Archives of “Trade wars” tag

rssGlobal stock market rally has further to run in 2020 – Reuters poll

But much depends on the US-China trade war still

The bias has turned more favourable in the most recent poll with a slim majority of respondents (53/102) viewing that risks to the outlook are now skewed more to the upside.

A look at the US-China trade war and its impact on markets

The impact escalation will have

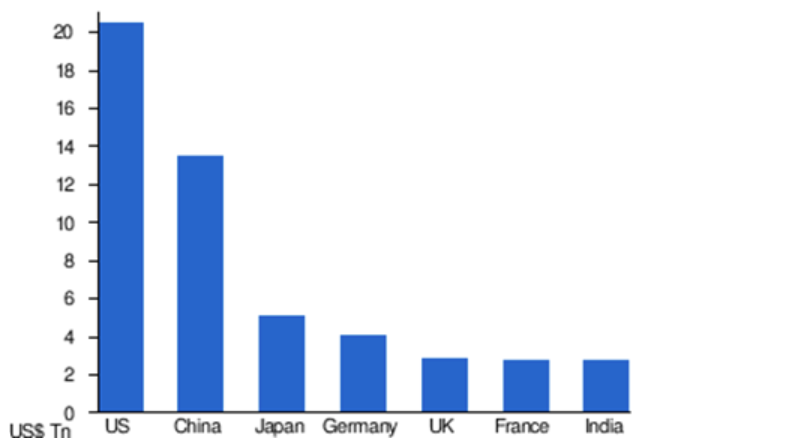

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.Furthermore, consider that when you add these two countries GDP together, they account for more than 40% of the world’s entire GDP. So, the first point to grasp is that the significance of a US-China trade war is really a global growth problem.

When you factor in the alliances and trade partners of both countries, the legitimate concern is that a China-US trade war spills over across the entire globe and slows down the entire world economy.

Week ahead: US jobs, China trade, Opec ,Wimbledon

A high-stakes meeting between the presidents of the US and China will set the tone for markets heading into the new week, as the world’s two most important economies seek a resolution to a long-running trade dispute.

Also on tap in the US, investors await data on the labour market and manufacturing sector in a holiday-shortened week. Elsewhere, Opec members will meet to iron out oil production plans.

Here’s what to watch.

Economic data and the Fed

A fresh round of key US economic data due next week will probably factor into the Federal Reserve’s decision on interest rates in late July.

At the top of the list is the labour department’s monthly jobs report. Economists polled by Thomson Reuters anticipate an increase of 158,000 non-farm payrolls in June, which would reflect an uptick in hiring compared to the 75,000 jobs added in the prior month. The unemployment rate is expected to remain at a near 50-year low of 3.6 per cent.

Investors will also be able to parse the latest surveys from the Institute for Supply Management on the US manufacturing and services sectors, as well as reports on auto sales, factory orders and the nation’s trade balance.

The Fed’s policy-setting committee will reconvene on July 30-31, and investors expect the central bank to lower its target rate for the first time since the 2008 financial crisis amid soft inflation and uncertainty over global trade. The market has priced in a 100 per cent chance of a rate cut, with 30.2 per cent odds that officials will approve a cut of 50 basis points, according to CME Group’s FedWatch Tool which monitors Fed funds futures.

New York Fed president John Williams and Cleveland Fed president Loretta Mester — a non-voting member of the Federal Open Market Committee — are scheduled to speak at separate events on July 2. (more…)