So much for that hope

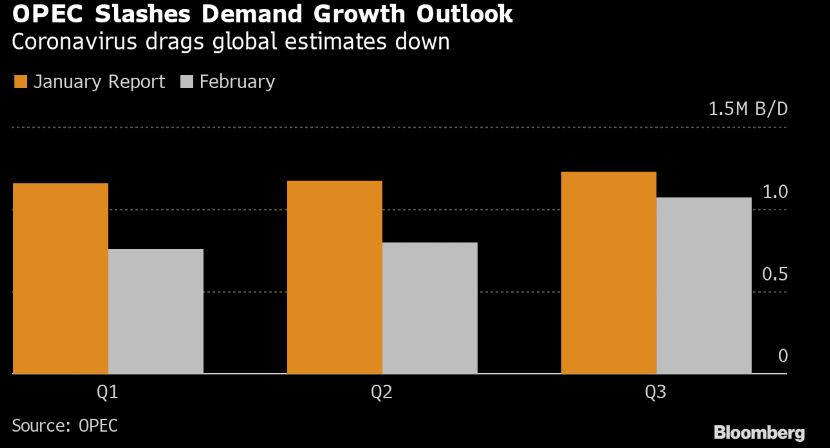

The sources say that most OPEC members agree on the need to cut oil output further and that they are considering to have a meeting on 14-15 February now. Just one to keep in mind as such a move may provide some relief to oil prices in the near-term.

It appears that Barkindo has shot down rumours of the OPEC+ meeting potentially being postponed to June, with the headlines also saying that none of the OPEC+ members had asked for a different time for the meeting.

Saudi Aramco, Saudi Arabia’s state-controlled oil company, held a record-breaking initial public offering earlier in December, becoming the world’s most valuable listed company, ahead of Apple of the U.S.

The listing on the Riyadh stock market on Dec. 11 gave Aramco a market value of $1.877 trillion. The $25.6 billion raised was also a record, breaking the previous mark set in 2014 by China’s e-commerce leader, Alibaba Group Holding.

The IPO has set off speculation about how the stock flotation will affect other state-owned oil producers, especially in Asia.

According to the International Monetary Fund’s latest forecast, Saudi Arabia will incur a fiscal deficit of 178.5 billion riyals ($47.57 billion) in 2019, staying in the red for the sixth consecutive year. The economy of the kingdom is greatly affected by the price of crude oil, which generates 70% of government revenue. As the world moves toward alternative forms of energy to combat climate change, the risks of relying heavily on oil will grow.

In 2016, Saudi Arabia adopted the Vision 2030 plan aimed at reducing its dependence on oil and creating a sustainable growth model. The listing of Aramco is key to the shift. (more…)

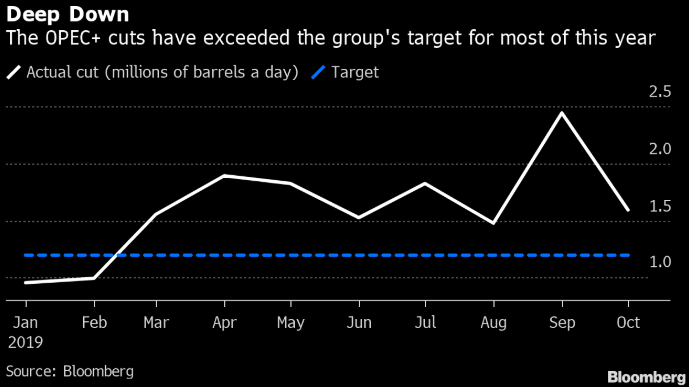

The closed session meeting is still taking place but as ever the case, the decision is already being leaked out. In any case, the 500k bpd additional cut here is what has been anticipated over the past two days.

Saudi Aramco has notified Japan’s top oil distributor about a potential change in shipments, stoking concerns about the kingdom’s ability to supply crude following attacks on its major refineries a week ago, Nikkei learned Saturday.

State-owned Aramco did not say why it wants to change the oil grade it supplies to JXTG Nippon Oil & Energy from light to heavy and medium, starting in October, JXTG officials said.

But the move indicates that the Saudi national oil company is having a hard time restoring its production as quickly as it has promised, despite repeated assurances that the company’s supply would be restored by the end of September.

Two of Aramco’s refineries were attacked in what is believed to be a drone and cruise missile strikes on Sept. 14. The attacks, which were claimed by Iran-backed Houthi rebels in Yemen, knocked out more than half the country’s oil production.

JXTG officials said they suspect that Aramco is taking more time than expected to repair its desulfurization facility, which is necessary to produce light-grade crude used in the production of gasoline and light gas oil.

Saudi Arabia accounted for almost 40% of Japanese oil imports in fiscal 2018. (more…)