Tokyo’s main index closes higher on slight recovery in Asian stocks

Equities continue to take a bit of a breather from US-China trade tensions as Japanese stocks inch higher after seeing European equities fare better in overnight trading. Chinese stocks are also performing better today but there’s a feeling that this is more of a relief rather than any risk-on mood amid lingering trade tensions.

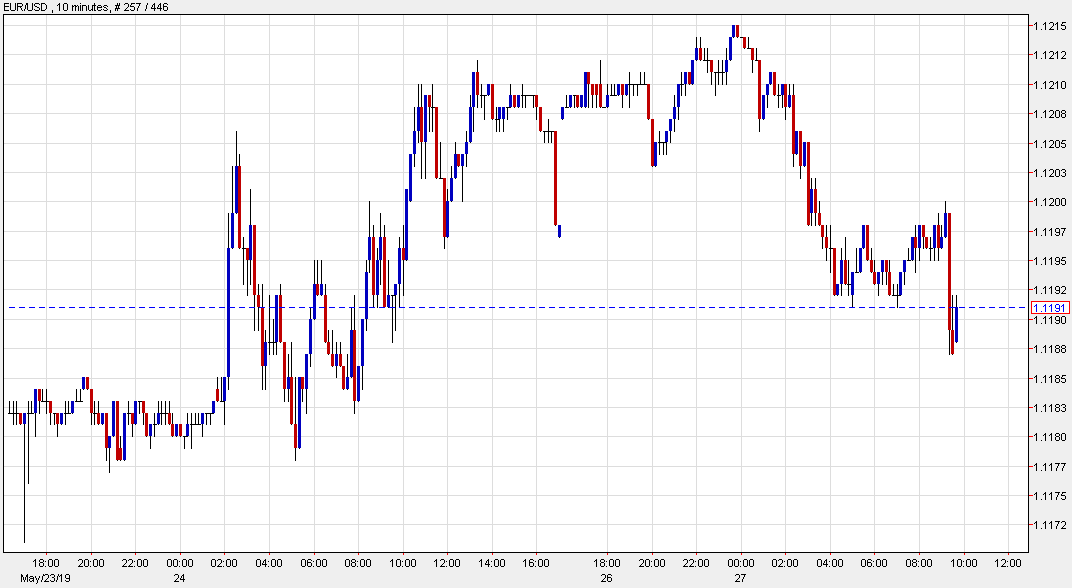

Treasury yields are not as optimistic, sitting slightly weaker on the day and that’s putting a floor on yen weakness with USD/JPY trading near flat levels around 109.53 currently. European equity futures should open with mild gains but there isn’t much to really shout about for the time being with sentiment still slightly cautious as well.