Brent crude is trading at $61

- Oil prices are stable around $60 per barrel

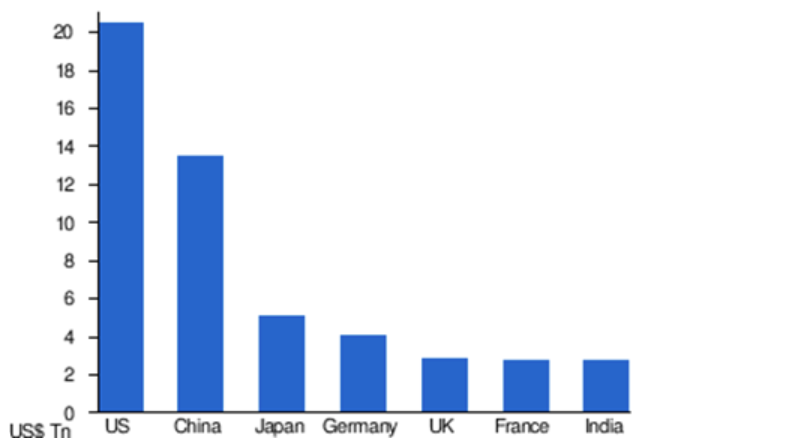

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.Furthermore, consider that when you add these two countries GDP together, they account for more than 40% of the world’s entire GDP. So, the first point to grasp is that the significance of a US-China trade war is really a global growth problem.

When you factor in the alliances and trade partners of both countries, the legitimate concern is that a China-US trade war spills over across the entire globe and slows down the entire world economy.

2301 GMT UK data – Lloyds Business barometer for September

2350 GMT Bank of Japan Summary of Opinions from the most recent monetary policy meeting.

2350 GMT Japan

August Retail Sales y/y,

Retail Sales m/m,

Industrial production for August preliminary

0100 GMT – New Zealand – ANZ business survey for September

0100 GMT Australia monthly inflation guide for September

Melbourne Institute

0100 PMI data from China for September

0110 GMT Bank of Japan Japanese Government Bond buying operation

0130 GMT Australia private sector credit for

0145GMT back to China for the Caixin / Markit Manufacturing PMI