Breaking a month-long lull in missile tests, North Korea fired two short range missiles into the sea off its east coast on Thursday in what appeared to be the latest try out of its new multiple rocket launchers, South Korea’s military said.

The test-firing came as the clock ticks down on the year-end deadline that Pyongyang had given the United States to restart stalled denuclearisation talks.

South Korea’s Joint Chiefs of Staff (JCS) said the North fired the two missiles into the sea from launchers in the eastern coastal town of Yonpo at around 5 p.m. (0800 GMT).

The rockets travelled up to 380 kilometres (236 miles) and reached an altitude of 97 km (60 miles), the JCS said.

Japanese Prime Minister Shinzo Abe said the launch was a threat to not only Japan but the region and beyond, though his defence ministry said the projectile did not enter Japanese airspace or its Exclusive Economic Zone.

“We will remain in close contact with the United States, South Korea and the international community to monitor the situation,” Abe told reporters. (more…)

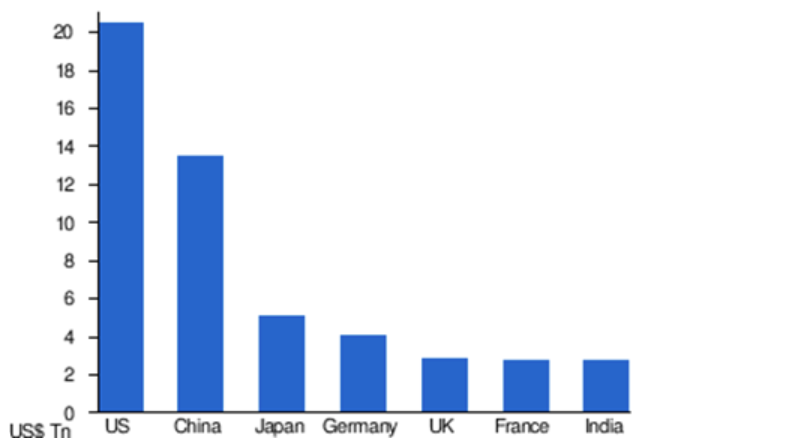

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.