How low can you go?

- Level 1: 2,521.25 or down 7% from Friday close

- Level 2: 2,358.59 or down 13% from Friday close

- Level 3: 2,168.82 or down 20% from Friday close

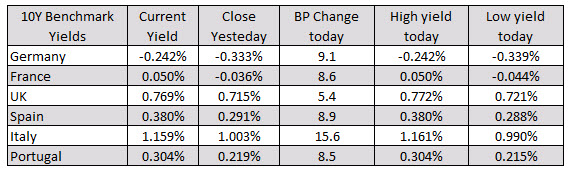

Yields are also higher as traders in global debt markets are also hoping global economies will get a boost on more cooperative US China relations.

10. Malaysia – Bursa Malaysia stock exchange

Loss in 2014: -10pc

How to access this market: The best route to this stock market is via the iShares MSCI Malaysia ETF, which tracks the up and down movements of shares listed in Malaysia.

9. Mexico – Bolsa Mexicana de Valores SAB de CV stock exchange

Loss in 2014: -12pc

How to access this market: One option is to buy a fund that has a significant chunk of its money in Mexican shares, such as the Blackrock Latin American Investment trust, which has around 30pc of its money in the country. Alternatively there is SPDR MSCI Mexico Quality Mix ETF and the iShares MSCI Mexico Capped ETF.

8. Brazil – Bovespa stock exchange (more…)