Today’s scary (Bloomberg) chart! #equities v Manufacturing

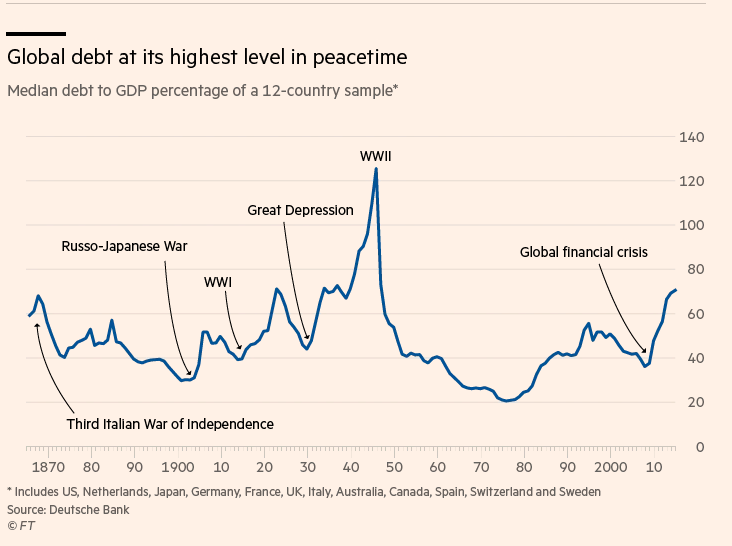

On average, the world’s major economies, have debts of more than 70% of their GDP’s. This is the highest level in the past 150 years apart from s spike during WWII. See the chart below courtesy of the Financial Times

In the UK that debt deficit is presently at around 87%, but it is only set to grow with both Conservative and Labour plans to increase public spending levels. This will in part be a Brexit boost to lift morale. Increasing welfare states, growing democracies and an ageing population all lead to to the conclusion that global debt is set to keep growing.

“The US has turned HK into the focus of China-US competition. It’s all the people in Hong Kong, including foreigners and foreign companies that suffer. The mainland only feels limited pain. Beijing has no reason to back off on issue of sovereignty, and let HK be at US’ disposal.”

trade balance adjusted Y -34.7bn

exports -9.2% y/y – worse than expected and the biggest y/y fall in 3 years.

imports -14.8% y/y – not as bad as expected but not good, ditto on the biggest y/y fall in 3 years.