Highlights of the October US employment report:

- Prior was +136K (revised to +180K)

- Estimates ranged from +25K to +140K

- Two month net revision +95K

- Unemployment rate 3.6% vs 3.6% expected (prior 3.5%)

- Participation rate 63.3% vs 63.1% exp (63.2% prior)

- Avg hourly earnings +0.3% m/m vs +0.2% exp

- Avg hourly earnings 3.0% y/y vs +3.0% exp

- Prior avg hourly earnings 2.9% (revised to 3.0%)

- Avg weekly hours 34.4 vs 34.4 exp

- Private payrolls +131K vs +80K exp

- Manufacturing -36K vs -55K expected

- U6 underemployment 7.0% vs 6.9% prior

- Temporary census hiring were reduced by 17K

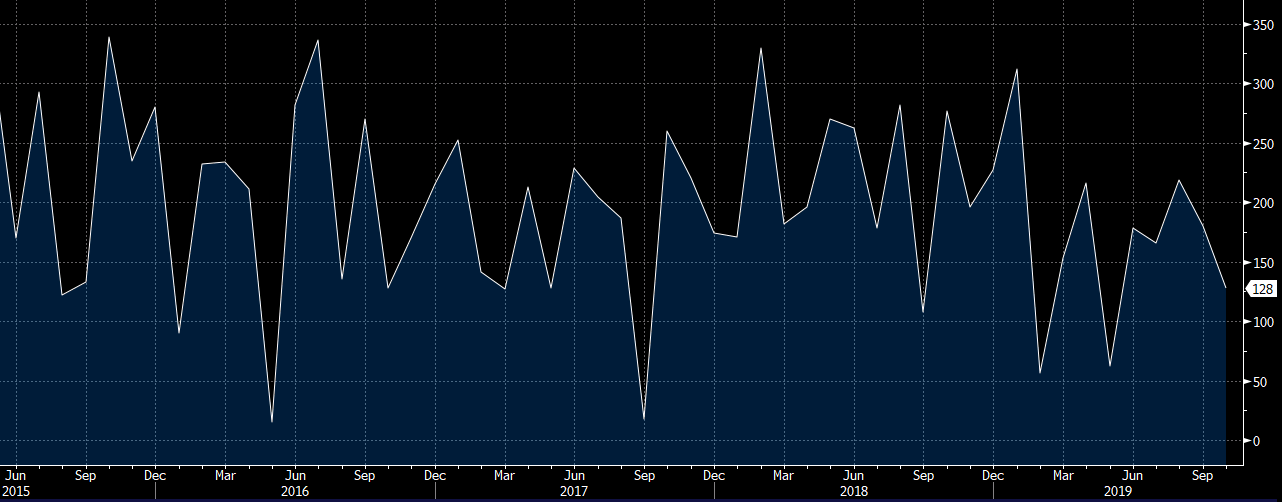

This is a very strong report. The GM strike wasn’t as large of a drag (cut 41.6K jobs) and those revisions are great. If you look at that chart, there’s no real sign of slowing in the US economy.

Another thing to note is that the participation rate continues to tick higher. That’s something the Fed wants to see and something that will embolden the doves (and they’re almost all doves now) to keep rates low even if the economy picks up.