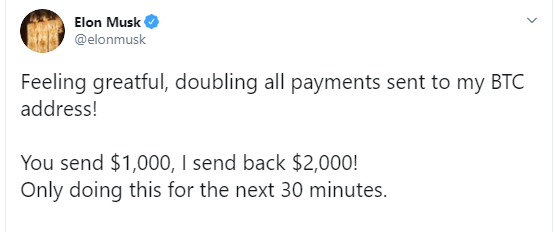

Accounts hacked so far by the Bitcoin scam, asking you send coins to a bogus address

- Bill Gates

- Elon Musk

- Joe Biden

- Warren Buffett

- Kanye West

- Michael Bloomberg

- Apple

- Uber

- Jeff Bezos

- Barack Obama

While Gilead may look cheap with its price-to-earnings ratio of 12 times and AstraZeneca may be attracted by the potential cost-cutting and decent free cashflow, Jefferies analysts said they do not view a deal as likely. “We think Gilead believes its HIV business is very underappreciated,” they said in a note, adding that the company “would prefer to build value over time and do its own tuck-in deals

The report says that China is moving forward with plans to buy up oil for its emergency reserves after the epic crash in oil prices over the past few weeks.

China’s 3Q GDP is due Oct 18 and it could be the first time on record that it prints below 6%. That could have a greater long-term impact on assets than a partial trade deal. Especially, as Bloomberg Economics expect policy makers to step up stimulus in response to stabilise the mainland economy.

If so, will that make China equities an asset class that become less correlated to the direction of Wall Street and global stocks? Would it trigger an asset swicth away from China bonds that spills over to other fixed income markets?

This is quite amazing via Bloomberg:

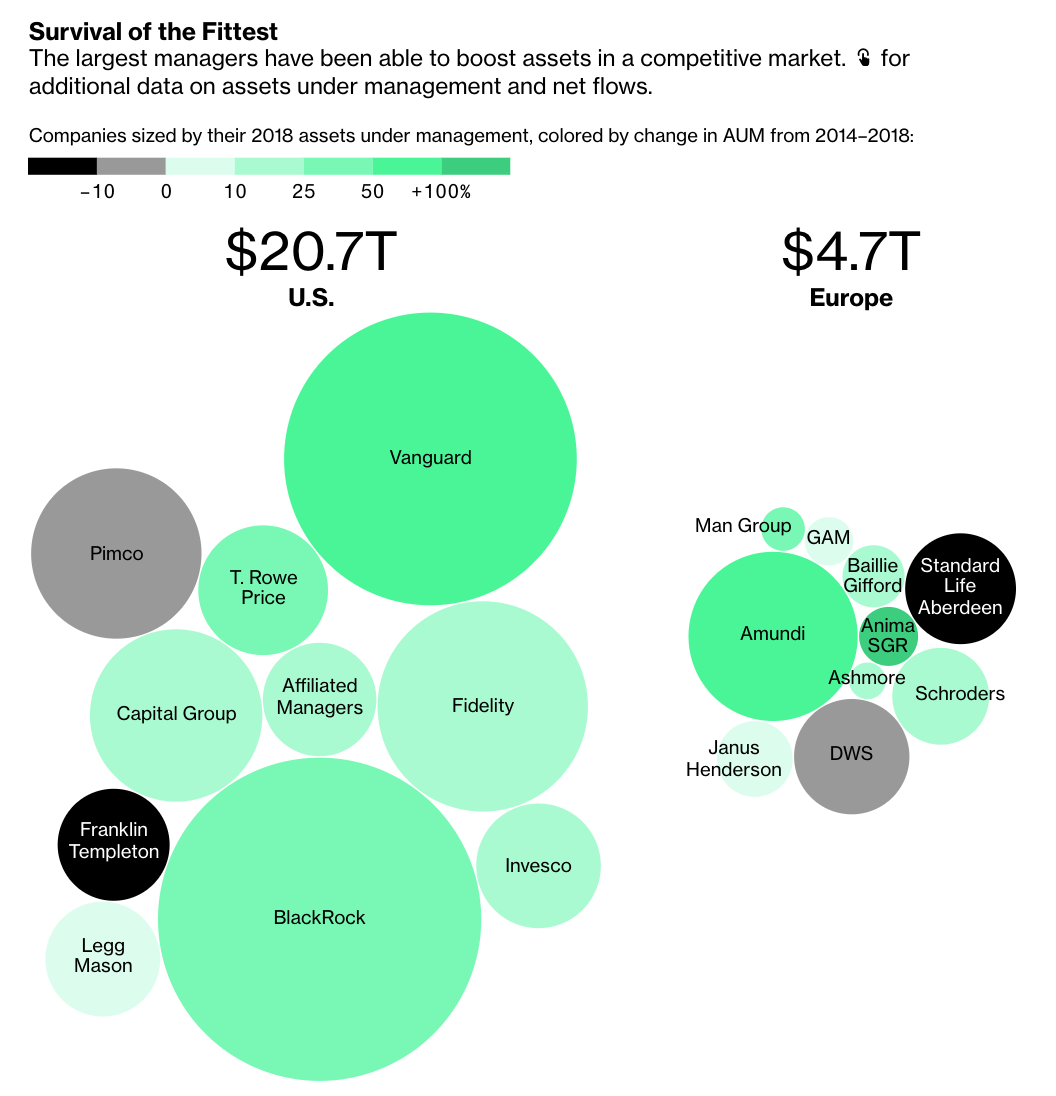

“The industry that gave rise to investing titans Peter Lynch, Bill Miller and Bill Gross is facing an existential crisis.

For years, mom-and-pop investors frustrated by high fees and subpar returns from big-name money managers have been shifting their savings into ultra-cheap funds that simply mimic the returns generated by benchmark stock and bond indexes. Passive investing, as it is known, was in. Active was out.

At first, few noticed the trickle of money out of funds run by star money managers into cheaper index products. But now, no one can ignore the flood. The exodus from active funds has sent fees inexorably lower, led to the loss of thousands of jobs and forced large-scale consolidation among firms. That’s pushing the industry, with $74 trillion in assets as measured by Boston Consulting Group, towards a shakeout where only the strongest will survive.”

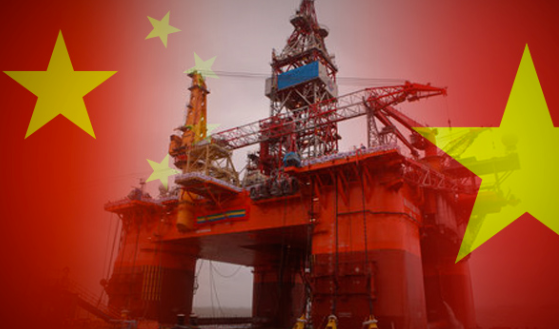

The graphic tells the story:

Michael Bloomberg has handed out some tips on his formula for success: