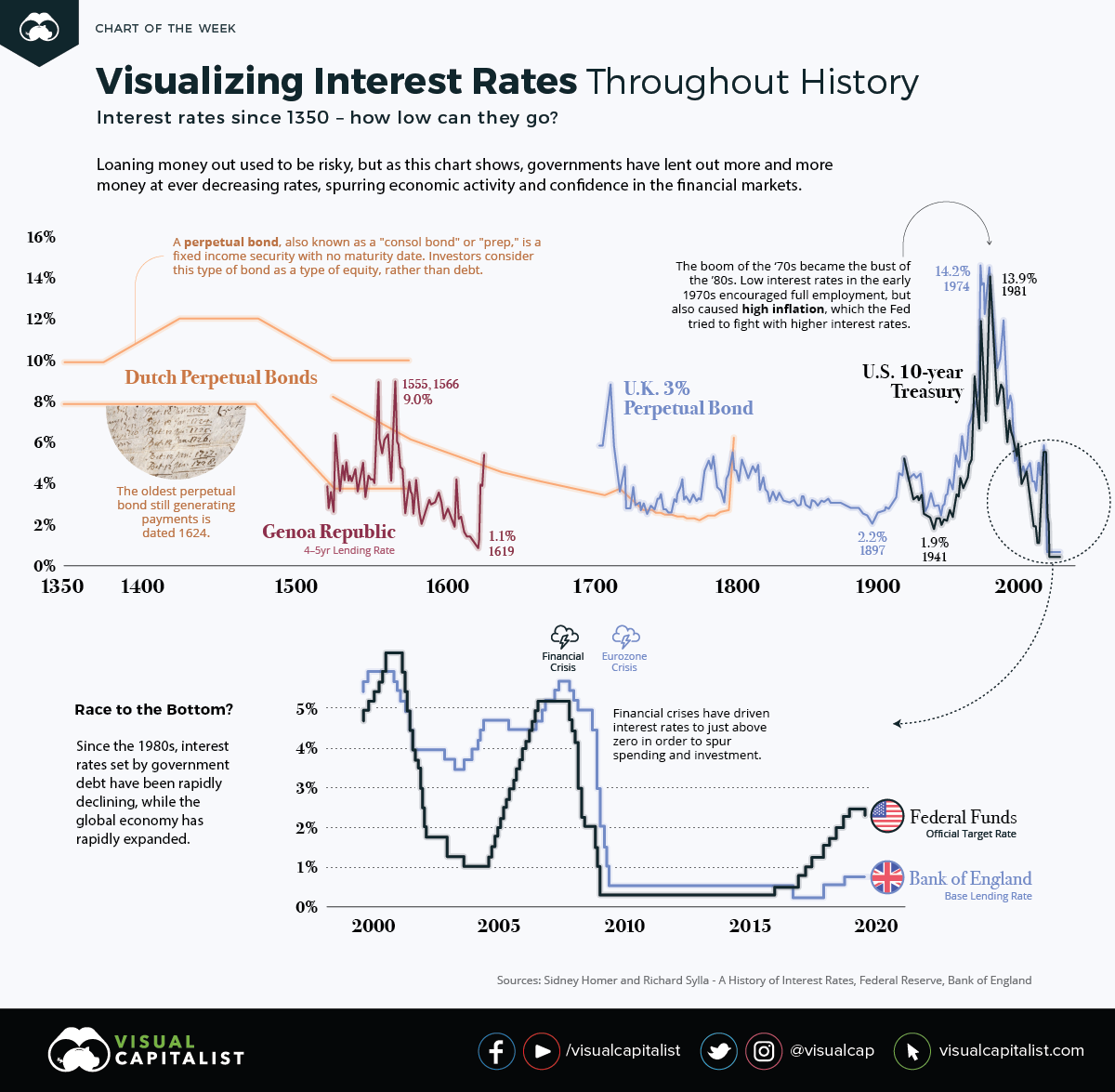

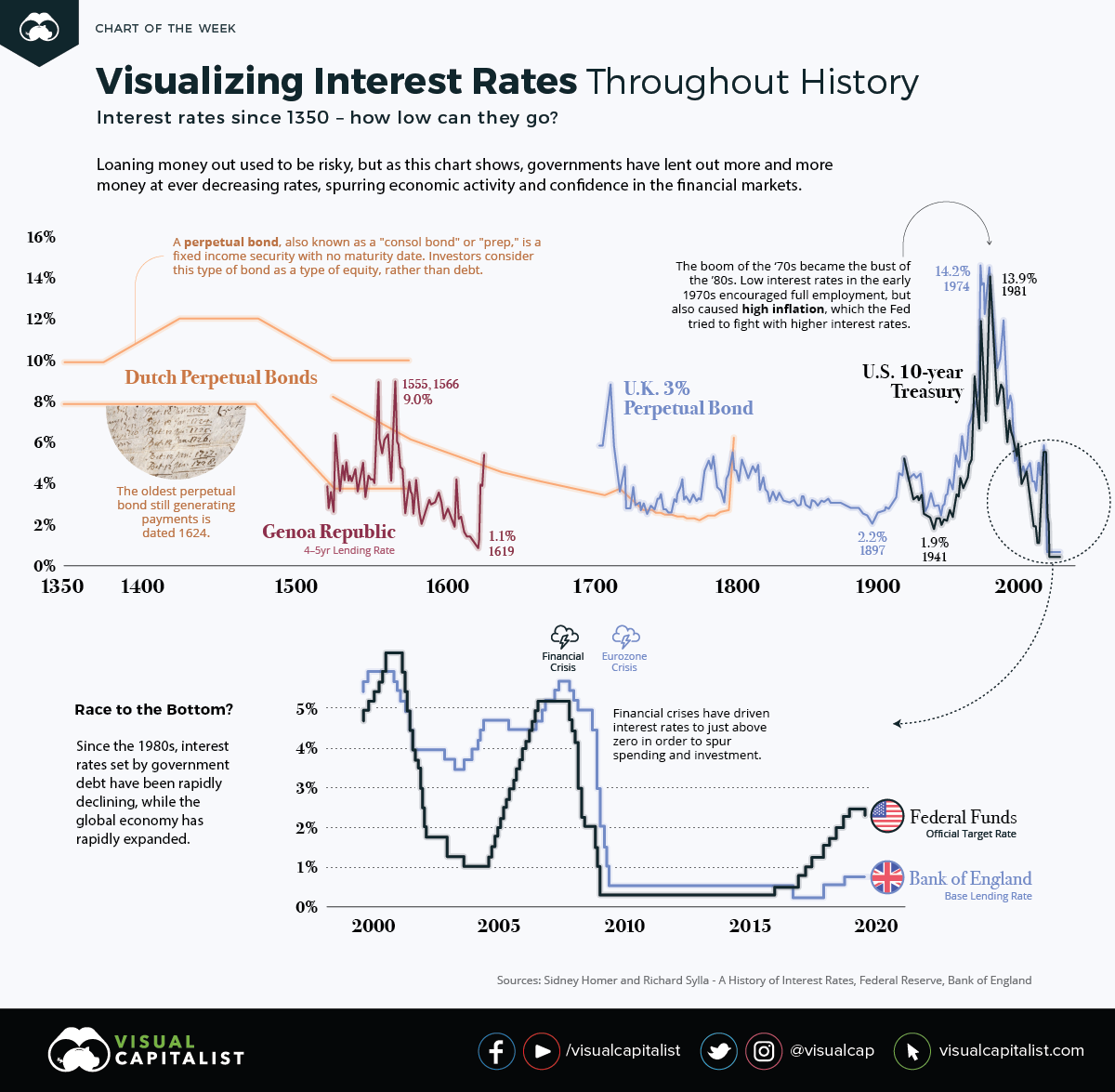

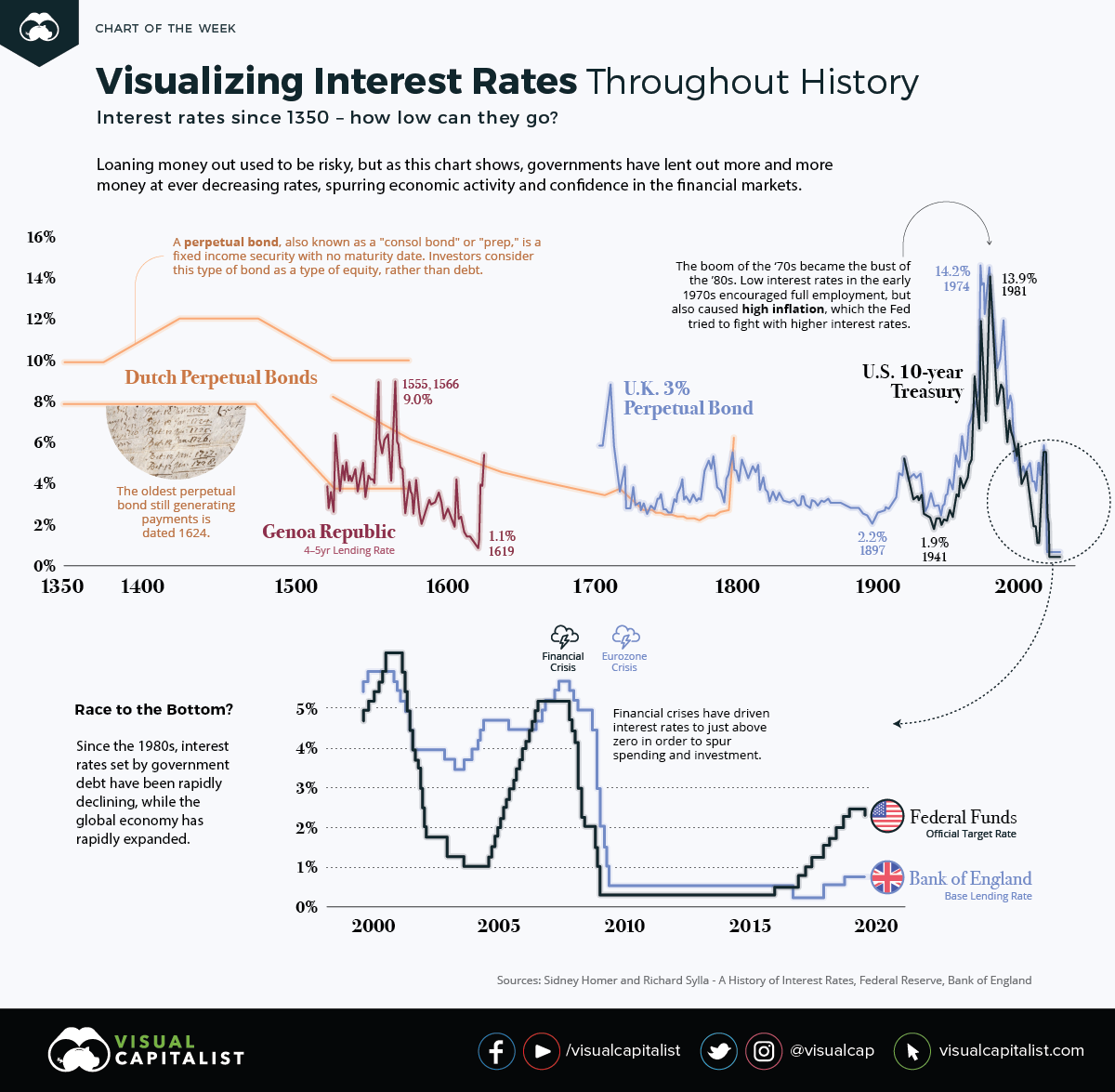

The kicker for me right now is that yields haven’t offered much support. US 10s are at 1.76% and that’s down from nearly 2% three weeks ago. The market continues to price in a 50% chance of a Fed cut by next July and I think as that comes out, there’s more upside for the dollar — especially against the funding currencies (JPY, CHF, EUR).