Treasury yields extend decline as risk sentiment grows softer

That is keeping further pressure on yen pairs today with USD/JPY trading at session lows currently at 109.25. Despite the slight optimism among equities in Asia Pacific trading, bonds/Treasuries did not buy it for a second and we’re seeing market sentiment start to favour bond traders on the session now.

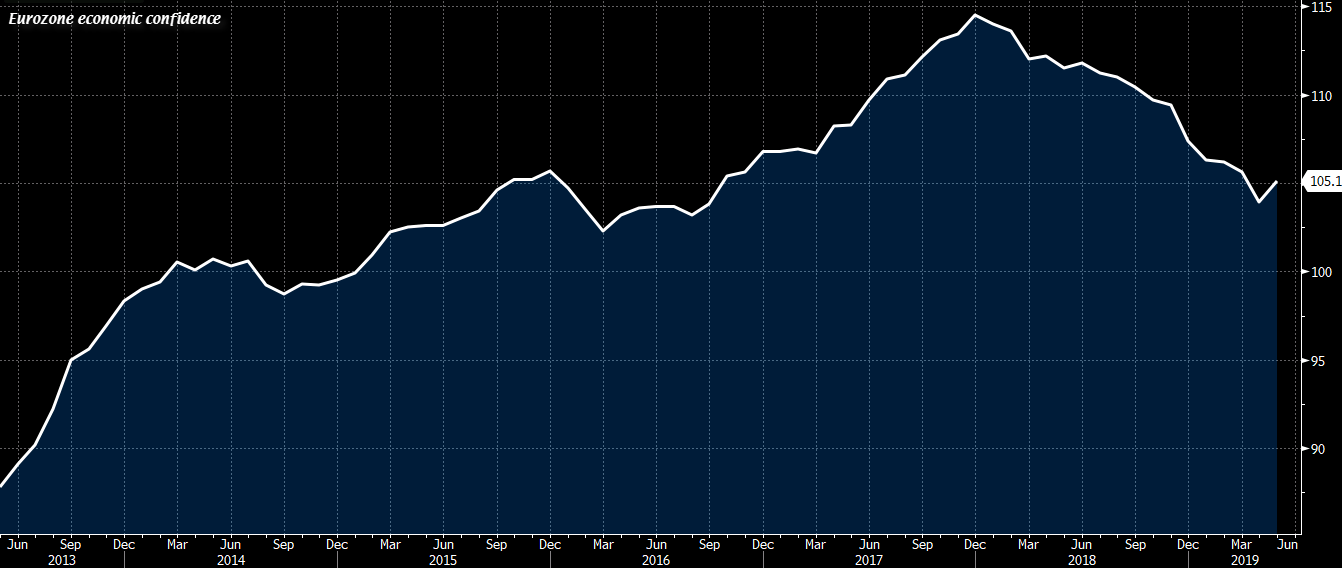

European equities are posting notable declines while US equity futures are down by 0.2% now after having been up by 0.2% at the start of the European morning.

There isn’t any fresh headlines that is driving the move here but lingering trade tensions is surely the major culprit. As highlighted yesterday, China’s April data is far from convincing of any near-term relief for the global economy and with trade tensions left unresolved, the worst could be yet to come.

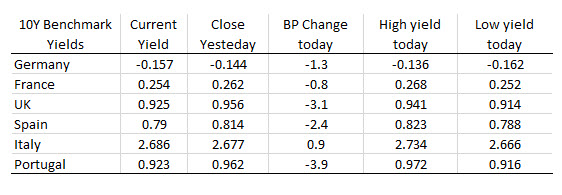

In other markets London/European traders look toward the exits, a snapshot shows

In other markets London/European traders look toward the exits, a snapshot shows