Taper back on the table?

The US stock market lost steam into the close with Dow industrial average and the S&P 500 closing in the red and giving up earlier gains. The NASDAQ index squeaked out a small gain on the day.

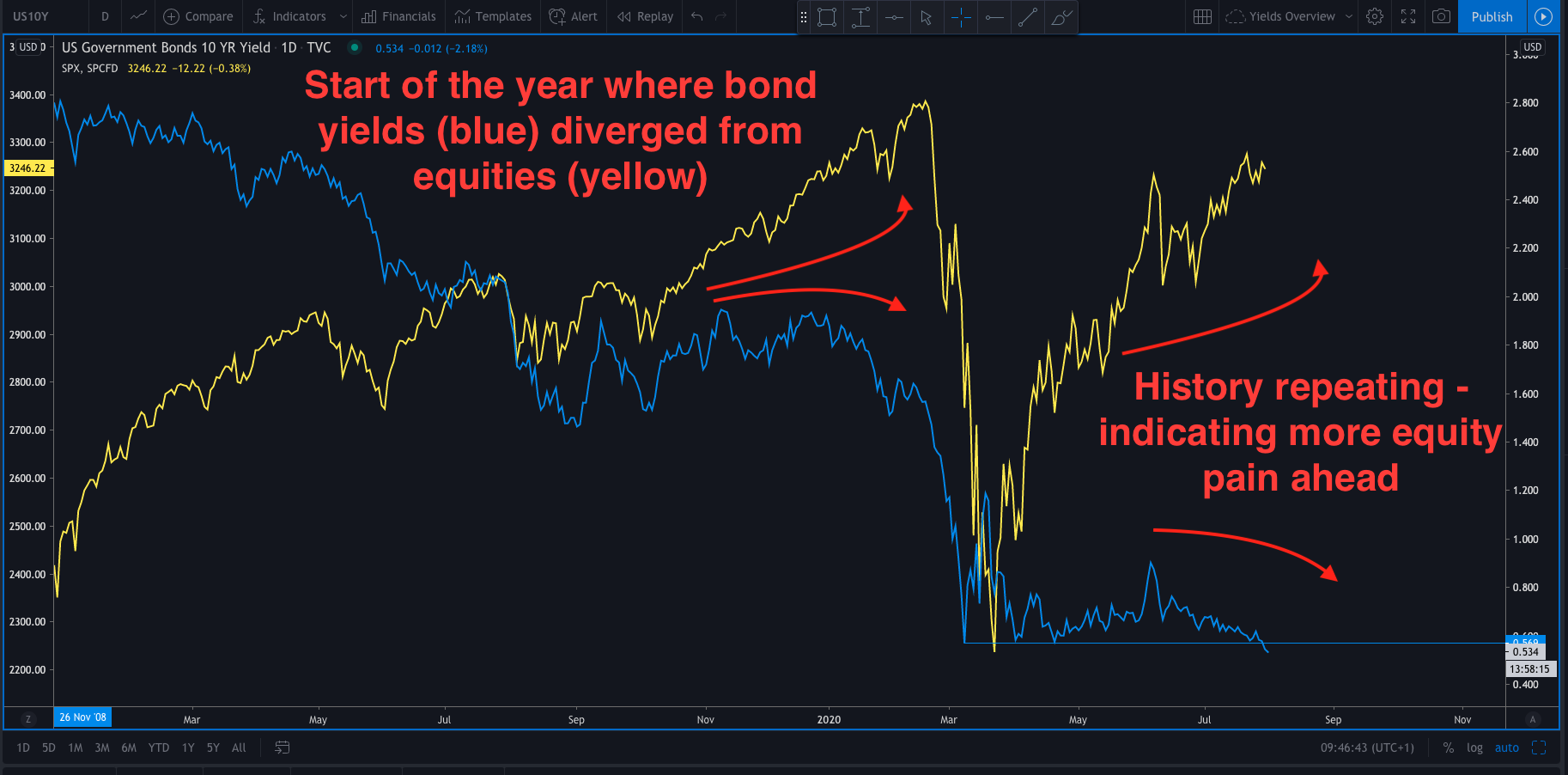

The constant fall in Bond yields is sending out a signal that all is not well in the world. The tail end of last week may have seen some excellent earnings from facebook, apple, amazon and alphabet and that started a fresh equity rally early Friday. However, the fall of Bond yields is saying, ‘look out! There may be trouble ahead. For the uninitiated bond traders tend to take a more long tern macro view. So, when equities rise, but bond yields are falling that is a signal something is wrong.

If you can recall at the start of the year one of the big questions was which market is right? Falling and yields or rising equities? The answer has been, ‘the falling bond yield market’. So, the general rule of thumb is go with the bond yield market. Now, of course this doesn’t mean that a funny divergence can last for weeks and months. However, at the very least it is a warning sign. That warning sign is showing again.

Yields are dropping

The 10Y Gilt yield (UK bond) hit a record low last week. The 10Y Bund (German bond) closed at its lowest level since mid-May on Thursday last week, while the 10 y UST (US bond) was down towards its lowest ever close last week too.

Why are they dropping?

The proverbial tea leaves are being read and a second wave of COVID-19 is being seen ahead. This will mean more monetary and fiscal policy help to get through the pandemic.So, yes the equity market has been rallying on the central bank support. However, the bond market is saying that the next stage of the global economy is fraught with dangers and a ‘V’ shaped recovery is more hope than reality.