Here are the rules – they are not unique or new. They are time tested and successful investor approved. Like Mom’s chicken soup for a cold – the rules are the rules. If you follow them you succeed – if you don’t, you don’t.

1) Sell Losers Short: Let Winners Run:

It seems like a simple thing to do but when it comes down to it the average investor sells their winners and keeps their losers hoping they will come back to even.

2) Buy Cheap And Sell Expensive:

You haggle, negotiate and shop extensively for the best deals on cars and flat screen televisions. However, you will pay any price for a stock because someone on television told you too. Insist on making investments when you are getting a “good deal” on it. If it isn’t – it isn’t, don’t try and come up with an excuse to justify overpaying for an investment. In the long run – overpaying will end in misery.

3) This Time Is Never Different:

As much as our emotions and psychological makeup want to always hope and pray for the best – this time is never different than the past. History may not repeat exactly but it surely rhymes awfully well.

4) Be Patient:

As with item number 2; there is never a rush to make an investment and there is NOTHING WRONG with sitting on cash until a good deal, a real bargain, comes along. Being patient is not only a virtue – it is a good way to keep yourself out of trouble.

5) Turn Off The Television:

Any good investment is NEVER dictated by day to day movements of the market which is merely nothing more than noise. If you have done your homework, made a good investment at a good price and have confirmed your analysis to correct – then the day to day market actions will have little, if any, bearing on the longer-term success of your investment. The only thing you achieve by watching the television from one minute to the next is increasing your blood pressure.

6) Risk Is Not Equal To Your Return:

Taking RISK in an investment or strategy is not equivalent to how much money you will make. It only relates to the permanent loss of capital that will be incurred when you are wrong. Invest conservatively and grow your money over time with the LEAST amount of risk possible.

7) Go Against The Herd:

The populous is generally right in the middle of a move up in the markets but they are seldom right at major turning points. When everyone agrees on the direction of the market due to any given set of reasons – generally something else happens. However, this also cedes to points 2) and 4); in order to buy something cheap or sell something at the best price – you are generally buying when everyone is selling and selling when everyone else is buying.

These are the rules. They are simple and impossible to follow for most. However, if you can incorporate them you will succeed in your investment goals in the long run. You most likely WILL NOT outperform the markets on the way up but you will not lose as much on the way down. This is important because it is much easier to replace a lost opportunity in investing – it is impossible to replace lost capital.

As an investor, it is simply your job to step away from your “emotions” for a moment and look objectively at the market around you. Is it currently dominated by “greed” or “fear?” Your long-term returns will depend greatly not only on how you answer that question, but how you manage the inherent risk.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

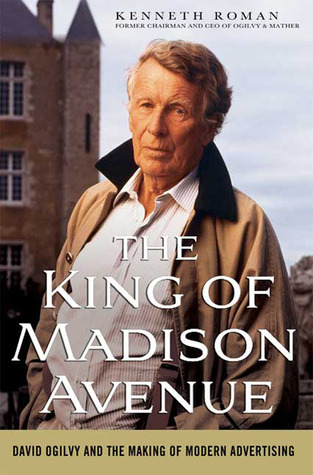

12 insights about markets and life from reading Ken Roman’s

12 insights about markets and life from reading Ken Roman’s  -Technicians believe that there is wisdom in price. That price has memory. That people who were inclined to buy at a certain price are somewhat likely to buy there again. Unless something’s changed, in which case their failure to re-buy (or buy more) at that formerly significant price level can be interpreted in an entirely new way – what was once an area of support on a chart becomes an area of resistance.

-Technicians believe that there is wisdom in price. That price has memory. That people who were inclined to buy at a certain price are somewhat likely to buy there again. Unless something’s changed, in which case their failure to re-buy (or buy more) at that formerly significant price level can be interpreted in an entirely new way – what was once an area of support on a chart becomes an area of resistance.