Oil drops $1 fast

As part of the discussions, China has offered to buy American products in exchange for a delay in a series of US tariffs and easing of a supply ban against Chinese telecommunications giant Huawei Technologies.

The source said China could also offer more market access, better protection for intellectual property and to cut excess industrial capacity, but would be more reluctant to compromise on subsidies, industrial policy and reform of state-owned enterprises.

In Beijing, the leadership is putting the focus on the longer term, suggesting that a trade deal with the US would be just a trade war truce.

In a speech last Tuesday, Chinese President Xi Jinping urged the Communist Party to embrace a long-term struggle against a range of risks.

This is beginning to get some traction and helping risk trades.

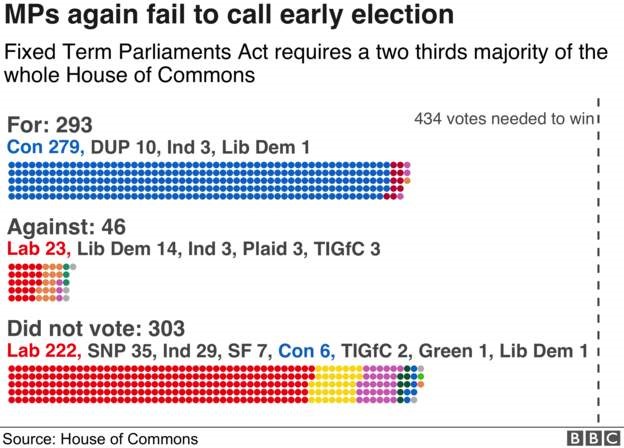

British Parliament has officially been prorogued (or suspended) until October 14. That means that there are no debates, nor votes held. In yesterday’s final House of Commons‘ session, MPs voted against the motion from the government to call a snap election.

The GBP/USD bounced back from its 3-year low, which weighs on the main British index

While the GBP/USD pair lost up to 6% since Boris Johnson’s appointment, the currency pair recently bounced back on its lowest level since October 2016 to trade around 1.2330 at the time of writing. As strong U.K. growth figures have recently been published, the pound has strengthened against other currencies. After the prorogation announcement the pound fell.

Many analysts expect the currency pair to keep declining, despite recent spikes, because of several major geopolitical considerations. These include mounting concerns over Prime Minister Boris Johnson’s tenure as head of government, the parliament suspension, the passage of Brexit legislation by October 31, 2019, and the ongoing uncertainty vis-a-vis the potential for a US trade war with the European Union.

Financial analysts have reiterated concerns on the falling purchasing power of the pound. Speculative net positions, including online exchange brokers such as Easy Markets on the GBP are strongly negative over 1 year, 2 years, and 5-year projections. Immediately prior to Brexit in 2016, the GBP/USD pair was hovering around 1.50. Since then, approximately 20% of the GBPs purchasing power has been erased, with significant downward momentum on the cards.

The relationship between British indices and the GBP/USD

As about 70% of the components of the FTSE 100 index are exporting companies, most of their revenues are coming from abroad. Therefore, a weaker GBP is positive for these companies, as it means that the purchasing power of foreign buyers of UK goods and services is higher.

On the other hand, a stronger GBP weakens the export-driven growth of UK-listed companies on the FTSE 100 index. The 2019 performance of the GBP/USD pair is bearish, and this dovetails with strongly positive returns on the FTSE 100. Some 2/3 of revenues generated on the FTSE 100 index are derived from foreign earnings.

That’s the reason why a weak GBP benefits the bourse. The FTSE 250 index is made up of all UK-based companies, and a weak GBP exposes this index to poor performance. As foreign-based companies repatriate their profits to the UK, the returns are worth substantially more in GBP. A weak sterling can increase share prices on the FTSE 100.

As you can see in the above chart, the FTSE index and the GBP/USD currency pair are negatively correlated, as they (mostly) evolve in opposite directions.

More twists and turns over Brexit expected

The question on every investor’s mind remains about the October 31st 2019 deadline for Brexit – Is it doable?

Most pundits tend to think not. The prospect of a negotiated settlement is growing slimmer by the day. With just over a month until the PMs deadline expires and with the Parliament being suspended, it is unlikely that the ‘Irish backstop’ idea will be scrapped by the EU.

A surprise Brexit deal could take markets completely by surprise and make the pound a highly attractive prospect.

It looks like China is really looking to play the long game here. The QFII and RQFII limits are basically an investor grant to allow for the purchase of certain cross-border securities products, if those investors are able to meet certain requirements.

Fitch Ratings on Tuesday forecasted India’s economic growth at 6.6 per cent during the current year, down from 6.8 per cent in the previous year, and said the government has only limited room to ease fiscal policy because of high debt.

It said GDP (gross domestic product) growth is likely to rebound to 7.1 per cent next year.

Keeping India’s rating unchanged at BBB- with a stable outlook, it said the rating balances a strong medium-term growth outlook and relative external resilience with sturdy foreign reserve buffers, against high public debt, financial sector fragilities and some lagging structural factors.

In its Asia-Pacific Sovereign Credit Overview, Fitch said India’s GDP growth decreased for a fifth consecutive quarter in the April-June quarter to 5 per cent, the lowest in six years.

“Domestic demand is faltering, with both private consumption and investment proving lackluster, while the global trade environment is also weak,” it said.

The contribution of gross fixed capital formation (1.3 per cent) remained weak at the same level of the January-March quarter, when it dropped sharply, while the contribution of private consumption fell to 1.8 per cent in the April-June from an average of 4.6 per cent in the preceding four quarters.

Manufacturing grew by only 0.6 per cent, it said.

The government’s policy measures to stimulate the economy include support for the automobile sector, a reduction in capital gains tax, and additional liquidity support for “shadow” banks. Accompanying structural reforms include a further easing of the foreign direct investment (FDI) regime and consolidation of the public banking sector. (more…)

Concerns about global trade have reached nearly 10 times the peaks seen in the previous two decades, the International Monetary Fund (IMF) has said.

“Globally, the trade policy uncertainty index is rising sharply, having been stable at low levels for about 20 years,” it said in a blogpost.

“The World Trade Uncertainty index jumped in the past year 10-fold from previously recorded highs as the US-China trade war escalated,” said the blogpost written by Hites Ahir, Nicholas Bloom and Davide Furceri.

The Americas and the Asia Pacific are most affected by concerns about the US-China trade war while Africa is least affected, the IMF said in a new index aimed at quantifying trade uncertainty.

The index is based on reports from the Economist Intelligence Unit (EIU) dating back to 1996 and borrows from the methodology used in the IMF’s own World Uncertainty Index.

To calculate the new gauge, IMF researchers counted how often the word ‘uncertainty’ appears in the EIU reports near terms such as ‘tariffs,’ ‘protectionism’ or ‘trade.’ (more…)