- The S&P index fell -23.11 points or 0.79% at 2900.53

- The NASDAQ index fell -54.25 points or -0.68% at 7948.56

- The Dow industrial average fell -173.35 points or -0.66% at 25962.42

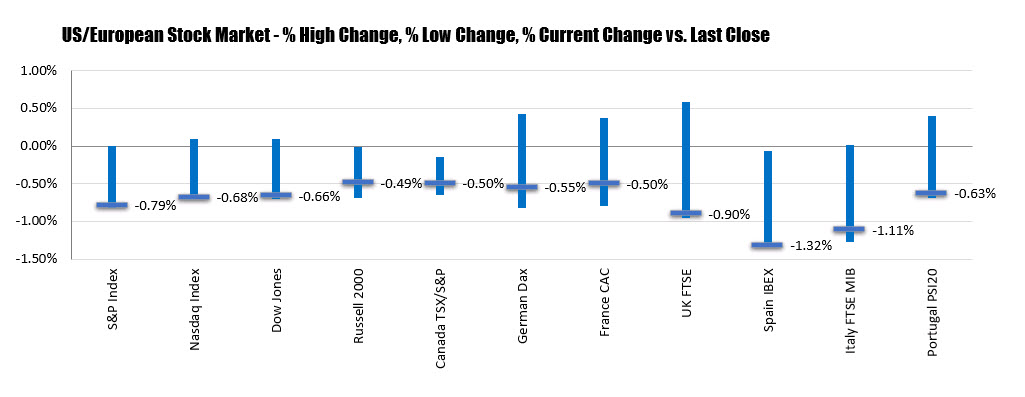

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.

The European indices were higher earlier in the day, but gave up those gains and also ended near low levels.

Winners on the day included:

- Beyond Meat, +6.55%

- Home Depot, +4.45%

- LYFT, +3.81%

- Qualcomm, +1.60%

- Twitter, +1.44%

- Broadcom, +0.57%

- Square, +0.48%

- Intuitive Surgical, +0.47%

Losers included:

- Netflix, -3.36%

- AMD, -2.41%

- American Express, -2.38%

- Bank of America, -2.02%

- UnitedHealth, -1.90%

- Micron, -1.73%

- Nvidia, -1.70%

- PNC financial, -1.68%

- General Mills, -1.65%

- Pfizer, -1.59%

- Coca-Cola, -1.5%

- IBM, -1.44%

- Alphabet, -1.41%

- Facebook, -1.39%

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.