1. The most important single factor in shaping security markets is public psychology.

2. To make money in the stock market you either have to be ahead of the crowd or very sure they are going in the same direction for some time to come.

3. Accepting losses is the most important single investment device to insure safety of capital.

4. The difference between the investor who year in and year out procures for himself a final net profit, and the one who is usually in the red, is not entirely a question of superior selection of stocks or superior timing. Rather, it is also a case of knowing how to capitalize successes and curtail failures.

5. One useful fact to remember is that the most important indications are made in the early stages of a broad market move. Nine times out of ten the leaders of an advance are the stocks that make new highs ahead of the averages.

6. There is a saying, “A picture is worth a thousand words.” One might paraphrase this by saying a profit is worth more than endless alibis or explanations…prices and trends are really the best and simplest “indicators” you can find.

7. Profits can be made safely only when the opportunity is available and not just because they happen to be desired or needed.

8. Willingness and ability to hold funds uninvested while awaiting real opportunities is a key to success in the battle for investment survival.-

9. In addition to many other contributing factors of inflation or deflation, a very great factor is the psychological. The fact that people think prices are going to advance or decline very much contributes to their movement, and the very momentum of the trend itself tends to perpetuate itself.

10. Most people, especially investors, try to get a certain percentage return, and actually secure a minus yield when properly calculated over the years. Speculators risk less and have a better chance of getting something, in my opinion.

11. I feel all relevant factors, important and otherwise, are registered in the market’s behavior, and, in addition, the action of the market itself can be expected under most circumstances to stimulate buying or selling in a manner consistent enough to allow reasonably accurate forecasting of news in advance of its actual occurrence. The market is better at predicting the news than the news is at predicting the market

12. You don’t need analysts in a bull market, and you don’t want them in a bear market.

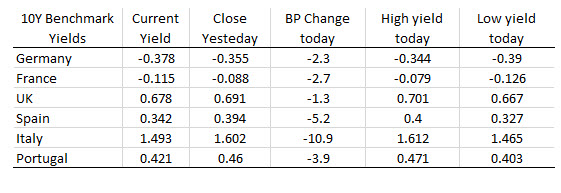

In a sign of the apocalypse, investors now accept a lower yield on Greek 10 year debt vs US 10 year debt. Greek 10 year yield is at 1.992% while 10 year yields in the US area at 2.048% currently.

In a sign of the apocalypse, investors now accept a lower yield on Greek 10 year debt vs US 10 year debt. Greek 10 year yield is at 1.992% while 10 year yields in the US area at 2.048% currently.