Rough week for equity markets:

- UK FTSE 100 -1.0%

- German DAX -0.9%

- French CAC -0.4%

- Spain IBEX +0.2%

- Italy MIB -0.7%

- UK FTSE 100 -0.3%

- German DAX -2.3%

- French CAC –1.8

- Spain IBEX -0.9%

- Italy MIB -1.3%

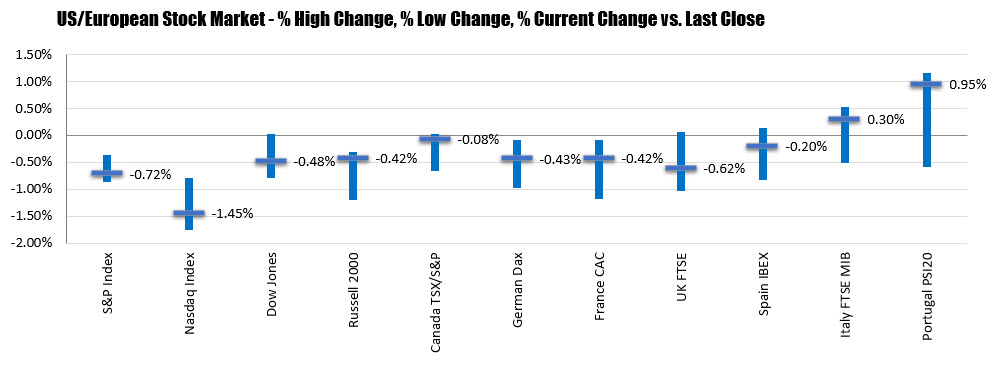

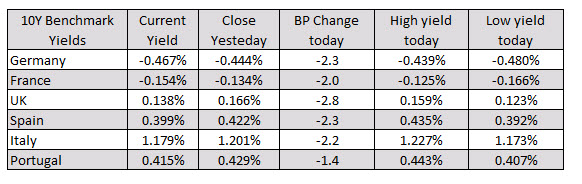

In the European debt market, the benchmark 10 year yields are ending the day mixed results. The UK and Spain yields are down marginally while Germany, France, Italy are marginally higher.

As London/European traders look to exit, the CHF remains the strongest. The JPY has taken over as the weakest of the majors. The USD has moved lower in the NY session (compared to opening levels). It is now mostly lower with declines vs. the CHF, EUR, CAD, AUD and NZD and gains only vs the JPY. It is back to unchanged vs the GBP after being higher vs the pound at the start of the day.

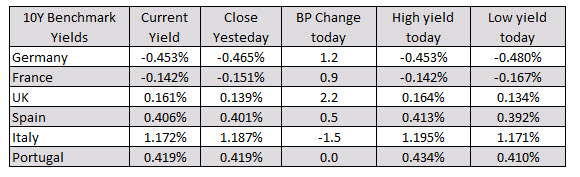

The European shares are ending the session with mixed results. France and Spain indices are lower. Germany, UK, Italy are trading higher.

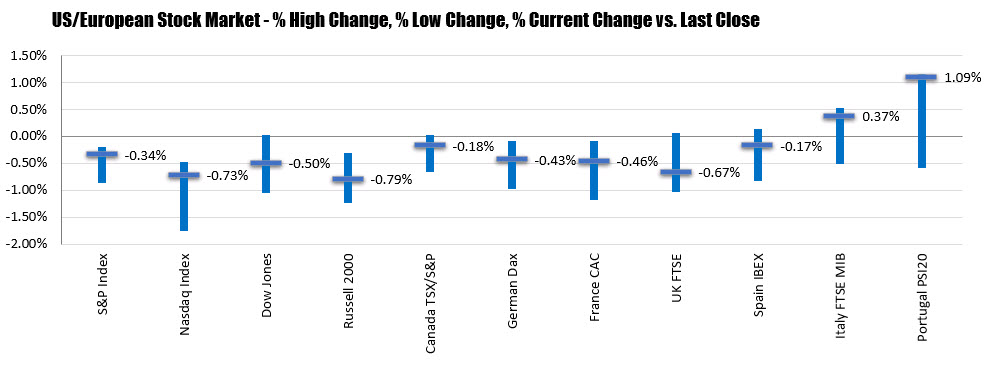

The major indices have broken their recent winning streaks. Admittedly the NASDAQ and the S&P index is at only reason for 2 straight days, but the Dow industrial average had a 4 day winning streak snapped in trading today.

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimate

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimatethe major European indices are ending the session with mixed results. Germany, France, UK and Spain show declines while Italy and Portugal eked out gains. The closes are showing:

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:It’s been another mixed day – albeit a fairly uneventful one – for European shares. The UK market moved higher despite poor UK manufacturing figures and renewed talk of triple dip recession, but most other exchanges recorded minor losses.

• The FTSE 100 finished at 6510.62, up 6.99 points or 0.11%

• France’s CAC climbed 0.1%

• Germany’s Dax was down 0.23%

• Italy’s FTSE MIB closed down 0.42%

• Spain’s Ibex was 0.26% lower

• The Athens market added 1.23%