1. Average people think MONEY is the root of all evil. Rich people believe POVERTY is the root of all evil.

2. Average people think selfishness is a vice. Rich people think selfishness is a virtue.

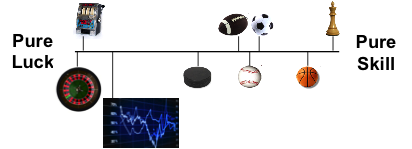

3. Average people have a lottery mentality. Rich people have an action mentality.

4. Average people think the road to riches is paved with formal education. Rich people believe in acquiring specific knowledge.

5. Average people long for the good old days. Rich people dream of the future.

6. Average people see money through the eyes of emotion. Rich people think about money logically.

7. Average people earn money doing things they don’t love. Rich people follow their passion. (more…)