- The Dow swung 300 points

- Major indices on pace for the first negative month close in 2019

- US/China deal a concern

The final numbers are showing:

- The S&P index fell -23.80 points or -0.84% at 2802.27. The low did bottom just above the natural 2800 level. If broken tomorrow, the 100 day MA is below that level at 2789.42 followed by the 200 day MA at 2776.48.

- The Nasdaq fell -29.657 points or -0.39% at 7607.35. The low reached 7603.758. The high was up a 7693.73. It’ss 100 day MA is down at 7583.079. A move below it and the 200 day MA at 7528.88 will be more negative

- The Dow fell -237.92 points or -0.93% at 25347.77. The high reache 25717.63. The low extended to 25342.28 – just below the close for the day.

Some winners today include:

- Fiat, +7.24% on merger talks

- AMD, up 9.8%

- Chipotle, +2.68%

- First Solar, +1.77%

- Facebook, +1.79%

- Adobe, +1.27%

- Mastercard, +0.79%

- Amazon, +0.79%

- Visa, +0.64%

Losers today include:

- Gilead, -4.37%

- General Mills, -3.26%

- Micron, -3.12%

- Intel, -2.24%

- Southwest Air -2.17%

- Emerson, -2.13%

- Morgan Stanley -1.84%

- Goldman Sachs -1.83%

- Stryker, -1.57%

- IBM, -1.37%

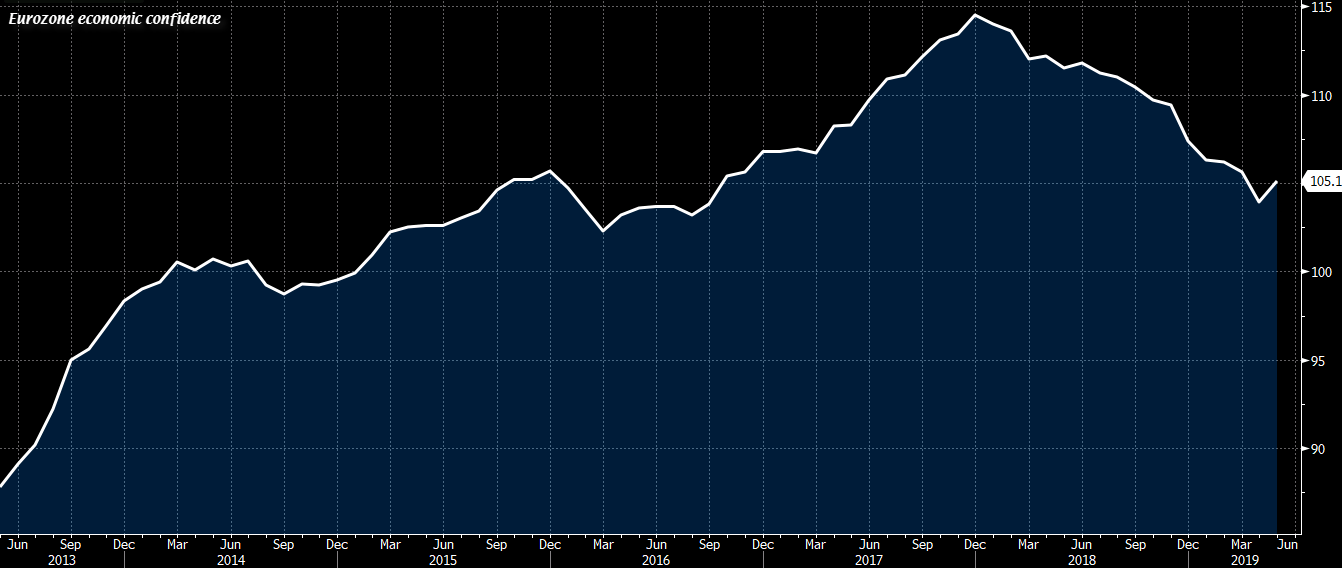

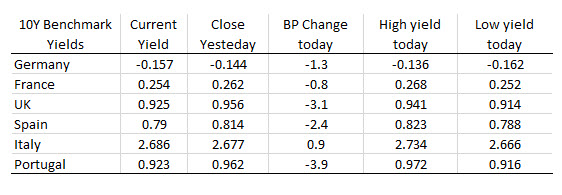

In other markets London/European traders look toward the exits, a snapshot shows

In other markets London/European traders look toward the exits, a snapshot shows