Wired: $2 Forbes: $15 Bloomberg: $93 NY Mag: $105 Slate: $131 Biz Insider: $182 WaPo: $182 USA Today: $208 NY Times: $208 FT: $290 Guardian: $318 Reuters: $327 AOL: $332 CNN: $333 Yahoo: $479 Keep this in mind when reading all headlines.

Archives of “November 5, 2019” day

rssChart of US debt.

Forgot to include sample size info – click image to enlarge

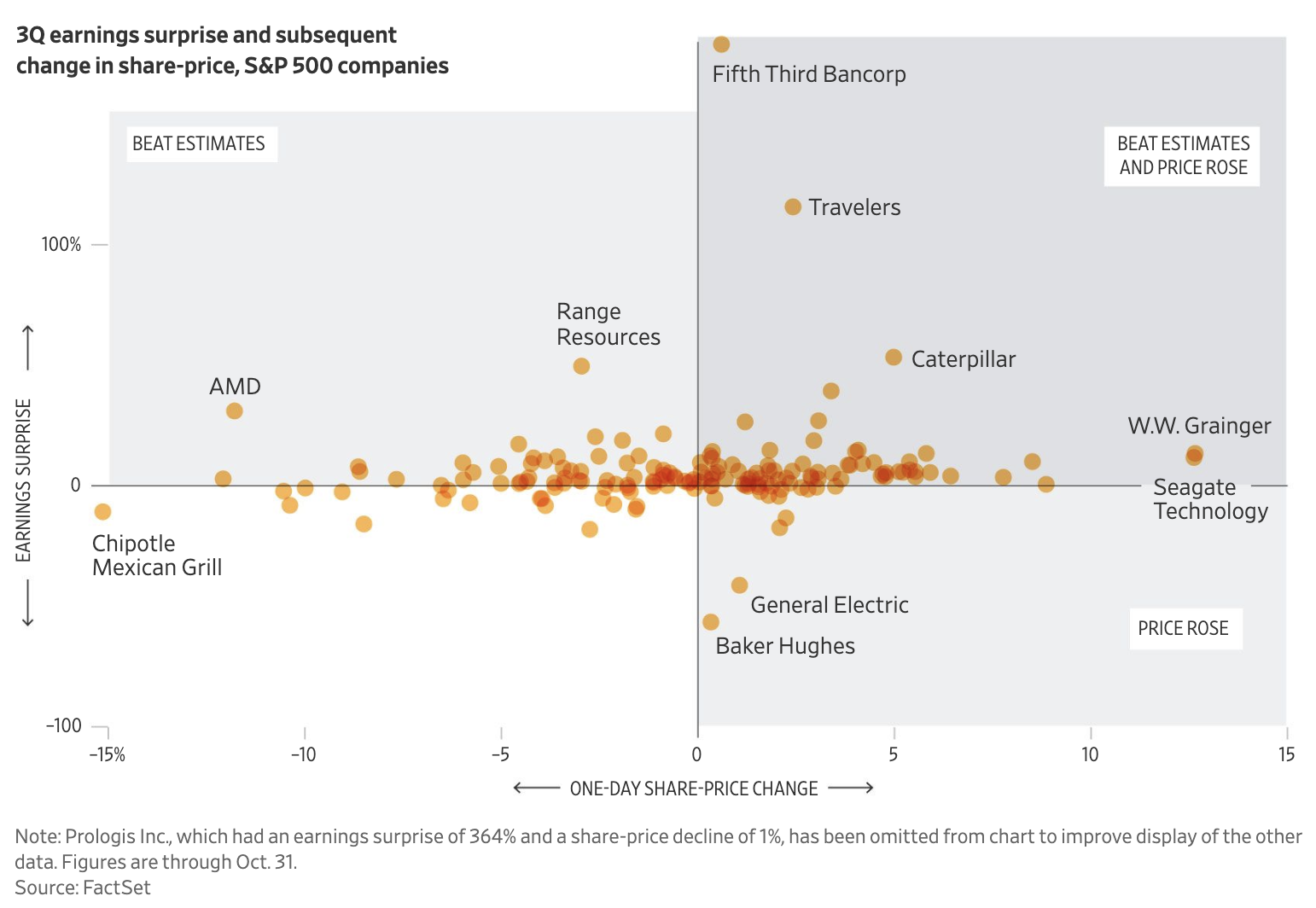

Earnings Tide Lifts Most Stocks

US considers rolling back tariffs Sept 1 Chinese tariffs to seal Phase One deal – report

FT report

Earlier Politico reported that China was pushing to get the Sept 1 tariffs of 15% on $112B of goods removed. Now the FT reports that the administration is ‘debating’ it.

This headlines have lifted AUD, yen crosses and risk trades.

The story cites five sources and says the US wants something in return:

“Washington would likely expect something in return, including beefed up provisions on the protection of intellectual property for US companies, greater certainty on the scale of Chinese purchases of US farm products, and a signing ceremony for the agreement on American soil.”

The report says that there is a growing belief in the US that they will have to make this type of concession but that it was unclear if Trump would sign off.

Watching this story going forward, I’ll be listening for hints on where the signing ceremony is rumored. If it’s in the US, that will be a good sign that a deal along these lines gets done.

At the same time, I’m not sure the market has the right reaction here. I see a deal as 99% priced in and the talk in this story hints at some very big decisions still unmade and plenty of risk that this falls apart.

China wants 15% tariffs imposed on Sept 1 removed in trade deal

Politico report

China is in a ‘full court press’ to get the 15% tariff imposed by Trump on $112B of goods removed before it signs the Phase One trade deal, according to Politico.

U.S. officials are currently struggling over how to make sure China lives up to its side of the deal. The main enforcement mechanism being considered is that all the tariffs could be re-imposed, one of the people said.

They cited a White House official who said the deal is almost there but there are still hangups on forced technology transfers and IP protections.

China hasn’t decided yet on signing the deal in the US or a neutral location.

Overnight US Market : Major US indices all close at record levels

The hat trick for the 3 major indices in the US

It’s a hat trick. In gains with goals, a hat trick is when a player scores 3 goals in the same game.

Well stock trading is not goal scoring, but there are 3 major indices in the US and today, for the first time in a number of months (since mid July), each of the major indices closed at a record levels. The Dow joined the S&P and Nasdaq in making new all-time highs . The S&P and NASDAQ started to make new highs last week .

Happy days are here again.

The final numbers are showing:

- The S&P index +11.36 points or 0.37% at 3078.27

- The NASDAQ index is up 46.802 points or 0.56% at 8433.19

- The Dow is up 114.75 points or 0.42% at 27462.13.

Uber reported earnings after the close and the market is disappointed with a loss of $0.68 a share versus the loss expected of -$0.81%. Uber sees FY Adj EBITDA loss of $2.8B-2.9B. See loss of $3B -$3.2B. The price is down over 5% in extended hours trading.

Thought For A Day